3 High Potential Growth Stocks On Chinese Exchanges With At Least 16% Insider Ownership

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, China's economic landscape presents both challenges and opportunities. As investors navigate through the complexities of the Chinese market, stocks with high insider ownership can offer potential growth prospects, reflecting strong confidence from those who know the companies best.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| Eoptolink Technology (SZSE:300502) | 26.7% | 39.4% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Fujian Wanchen Biotechnology Group (SZSE:300972) | 15.3% | 75.9% |

| UTour Group (SZSE:002707) | 24% | 33.1% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithm and software solutions in the computer vision industry, with a market capitalization of approximately CN¥11.51 billion.

Operations: The company generates its revenue primarily from providing algorithm and software solutions in the computer vision sector.

Insider Ownership: 34.5%

ArcSoft, a growth-oriented company in China, demonstrates strong potential with its earnings and revenue forecast to grow significantly above the market averages at 32.4% and 21.9% per year respectively. Despite a low projected Return on Equity of 6.6%, the company's recent activities, including an earnings increase in Q1 2024 and share buybacks worth CNY 13.2 million, highlight proactive management actions supporting growth amidst high insider ownership scenarios.

- Click here and access our complete growth analysis report to understand the dynamics of ArcSoft.

- Our comprehensive valuation report raises the possibility that ArcSoft is priced higher than what may be justified by its financials.

Primarius Technologies (SHSE:688206)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Primarius Technologies Co., Ltd. specializes in researching, designing, and developing EDA tools in China, with a market capitalization of approximately CN¥5.61 billion.

Operations: Primarius Technologies generates its revenue primarily from EDA solutions, totaling CN¥346.78 million.

Insider Ownership: 16.2%

Primarius Technologies, despite its substantial net loss in Q1 2024 (CNY 36.47 million), shows promising growth prospects with revenue increasing to CNY 81.81 million from CNY 63.93 million year-over-year and a very large expected earnings growth rate of 109.93% per annum. Analysts project the stock price could rise by 35.5%. The company also completed a share buyback worth CNY 7.98 million, indicating confidence from management amidst efforts to achieve profitability within three years.

- Click to explore a detailed breakdown of our findings in Primarius Technologies' earnings growth report.

- According our valuation report, there's an indication that Primarius Technologies' share price might be on the expensive side.

Winner Technology (SZSE:300609)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Winner Technology Co., Inc. specializes in providing artificial intelligence (AI) and big data application solutions, with a market capitalization of approximately CN¥1.93 billion.

Operations: The company specializes in AI and big data application solutions, generating revenue exclusively from these segments.

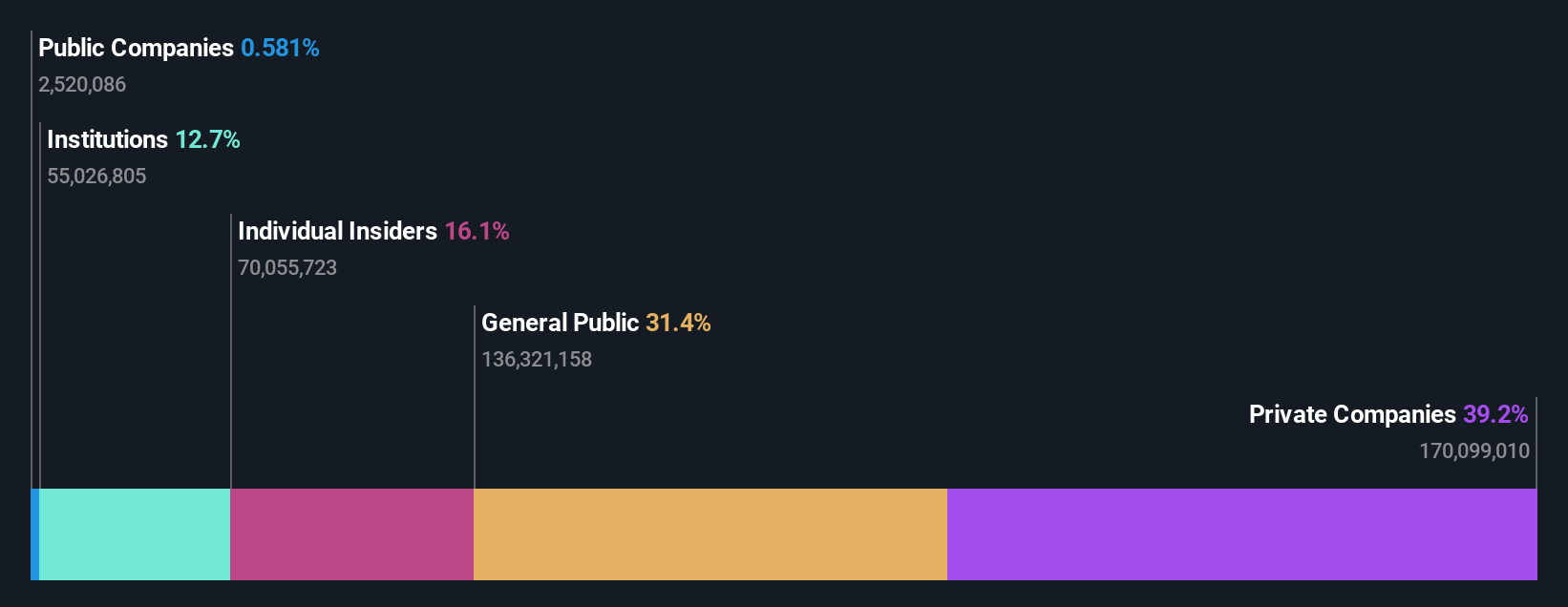

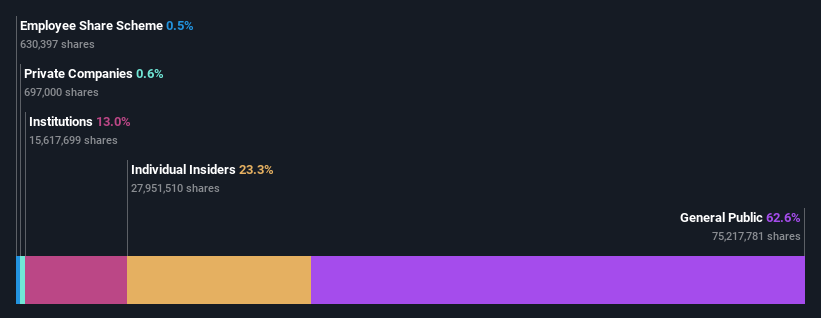

Insider Ownership: 23.8%

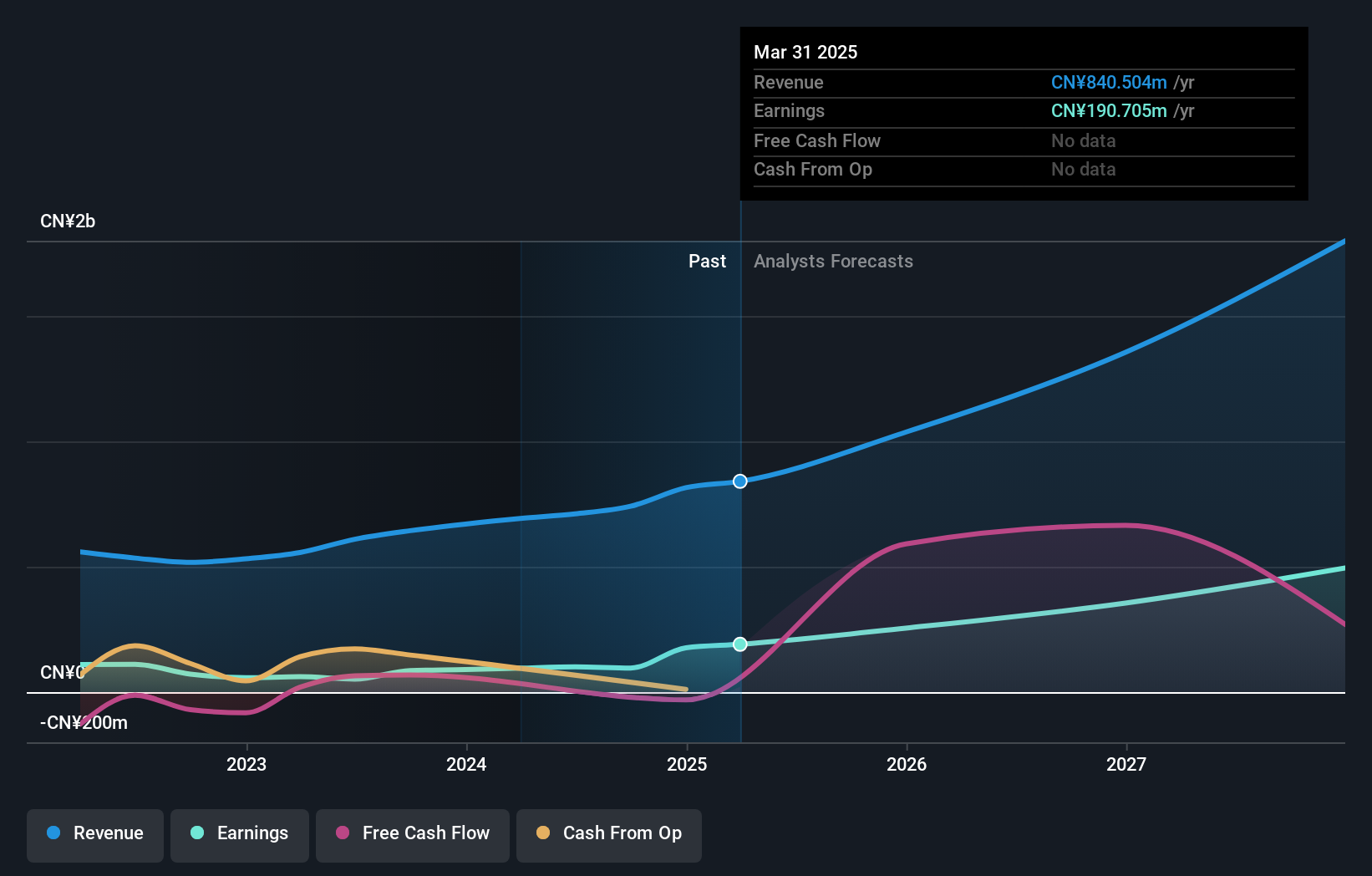

Winner Technology, despite its volatile share price and recent financial struggles, including a net loss reported in Q1 2024, is poised for significant growth with revenue expected to increase by 61.7% annually. The company's commitment to returning value to shareholders is evident from the consistent dividend payments announced in 2023 and maintained through recent AGMs. Looking ahead, Winner Technology is forecasted to reach profitability within the next three years, suggesting potential improvement in financial health.

- Take a closer look at Winner Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Winner Technology's current price could be inflated.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Chinese Companies With High Insider Ownership list of 395 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Winner Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300609

Winner Technology

Provides artificial intelligence (AI) and big data application solutions.

Adequate balance sheet slight.