- China

- /

- Semiconductors

- /

- SHSE:600667

The three-year loss for Wuxi Taiji Industry Limited (SHSE:600667) shareholders likely driven by its shrinking earnings

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. We regret to report that long term Wuxi Taiji Industry Limited Corporation (SHSE:600667) shareholders have had that experience, with the share price dropping 30% in three years, versus a market decline of about 21%. But it's up 5.6% in the last week.

While the stock has risen 5.6% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Wuxi Taiji Industry Limited

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Wuxi Taiji Industry Limited became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

With a rather small yield of just 1.7% we doubt that the stock's share price is based on its dividend. Revenue is actually up 25% over the three years, so the share price drop doesn't seem to hinge on revenue, either. It's probably worth investigating Wuxi Taiji Industry Limited further; while we may be missing something on this analysis, there might also be an opportunity.

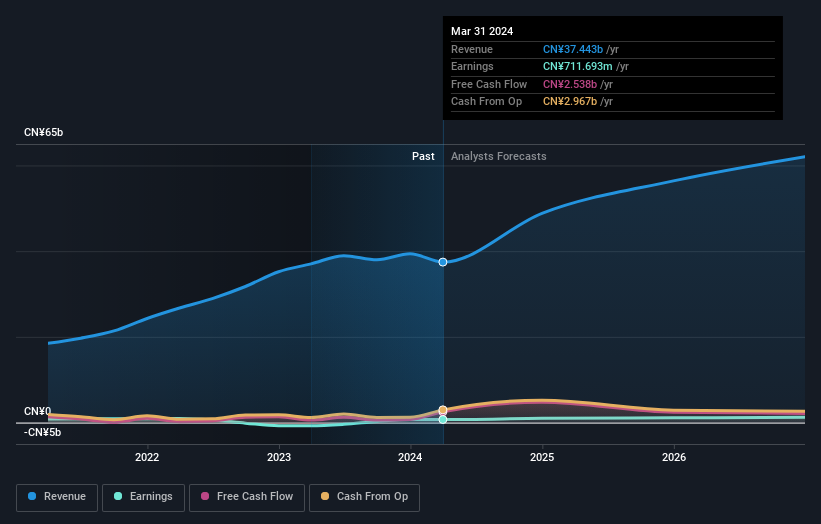

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So it makes a lot of sense to check out what analysts think Wuxi Taiji Industry Limited will earn in the future (free profit forecasts).

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Wuxi Taiji Industry Limited's TSR for the last 3 years was -27%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While it's never nice to take a loss, Wuxi Taiji Industry Limited shareholders can take comfort that , including dividends,their trailing twelve month loss of 9.6% wasn't as bad as the market loss of around 13%. Given the total loss of 3% per year over five years, it seems returns have deteriorated in the last twelve months. Whilst Baron Rothschild does tell the investor "buy when there's blood in the streets, even if the blood is your own", buyers would need to examine the data carefully to be comfortable that the business itself is sound. It's always interesting to track share price performance over the longer term. But to understand Wuxi Taiji Industry Limited better, we need to consider many other factors. For example, we've discovered 1 warning sign for Wuxi Taiji Industry Limited that you should be aware of before investing here.

But note: Wuxi Taiji Industry Limited may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Taiji Industry Limited might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600667

Wuxi Taiji Industry Limited

Primarily engages in the semiconductor packaging and testing business.

Flawless balance sheet, undervalued and pays a dividend.