- China

- /

- Semiconductors

- /

- SHSE:603688

3 Asian Growth Stocks With Insider Ownership Seeing Up To 45% Revenue Growth

Reviewed by Simply Wall St

As global markets navigate the complexities of trade negotiations and inflation concerns, Asian economies are showing resilience with notable stock market gains. In such a climate, growth companies with substantial insider ownership can be particularly appealing due to their potential for strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| Techwing (KOSDAQ:A089030) | 19.1% | 68% |

| Synspective (TSE:290A) | 12.8% | 49.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 24.3% |

| Samyang Foods (KOSE:A003230) | 14.9% | 27.8% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 43% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 12.8% | 43.7% |

We're going to check out a few of the best picks from our screener tool.

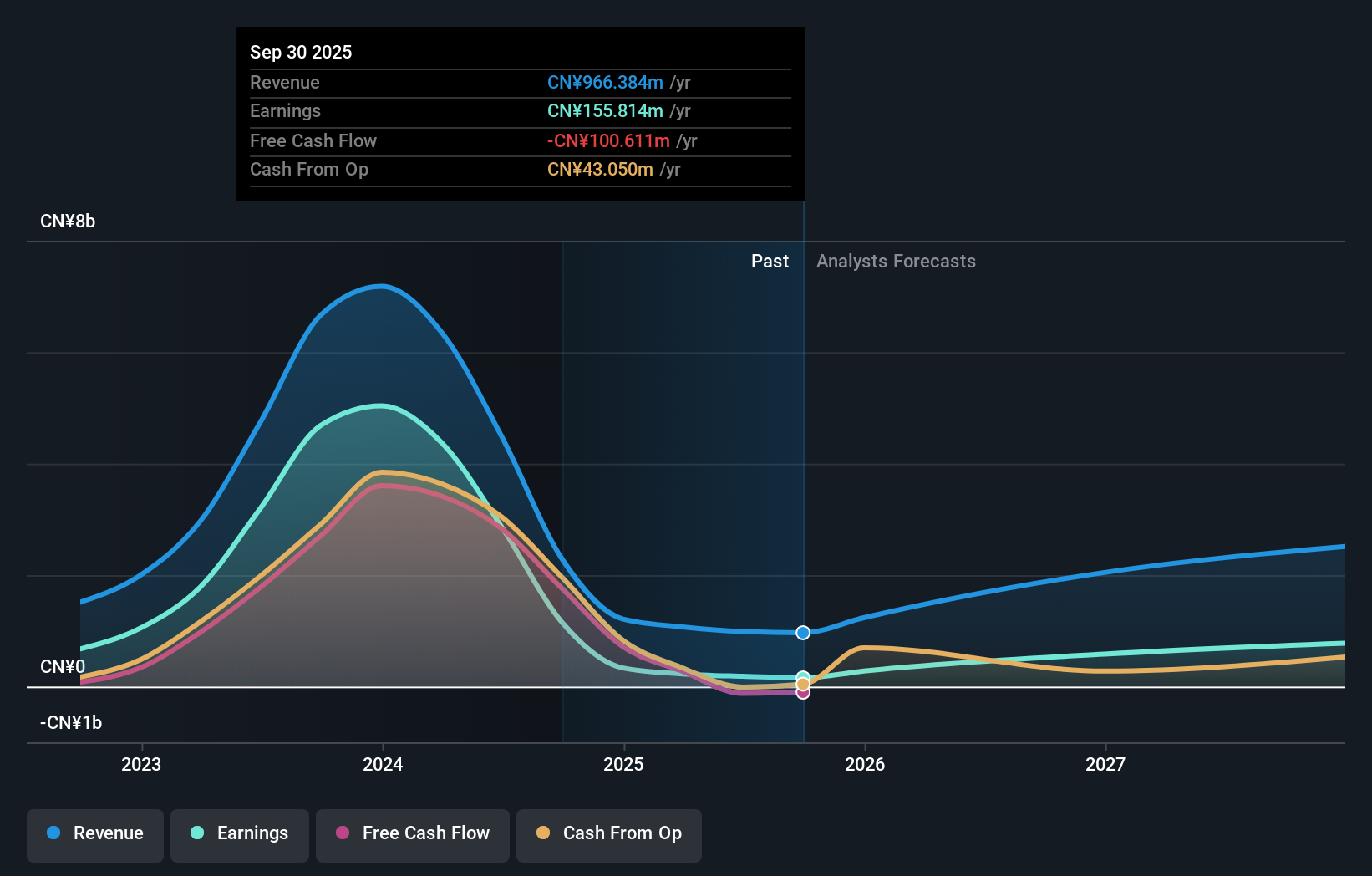

Jiangsu Pacific Quartz (SHSE:603688)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Pacific Quartz Co., Ltd. is involved in the research, development, manufacture, marketing, and sale of quartz materials in China and has a market capitalization of CN¥20.98 billion.

Operations: The company generates revenue from the research, development, manufacture, marketing, and sale of quartz materials in China.

Insider Ownership: 31.6%

Revenue Growth Forecast: 31.9% p.a.

