- China

- /

- Semiconductors

- /

- SHSE:688012

Advanced Micro-Fabrication Equipment China's (SHSE:688012) investors will be pleased with their stellar 215% return over the last five years

When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Advanced Micro-Fabrication Equipment Inc. China (SHSE:688012) share price has soared 214% in the last half decade. Most would be very happy with that. It's also good to see the share price up 60% over the last quarter. But this could be related to the strong market, which is up 25% in the last three months.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

View our latest analysis for Advanced Micro-Fabrication Equipment China

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

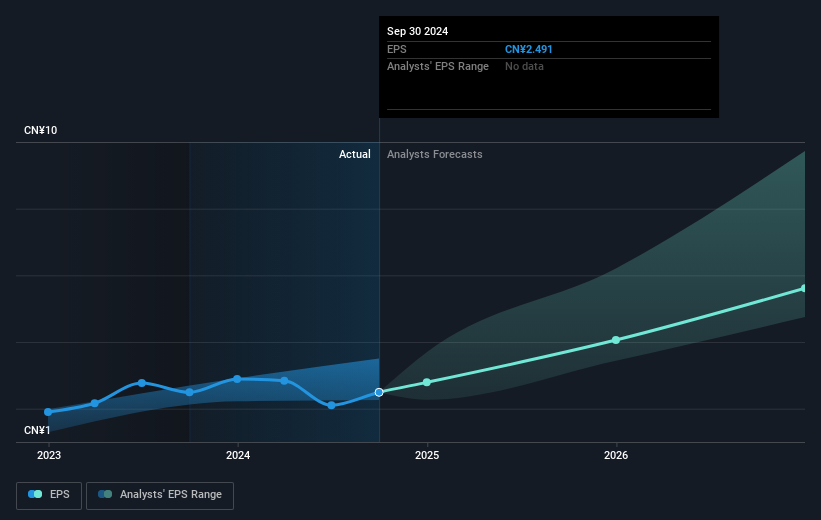

During five years of share price growth, Advanced Micro-Fabrication Equipment China achieved compound earnings per share (EPS) growth of 46% per year. The EPS growth is more impressive than the yearly share price gain of 26% over the same period. Therefore, it seems the market has become relatively pessimistic about the company. Of course, with a P/E ratio of 84.68, the market remains optimistic.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

This free interactive report on Advanced Micro-Fabrication Equipment China's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that Advanced Micro-Fabrication Equipment China has rewarded shareholders with a total shareholder return of 31% in the last twelve months. That gain is better than the annual TSR over five years, which is 26%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Advanced Micro-Fabrication Equipment China better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with Advanced Micro-Fabrication Equipment China (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

But note: Advanced Micro-Fabrication Equipment China may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688012

Advanced Micro-Fabrication Equipment China

Advanced Micro-Fabrication Equipment Inc.

High growth potential with excellent balance sheet.