- China

- /

- Semiconductors

- /

- SHSE:688123

Three Stocks Analysts Believe Are Trading Below Their Estimated Intrinsic Value

Reviewed by Simply Wall St

In a week marked by busy earnings reports and mixed economic signals, global markets have shown varied performance, with major U.S. indices like the S&P 500 and Nasdaq Composite experiencing declines after reaching record highs. As investors navigate this complex environment, identifying stocks that are trading below their estimated intrinsic value can offer potential opportunities for those looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| First National (NasdaqCM:FXNC) | US$22.50 | US$44.83 | 49.8% |

| Harmony Gold Mining (JSE:HAR) | ZAR180.36 | ZAR359.54 | 49.8% |

| Anhui Huaheng Biotechnology (SHSE:688639) | CN¥36.00 | CN¥71.71 | 49.8% |

| IMAGICA GROUP (TSE:6879) | ¥480.00 | ¥956.03 | 49.8% |

| Plus Alpha ConsultingLtd (TSE:4071) | ¥2153.00 | ¥4304.26 | 50% |

| West Bancorporation (NasdaqGS:WTBA) | US$23.49 | US$46.79 | 49.8% |

| Redcentric (AIM:RCN) | £1.1775 | £2.35 | 50% |

| DoubleVerify Holdings (NYSE:DV) | US$19.72 | US$39.40 | 49.9% |

| Alnylam Pharmaceuticals (NasdaqGS:ALNY) | US$272.22 | US$544.40 | 50% |

| Royal Plus (SET:PLUS) | THB5.45 | THB10.88 | 49.9% |

Let's explore several standout options from the results in the screener.

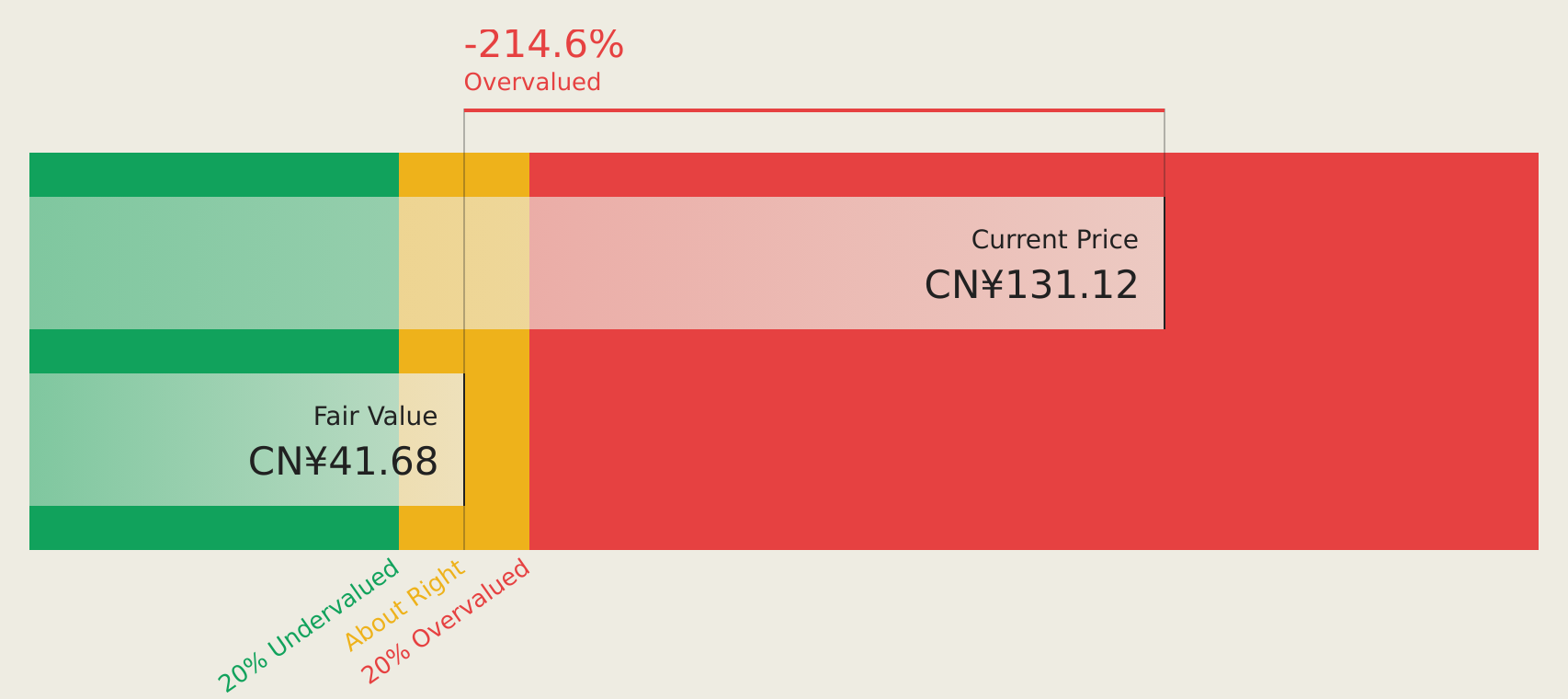

Giantec Semiconductor (SHSE:688123)

Overview: Giantec Semiconductor Corporation is involved in the research, development, design, and sale of memory, analog, and mixed-signal integrated circuits across various regions including China and internationally, with a market cap of CN¥9.60 billion.

Operations: The company's revenue is primarily derived from the Integrated Circuit Design Industry, amounting to CN¥970.87 million.

Estimated Discount To Fair Value: 18.5%

Giantec Semiconductor's recent earnings report highlights significant growth, with net income reaching CN¥211.36 million for the first nine months of 2024, up from CN¥82.42 million a year ago. The stock is trading at CN¥61.56, below its estimated fair value of CN¥75.53 and offers good relative value compared to peers. Despite high share price volatility, forecasted earnings and revenue growth rates surpass market averages, suggesting potential undervaluation based on cash flows.

- Our expertly prepared growth report on Giantec Semiconductor implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Giantec Semiconductor with our comprehensive financial health report here.

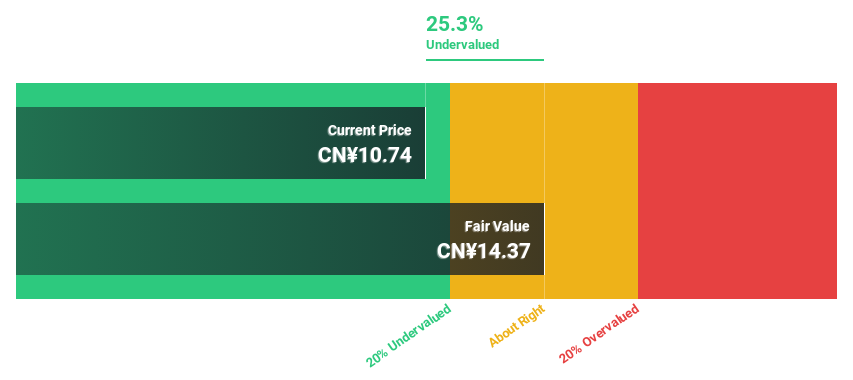

ValiantLtd (SZSE:002643)

Overview: Valiant Co., Ltd. is a global producer and seller of chemical materials, with a market capitalization of CN¥10.17 billion.

Operations: Valiant Co., Ltd. generates revenue through its global production and sale of chemical materials.

Estimated Discount To Fair Value: 23%

Valiant Ltd is trading at CN¥11.07, below its estimated fair value of CN¥14.37, indicating it may be undervalued based on cash flows. While earnings are forecast to grow 29.8% annually, surpassing the market average of 26.1%, recent financials show a decline in net income to CN¥295.95 million for the first nine months of 2024 from CN¥575.45 million a year ago, and revenue decreased to CN¥2,762.59 million from CN¥3,175.6 million.

- The growth report we've compiled suggests that ValiantLtd's future prospects could be on the up.

- Take a closer look at ValiantLtd's balance sheet health here in our report.

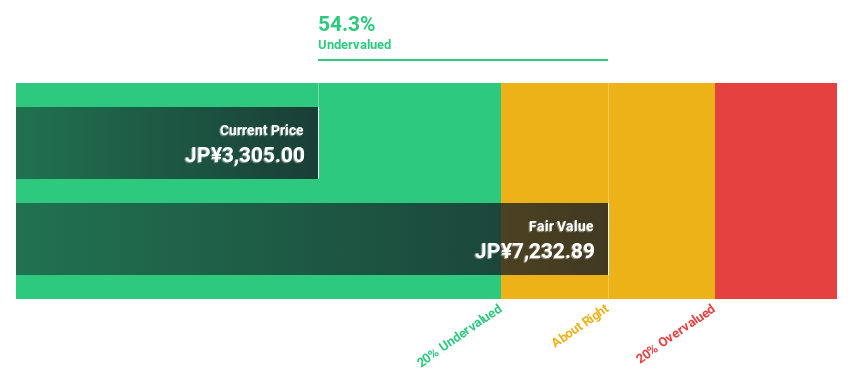

Musashi Seimitsu Industry (TSE:7220)

Overview: Musashi Seimitsu Industry Co., Ltd. manufactures and sells transportation equipment both in Japan and internationally, with a market cap of ¥130.46 billion.

Operations: Musashi Seimitsu Industry Co., Ltd. generates revenue from several regions, with ¥36.59 billion from China, ¥68.07 billion from Japan, ¥99.38 billion from Europe, ¥106.36 billion from the Americas, and ¥83.70 billion from Asia (excluding China).

Estimated Discount To Fair Value: 26.5%

Musashi Seimitsu Industry is trading at ¥2095, significantly below its estimated fair value of ¥2851.99, highlighting potential undervaluation based on cash flows. Despite a high debt level and an unstable dividend history, earnings are expected to grow 22.1% annually, outpacing the Japanese market's 8.8%. Recent earnings grew by over 100%, with future revenue growth forecasted at 5.1% per year, exceeding the market average of 4.2%.

- Upon reviewing our latest growth report, Musashi Seimitsu Industry's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Musashi Seimitsu Industry.

Make It Happen

- Navigate through the entire inventory of 932 Undervalued Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688123

Giantec Semiconductor

Engages in the research, development, design, and sale of memory, analog, and mixed-signal integrated circuits in China, Taiwan, South Korea, Hong Kong, the United States, Japan, the Southeast Asia, Europe, and internationally.

Exceptional growth potential with flawless balance sheet.