- China

- /

- Electronic Equipment and Components

- /

- SZSE:002960

High Growth Tech Stocks Including Piesat Information Technology And Two Others

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets saw major indices like the Nasdaq Composite and S&P MidCap 400 reach record highs before retreating, while small-cap stocks demonstrated relative resilience compared to their larger counterparts. Amidst this backdrop of cautious optimism and fluctuating market dynamics, investors often look for tech stocks with strong growth potential that can navigate these complex conditions effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| Sarepta Therapeutics | 23.80% | 44.01% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| Travere Therapeutics | 31.20% | 72.26% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1289 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Piesat Information Technology (SHSE:688066)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Piesat Information Technology Co., Ltd. is a company that offers satellite internet services in China, with a market capitalization of approximately CN¥6.05 billion.

Operations: The company's primary revenue stream is from its Satellite Application segment, generating CN¥1.58 billion.

Despite recent challenges, Piesat Information Technology has shown promising signs of growth, with revenue projected to increase by 28.5% annually, outpacing the Chinese market's average of 14%. This growth is underpinned by substantial investments in R&D, crucial for maintaining competitive edge in the tech sector. Furthermore, earnings are expected to surge by 103.9% per year, positioning the company on a trajectory towards profitability within three years. However, it's important to note that Piesat faces high volatility in its share price and significant losses as reflected in recent earnings reports—CNY 221.8 million lost over nine months up to September 2024 compared to CNY 40.5 million the previous year—highlighting potential risks alongside its growth prospects.

Naruida Technology (SHSE:688522)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Naruida Technology Co., Ltd. specializes in the production and sale of polarized multifunctional active phased array radars in China, with a market cap of CN¥14.41 billion.

Operations: Naruida Technology focuses on the development and commercialization of advanced radar systems, catering primarily to the Chinese market. The company's revenue is derived from its specialized products in polarized multifunctional active phased array radars.

Naruida Technology, amidst a competitive tech landscape, has demonstrated robust revenue growth at 60.8% annually, significantly outpacing the broader Chinese market's average. This surge is bolstered by its strategic R&D investments which have escalated to capture emerging technological trends, evident from its R&D expenditure rising to 23% of total revenues. Despite a dip in net income from CNY 33.24 million to CNY 26.01 million over the last nine months, the firm remains committed to innovation and market expansion as shown by its recent inclusion in the S&P Global BMI Index and active share buyback program totaling CNY 15.1 million for 0.17% of shares repurchased since July this year. These moves underline Naruida's proactive stance in fortifying its market position and enhancing shareholder value.

- Click to explore a detailed breakdown of our findings in Naruida Technology's health report.

Understand Naruida Technology's track record by examining our Past report.

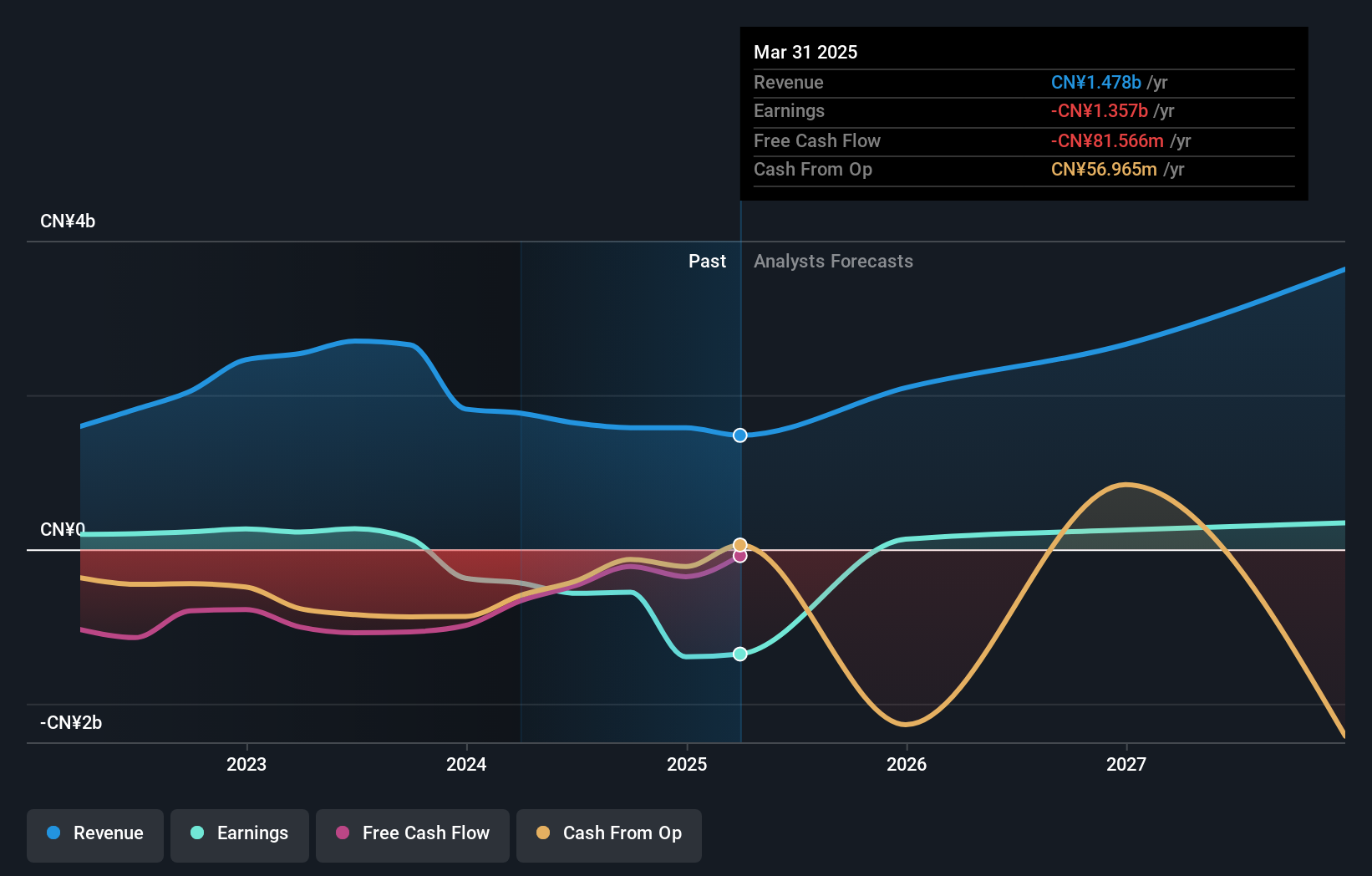

Jade Bird Fire (SZSE:002960)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jade Bird Fire Co., Ltd. develops, manufactures, and sells professional fire safety electronic products and systems both in China and internationally, with a market cap of CN¥8.23 billion.

Operations: The company focuses on the development, manufacturing, and sale of fire safety electronic products and systems. It operates both domestically in China and internationally.

Jade Bird Fire has navigated a challenging period with its recent earnings revealing a dip in sales to CNY 3.52 billion from CNY 3.64 billion year-over-year and net income falling to CNY 335.33 million from CNY 505.5 million, reflecting broader market pressures. Despite these hurdles, the company's commitment to growth is underscored by its aggressive share repurchase strategy, buying back shares worth CNY 88.31 million since July, representing a significant reinvestment into its own equity at 1.13% of outstanding shares. This move aligns with an anticipated revenue growth rate of 19.1% per year, slightly outpacing the Chinese market's forecasted growth, and positions Jade Bird Fire favorably as it continues adapting within the tech sector.

- Click here and access our complete health analysis report to understand the dynamics of Jade Bird Fire.

Assess Jade Bird Fire's past performance with our detailed historical performance reports.

Key Takeaways

- Embark on your investment journey to our 1289 High Growth Tech and AI Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002960

Jade Bird Fire

Develops, manufactures, and sells professional fire safety electronic products and fire safety systems in China and internationally.

Flawless balance sheet with reasonable growth potential.