Hunan Copote Science TechnologyLtd (SHSE:600476) shareholder returns have been respectable, earning 50% in 3 years

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Hunan Copote Science Technology Co.,Ltd. (SHSE:600476), which is up 50%, over three years, soundly beating the market decline of 17% (not including dividends).

Since the stock has added CN¥293m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Hunan Copote Science TechnologyLtd

While Hunan Copote Science TechnologyLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

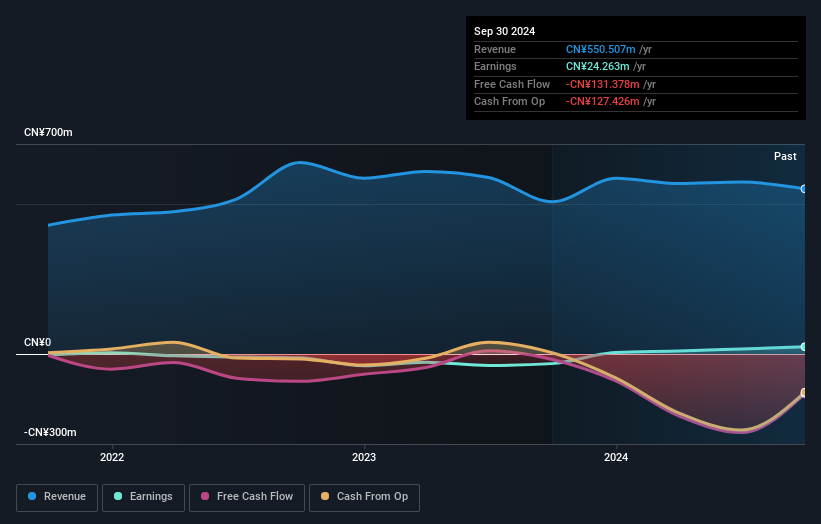

Hunan Copote Science TechnologyLtd's revenue trended up 6.5% each year over three years. Considering the company is losing money, we think that rate of revenue growth is uninspiring. The modest growth is probably broadly reflected in the share price, which is up 15%, per year over 3 years. The real question is when the business will generate profits, and how quickly they will grow. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of Hunan Copote Science TechnologyLtd's earnings, revenue and cash flow.

A Different Perspective

While the broader market gained around 9.8% in the last year, Hunan Copote Science TechnologyLtd shareholders lost 3.1%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand Hunan Copote Science TechnologyLtd better, we need to consider many other factors. For instance, we've identified 2 warning signs for Hunan Copote Science TechnologyLtd that you should be aware of.

But note: Hunan Copote Science TechnologyLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Copote Science TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600476

Hunan Copote Science TechnologyLtd

Provides software and information technology services in the postal industry in China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives