- China

- /

- Tech Hardware

- /

- SZSE:300042

High Growth Tech Stocks Including BeijingABT NetworksLtd And Two More

Reviewed by Simply Wall St

In a week marked by significant economic data and earnings reports, global markets saw mixed performances with small-cap stocks holding up better than their larger counterparts, despite cautious earnings from major tech players. Against this backdrop of fluctuating indices and economic signals, identifying high-growth tech stocks requires careful consideration of their potential to thrive amidst macroeconomic challenges and evolving market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Sarepta Therapeutics | 23.43% | 41.52% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.41% | 70.53% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

BeijingABT NetworksLtd (SHSE:688168)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BeijingABT Networks Co., Ltd. develops and provides visualized network security technology solutions in China with a market cap of CN¥3.41 billion.

Operations: The company generates revenue primarily from its network security segment, amounting to CN¥570.29 million.

BeijingABT NetworksLtd., despite its recent net loss of CNY 81.53 million, shows a promising revenue increase to CNY 297.41 million, up from CNY 275.4 million year-over-year, indicating resilience in sales growth. The company's commitment to innovation is evident in its R&D spending trends which align with its strategic focus on expanding technological capabilities within the high-demand sectors of tech and AI. With earnings expected to surge by an impressive 69.1% annually, BeijingABT NetworksLtd is navigating through a transformative phase that could set a precedent for future profitability and market positioning, especially as it outpaces the average market revenue growth forecast of 23.6% per year against China's 13.9%. This robust growth trajectory coupled with their significant investment in research and development positions them favorably within the competitive landscape despite current financial setbacks.

- Navigate through the intricacies of BeijingABT NetworksLtd with our comprehensive health report here.

Learn about BeijingABT NetworksLtd's historical performance.

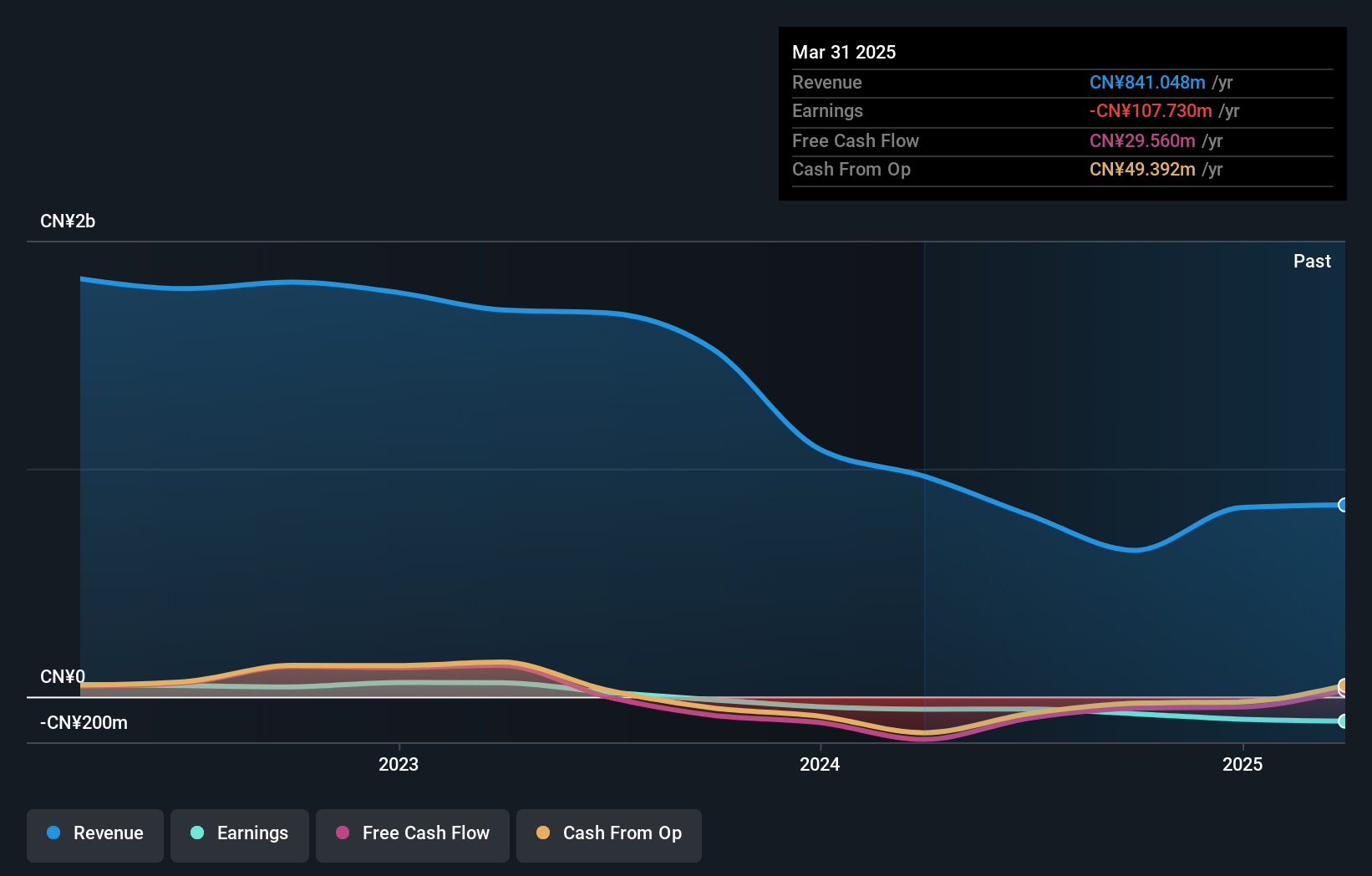

Netac Technology (SZSE:300042)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Netac Technology Co., Ltd. is engaged in the manufacturing and sale of flash memory products both in China and internationally, with a market capitalization of CN¥4.57 billion.

Operations: Netac Technology Co., Ltd. focuses on the production and distribution of flash memory products across domestic and international markets. The company operates with a market capitalization of CN¥4.57 billion, emphasizing its significant presence in the technology sector.

Netac Technology, despite recent financial setbacks with a net loss widening to CNY 68.2 million from CNY 36.8 million year-over-year, is poised for significant growth with revenue projected to expand by an impressive 55.5% annually. This forecast outstrips the broader Chinese market's growth rate of 13.9%, underscoring Netac's potential in capturing market share. The firm's commitment to innovation is reflected in its R&D spending, crucial for sustaining its competitive edge in the tech sector. Moreover, earnings are expected to surge by a robust 121.2% annually over the next three years, signaling a strong turnaround and promising future prospects as it aims to transition into profitability and enhance shareholder value through strategic initiatives including being added recently to the S&P Global BMI Index.

- Get an in-depth perspective on Netac Technology's performance by reading our health report here.

Evaluate Netac Technology's historical performance by accessing our past performance report.

