- Germany

- /

- Specialty Stores

- /

- XTRA:ZAL

3 Growth Companies Insiders Are Betting On

Reviewed by Simply Wall St

As global markets navigate the uncertainties surrounding the incoming Trump administration, investors are closely monitoring policy shifts that could impact corporate earnings and sector performance. Amidst this backdrop, growth companies with high insider ownership stand out as potential opportunities, as insiders often have unique insights into their company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| On Holding (NYSE:ONON) | 31% | 29.8% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.7% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.8% | 95% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

Suzhou TZTEK Technology (SHSE:688003)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China and has a market cap of CN¥9.57 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 15.3%

Suzhou TZTEK Technology is poised for robust growth, with revenue expected to increase by 42.8% annually, outpacing the Chinese market's average. Earnings are projected to grow significantly at 60.42% per year. However, recent financial results show a net loss of CNY 13.67 million for the nine months ending September 2024, compared to a net income previously. Despite high volatility in share price and an uncovered dividend yield of 1.2%, insider ownership remains substantial without notable recent trading activity.

- Click here and access our complete growth analysis report to understand the dynamics of Suzhou TZTEK Technology.

- Our valuation report unveils the possibility Suzhou TZTEK Technology's shares may be trading at a premium.

Bestechnic (Shanghai) (SHSE:688608)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Bestechnic (Shanghai) Co., Ltd. focuses on the research, design, development, manufacture, and sale of smart audio and video SoC chips with a market cap of CN¥30.38 billion.

Operations: The company's revenue primarily derives from its Integrated Circuit segment, which generated CN¥3.09 billion.

Insider Ownership: 25.7%

Bestechnic (Shanghai) demonstrates strong growth potential, with earnings forecasted to increase by 39.3% annually, surpassing the Chinese market average. Recent financial results highlight a significant rise in net income to CNY 289.1 million for the nine months ending September 2024, up from CNY 117.77 million previously. Despite high share price volatility and low expected return on equity at 9.3%, insider ownership remains substantial without recent trading activity impacting it significantly.

- Dive into the specifics of Bestechnic (Shanghai) here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Bestechnic (Shanghai) shares in the market.

Zalando (XTRA:ZAL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zalando SE operates an online platform for fashion and lifestyle products with a market cap of €7.07 billion.

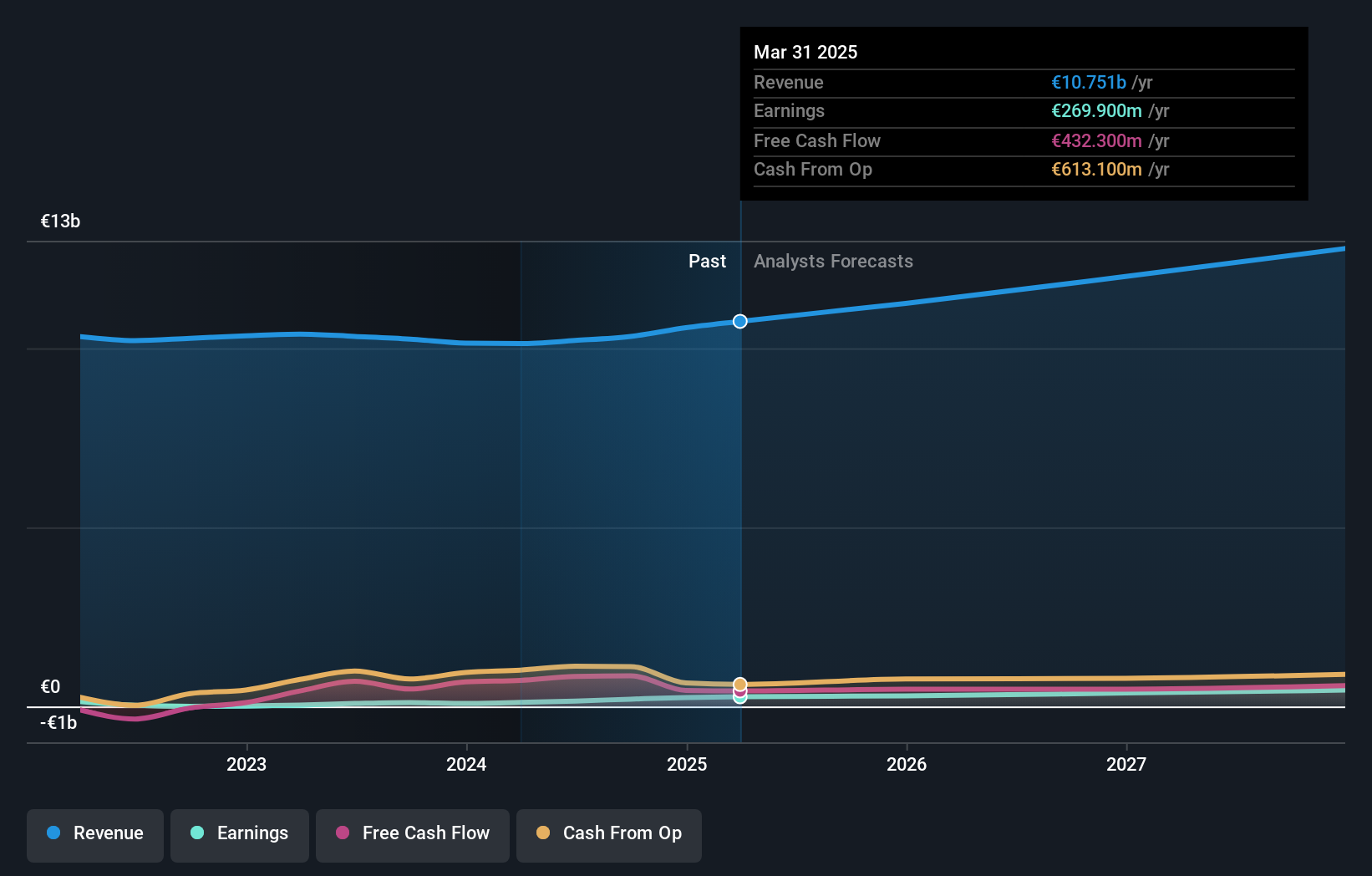

Operations: The company's revenue segments include Reconciliation at €-291.40 million and Segment Adjustment at €24.79 billion.

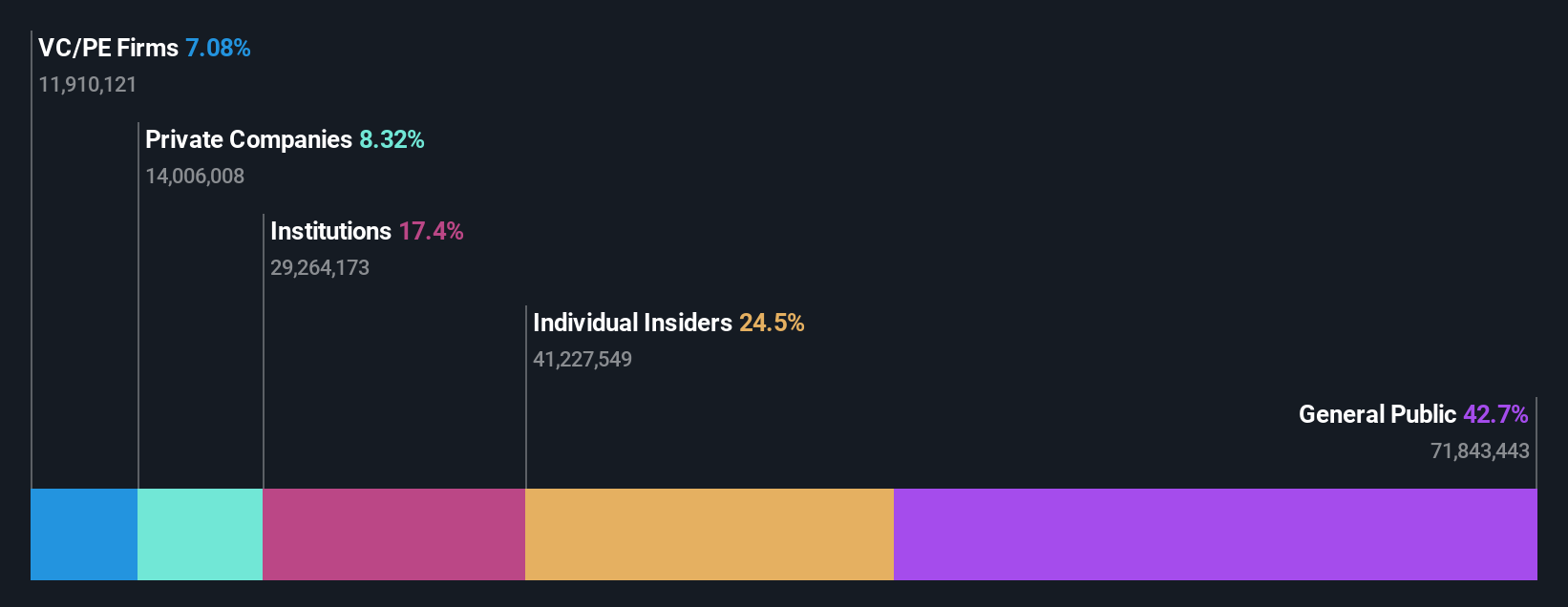

Insider Ownership: 10.4%

Zalando exhibits promising growth prospects, with earnings expected to grow by 22% annually, outpacing the German market. Recent financial results show a turnaround with a net income of EUR 44.3 million in Q3 2024 compared to a loss last year. Despite trading significantly below estimated fair value and limited insider trading activity, its return on equity is forecasted to be modest at 13.2%, while revenue growth remains steady but not exceptionally high.

- Navigate through the intricacies of Zalando with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Zalando's share price might be too optimistic.

Turning Ideas Into Actions

- Unlock our comprehensive list of 1546 Fast Growing Companies With High Insider Ownership by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zalando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ZAL

Excellent balance sheet with reasonable growth potential.