- China

- /

- Semiconductors

- /

- SZSE:300604

While shareholders of Hangzhou Changchuan TechnologyLtd (SZSE:300604) are in the black over 5 years, those who bought a week ago aren't so fortunate

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. To wit, the Hangzhou Changchuan Technology Co.,Ltd (SZSE:300604) share price has soared 373% over five years. This just goes to show the value creation that some businesses can achieve. On top of that, the share price is up 61% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 24% in 90 days).

While the stock has fallen 9.3% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

View our latest analysis for Hangzhou Changchuan TechnologyLtd

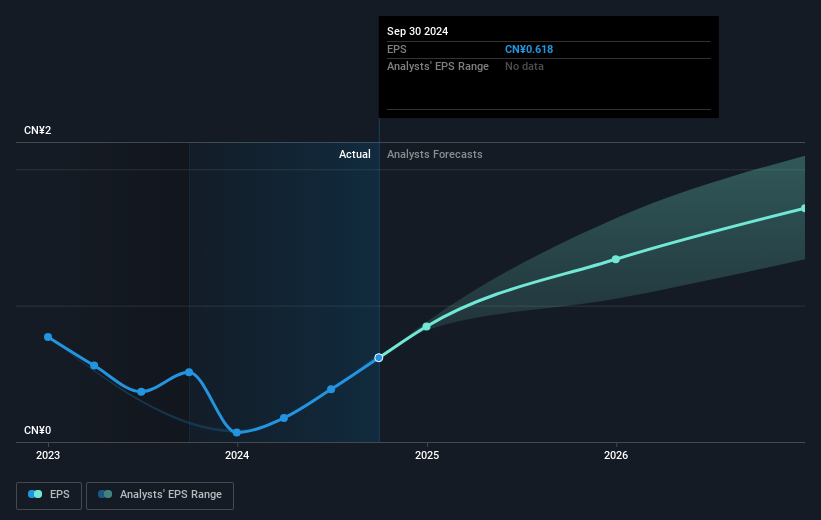

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last half decade, Hangzhou Changchuan TechnologyLtd became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Hangzhou Changchuan TechnologyLtd has improved its bottom line lately, but is it going to grow revenue? If you're interested, you could check this free report showing consensus revenue forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Hangzhou Changchuan TechnologyLtd, it has a TSR of 378% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's good to see that Hangzhou Changchuan TechnologyLtd has rewarded shareholders with a total shareholder return of 16% in the last twelve months. That's including the dividend. However, the TSR over five years, coming in at 37% per year, is even more impressive. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 2 warning signs for Hangzhou Changchuan TechnologyLtd that you should be aware of.

But note: Hangzhou Changchuan TechnologyLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Changchuan TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300604

Hangzhou Changchuan TechnologyLtd

Researches and develops, produces, and sells integrated circuit equipment and high-frequency communication materials.

Exceptional growth potential with excellent balance sheet.