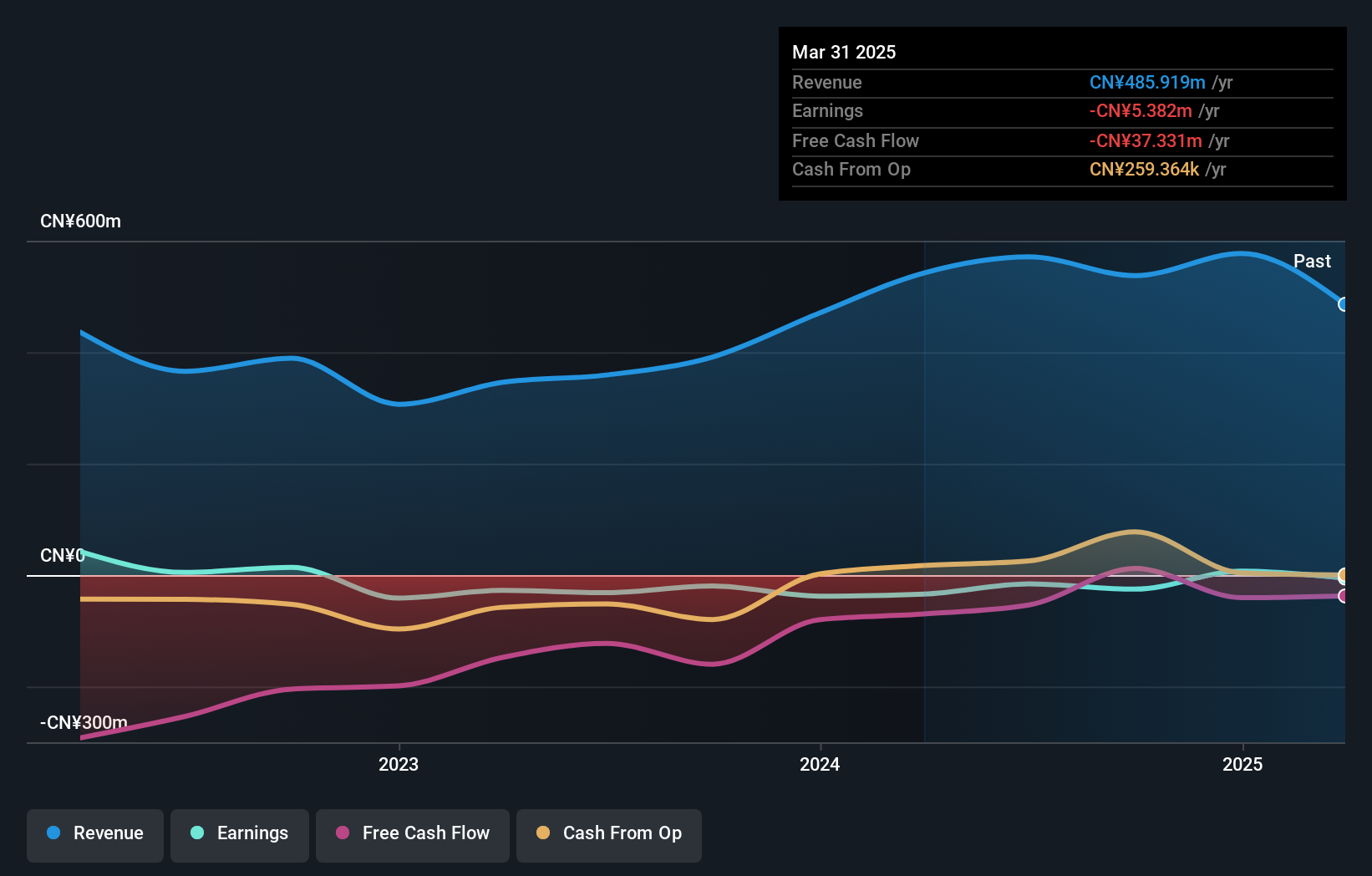

Shenzhen LihexingLtd (SZSE:301013)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Lihexing Co., Ltd. focuses on the R&D, production, and sale of automation and intelligent equipment for the information and communication technology industry in China, with a market cap of CN¥3.24 billion.

Operations: Shenzhen Lihexing Co., Ltd. specializes in developing and manufacturing automation and intelligent equipment tailored for China's information and communication technology sector.

Shenzhen LihexingLtd has shown remarkable resilience and growth, with a recent earnings report highlighting a jump in net income to CNY 15.32 million from CNY 2.88 million year-over-year, driven by a substantial revenue increase to CNY 359.27 million. This performance underscores a robust annual revenue growth rate of 33.6%, significantly outpacing the broader Chinese market's expansion of 13.9%. The company's strategic emphasis on R&D is evident with expenditures poised to bolster future innovations, crucial for maintaining its competitive edge in an aggressive tech landscape where earnings are expected to surge by an impressive 67.56% annually.

- Take a closer look at Shenzhen LihexingLtd's potential here in our health report.

Assess Shenzhen LihexingLtd's past performance with our detailed historical performance reports.

Summing It All Up

- Reveal the 1289 hidden gems among our High Growth Tech and AI Stocks screener with a single click here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Netac Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300042

Netac Technology

Manufactures and sells flash memory products in the People’s Republic of China and internationally.

High growth potential with mediocre balance sheet.