Pulling back 13% this week, Bringspring Science and Technology's SZSE:300290) five-year decline in earnings may be coming into investors focus

Bringspring Science and Technology Co., Ltd. (SZSE:300290) shareholders might be concerned after seeing the share price drop 13% in the last week. But over five years returns have been remarkably great. In fact, during that period, the share price climbed 333%. Impressive! So it might be that some shareholders are taking profits after good performance. The most important thing for savvy investors to consider is whether the underlying business can justify the share price gain.

While this past week has detracted from the company's five-year return, let's look at the recent trends of the underlying business and see if the gains have been in alignment.

View our latest analysis for Bringspring Science and Technology

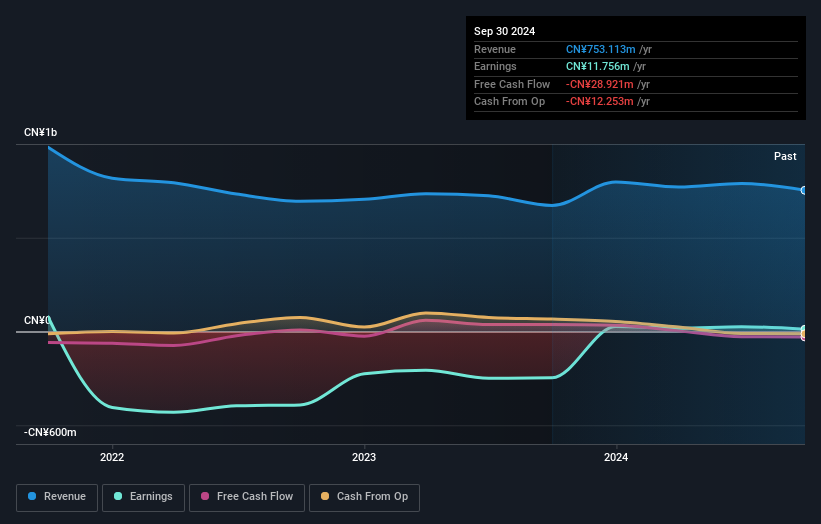

While Bringspring Science and Technology made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over the last half decade Bringspring Science and Technology's revenue has actually been trending down at about 0.07% per year. This is in stark contrast to the strong share price growth of 34%, compound, per year. Obviously, whatever the market is excited about, it's not a track record of revenue growth. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Bringspring Science and Technology's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Bringspring Science and Technology's TSR of 336% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Bringspring Science and Technology shareholders have received a total shareholder return of 219% over one year. That's better than the annualised return of 34% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 2 warning signs for Bringspring Science and Technology (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

Of course Bringspring Science and Technology may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bringspring Science and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300290

Bringspring Science and Technology

Bringspring Science and Technology Co., Ltd.

Excellent balance sheet with questionable track record.