Jiangsu Pacific Quartz is poised for significant growth, with revenue expected to increase by 31.9% annually, outpacing the broader CN market's 12.8%. Earnings are set to grow at an impressive rate of 45.1% per year, surpassing the market average of 23.9%. Despite a low forecasted return on equity of 10.4%, insider ownership remains strong, although recent financials have been influenced by large one-off items and profit margins have decreased from last year’s high levels.

- Take a closer look at Jiangsu Pacific Quartz's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Jiangsu Pacific Quartz is trading beyond its estimated value.

Espressif Systems (Shanghai) (SHSE:688018)

Simply Wall St Growth Rating: ★★★★★★

Overview: Espressif Systems (Shanghai) Co., Ltd. is a fabless semiconductor company that develops and sells advanced low-power wireless communication chipsets globally, with a market cap of CN¥25.24 billion.

Operations: Espressif Systems generates revenue primarily from its semiconductor segment, amounting to CN¥2.18 billion.

Insider Ownership: 36.5%

Revenue Growth Forecast: 20.9% p.a.

Espressif Systems (Shanghai) is positioned for robust growth, with earnings projected to rise 28.4% annually, outpacing the CN market's 23.9%. Revenue is expected to grow at 20.9% per year, exceeding the broader market's 12.9%. The company's Price-To-Earnings ratio of 66.6x is below the semiconductor industry average of 71.5x, indicating good value despite high insider ownership and no recent insider trading activity reported over three months.

- Unlock comprehensive insights into our analysis of Espressif Systems (Shanghai) stock in this growth report.

- The valuation report we've compiled suggests that Espressif Systems (Shanghai)'s current price could be inflated.

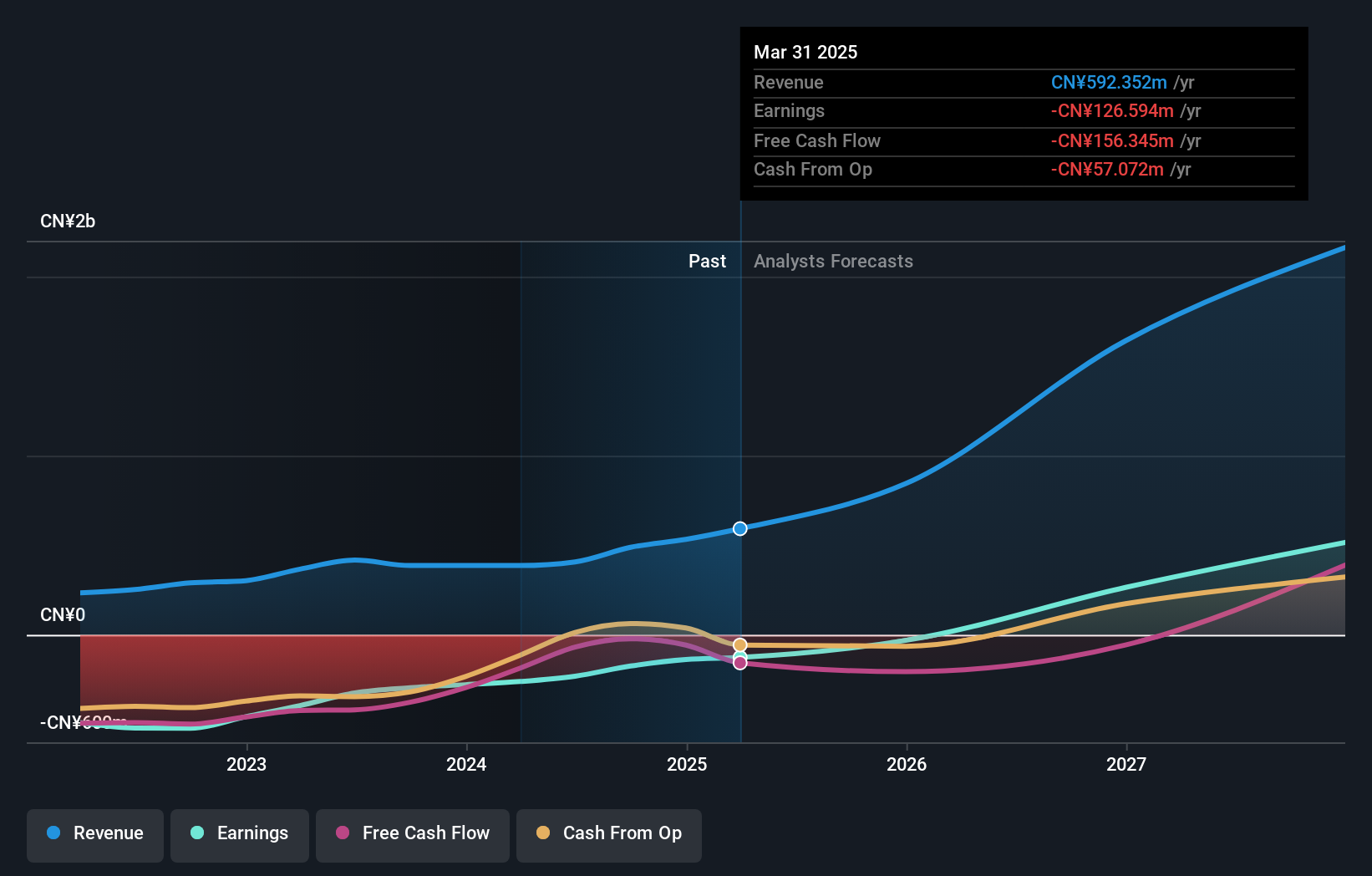

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Zelgen Biopharmaceuticals Co., Ltd. is a biopharmaceutical company focused on the research, development, and commercialization of innovative drugs, with a market cap of CN¥29.96 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling CN¥592.35 million.

Insider Ownership: 29.4%

Revenue Growth Forecast: 45.9% p.a.

Suzhou Zelgen Biopharmaceuticals is trading at 49.5% below its estimated fair value, suggesting potential undervaluation. The company is forecast to become profitable within three years, with revenue growth expected at 45.9% annually, significantly outpacing the Chinese market's 12.8%. However, its return on equity is projected to remain low at 16.1%. Recently added to the Shanghai Stock Exchange Health Care Sector Index, it has experienced high share price volatility without notable insider trading activity in the past three months.

- Click here to discover the nuances of Suzhou Zelgen BiopharmaceuticalsLtd with our detailed analytical future growth report.

- The analysis detailed in our Suzhou Zelgen BiopharmaceuticalsLtd valuation report hints at an inflated share price compared to its estimated value.

Summing It All Up

- Embark on your investment journey to our 593 Fast Growing Asian Companies With High Insider Ownership selection here.

- Interested In Other Possibilities? AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603688

Jiangsu Pacific Quartz

Engages in the research and development, manufacture, marketing, and sale of quartz materials in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives