- China

- /

- Semiconductors

- /

- SHSE:688230

Undiscovered Gems with Strong Potential for January 2025

Reviewed by Simply Wall St

As global markets experience a rebound with easing core U.S. inflation and robust bank earnings, small-cap stocks have caught the attention of investors, reflected in the S&P MidCap 400's notable gains. In this dynamic environment, identifying promising stocks involves looking for companies that demonstrate resilience and growth potential amidst shifting economic indicators and sector performances.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Evergent Investments | 5.49% | 1.15% | 8.81% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| Ellaktor | 73.80% | -24.52% | 51.72% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| MIA Teknoloji Anonim Sirketi | 17.47% | 61.65% | 67.97% | ★★★★★☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Hangzhou Greenda Electronic Materials (SHSE:603931)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Greenda Electronic Materials Co., Ltd. specializes in the production and distribution of electronic materials, with a market cap of CN¥4.63 billion.

Operations: Greenda Electronic Materials generates revenue primarily through the production and distribution of electronic materials. The company's net profit margin has shown variability, reflecting changes in cost structures and pricing strategies.

Hangzhou Greenda Electronic Materials shows resilience with its debt-free status, a notable shift from five years ago when the debt-to-equity ratio was 10.5%. Its price-to-earnings ratio of 28.3x is attractive compared to the broader CN market at 34.3x, suggesting potential value for investors. Despite a slight dip in revenue to CNY 510.84 million and net income to CNY 110.94 million for the nine months ending September 2024, earnings grew by an impressive 11.6% over the past year, outpacing the Chemicals industry which saw a -5% growth rate, hinting at strong operational performance amidst challenges.

Shanghai Prisemi ElectronicsLtd (SHSE:688230)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Prisemi Electronics Co., Ltd. is a high-tech electronics company that focuses on researching, developing, producing, and selling power integrated circuits (ICs) and power devices in China, with a market capitalization of CN¥5.45 billion.

Operations: Prisemi generates revenue primarily from the sale of integrated circuits, amounting to CN¥350.96 million. The company's market capitalization stands at CN¥5.45 billion.

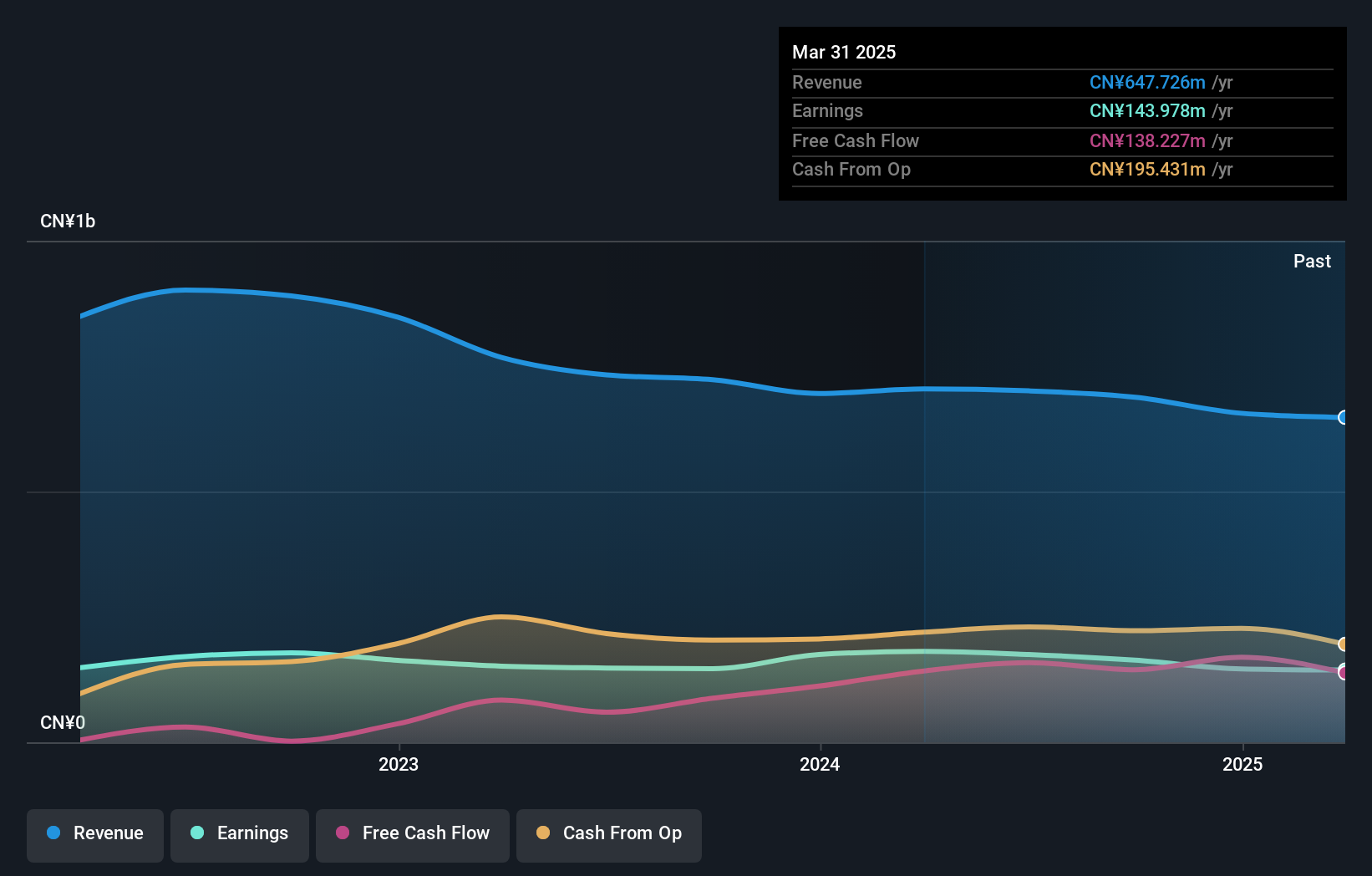

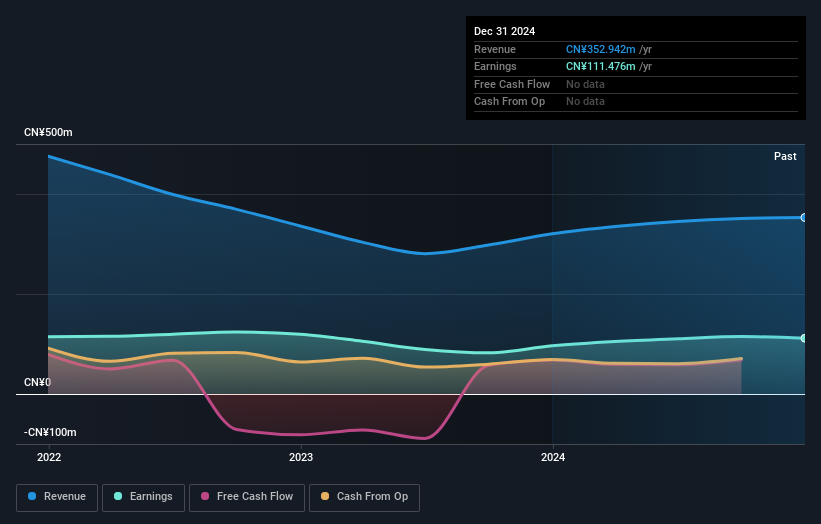

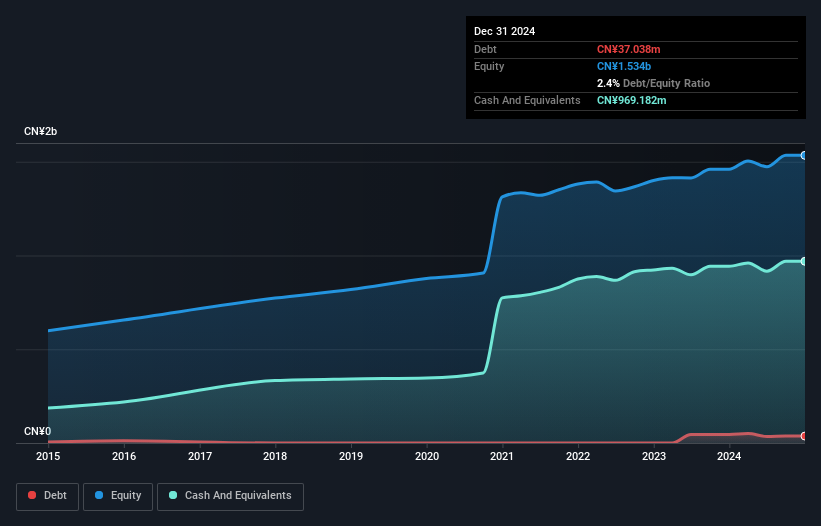

Prisemi Electronics, a nimble player in the semiconductor space, has shown impressive earnings growth of 39.5% over the past year, outpacing the industry average of 12.1%. The company boasts high-quality earnings and remains debt-free for five years, enhancing its financial stability. With a price-to-earnings ratio of 47.4x, it stands as a good value compared to the sector's average of 64.5x. Recent reports indicate sales climbed to CNY 254 million from CNY 224 million last year, while net income rose to CNY 82 million from CNY 64 million, reflecting solid operational performance amidst market volatility.

Hangzhou Toka InkLtd (SHSE:688571)

Simply Wall St Value Rating: ★★★★★☆

Overview: Hangzhou Toka Ink Co., Ltd. focuses on the research, development, production, and sale of energy-saving and environmentally friendly ink products, digital materials, and functional materials with a market capitalization of CN¥2.86 billion.

Operations: Hangzhou Toka Ink generates revenue primarily from the sale of ink products, digital materials, and functional materials. The company's financial performance is highlighted by its market capitalization of CN¥2.86 billion.

Hangzhou Toka Ink has shown promising financial performance, with earnings growth of 23% over the past year, outpacing the chemicals industry average. The company's net income for the first nine months of 2024 reached CNY 101 million, up from CNY 83 million in the previous year. Its debt situation appears manageable, with interest payments well covered by EBIT at a ratio of 106.8 times. Additionally, Hangzhou Toka Ink is trading at a significant discount to its estimated fair value by about 25%. These factors suggest potential for increased investor interest as it continues to perform robustly within its sector.

Key Takeaways

- Delve into our full catalog of 4644 Undiscovered Gems With Strong Fundamentals here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688230

Shanghai Prisemi ElectronicsLtd

Researches and develops, produces, and sells power ICs and power devices in China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives