- China

- /

- Life Sciences

- /

- SZSE:301096

3 Growth Stocks With High Insider Ownership Featuring 28% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the European Central Bank and fluctuating oil prices, U.S. indices like the S&P 500 and Nasdaq Composite have shown resilience with notable gains, driven by sectors such as utilities and real estate. Amidst this backdrop, identifying growth companies with substantial insider ownership can be particularly appealing, as these stocks often demonstrate strong alignment between management interests and shareholder value—a critical factor in today's ever-evolving market environment.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We'll examine a selection from our screener results.

Hangzhou Zhongtai Cryogenic Technology (SZSE:300435)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hangzhou Zhongtai Cryogenic Technology Corporation develops, designs, manufactures, and sells cryogenic equipment in China with a market cap of CN¥4.50 billion.

Operations: The company's revenue is primarily derived from its Gas Operation Segment, which contributes CN¥1.65 billion, and Equipment Manufacturing, which accounts for CN¥1.19 billion.

Insider Ownership: 12.3%

Earnings Growth Forecast: 30% p.a.

Hangzhou Zhongtai Cryogenic Technology is trading at a substantial discount to its estimated fair value and shows strong relative value compared to peers. Despite a recent decline in sales and net income, earnings are projected to grow significantly at 30% per year, outpacing the Chinese market average. Revenue growth is expected at 19.5%, above the market rate of 13.5%. The company recently completed a share buyback program, enhancing shareholder value amidst an unstable dividend history.

- Delve into the full analysis future growth report here for a deeper understanding of Hangzhou Zhongtai Cryogenic Technology.

- Our valuation report here indicates Hangzhou Zhongtai Cryogenic Technology may be undervalued.

Jiangxi Synergy Pharmaceutical (SZSE:300636)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangxi Synergy Pharmaceutical Co., Ltd. manufactures and sells active pharmaceutical ingredients (APIs) worldwide, with a market cap of CN¥3.69 billion.

Operations: The company's revenue primarily comes from Pharmaceutical Manufacturing, totaling CN¥721 million.

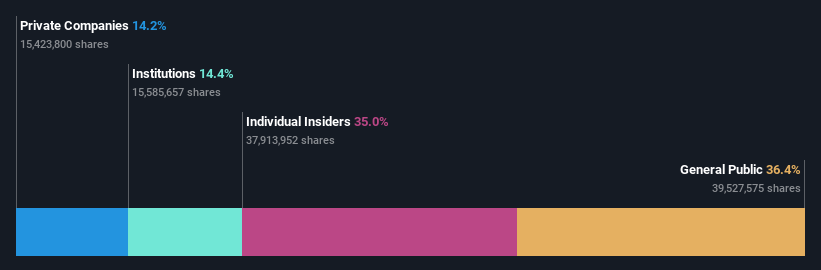

Insider Ownership: 32.8%

Earnings Growth Forecast: 32.1% p.a.

Jiangxi Synergy Pharmaceutical's earnings are projected to grow significantly at 32.1% annually, surpassing the Chinese market average of 23.8%. Revenue growth is expected at 22.8%, also outpacing the market rate of 13.5%. Recent earnings results show sales of CNY 569.93 million and net income rising to CNY 95.74 million for the first nine months of 2024, indicating solid performance despite a modest past year's growth of just 3%.

- Click to explore a detailed breakdown of our findings in Jiangxi Synergy Pharmaceutical's earnings growth report.

- Our valuation report here indicates Jiangxi Synergy Pharmaceutical may be overvalued.

Hangzhou Bio-Sincerity Pharma-TechLtd (SZSE:301096)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hangzhou Bio-Sincerity Pharma-Tech Co., Ltd. operates in the pharmaceutical industry, focusing on research and development, with a market cap of CN¥4.77 billion.

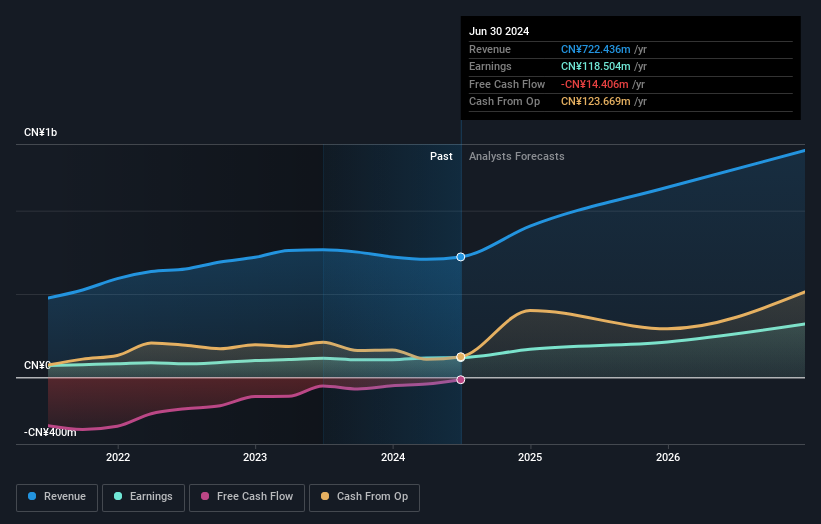

Operations: The company generates revenue primarily from its biotechnology segment, amounting to CN¥1.12 billion.

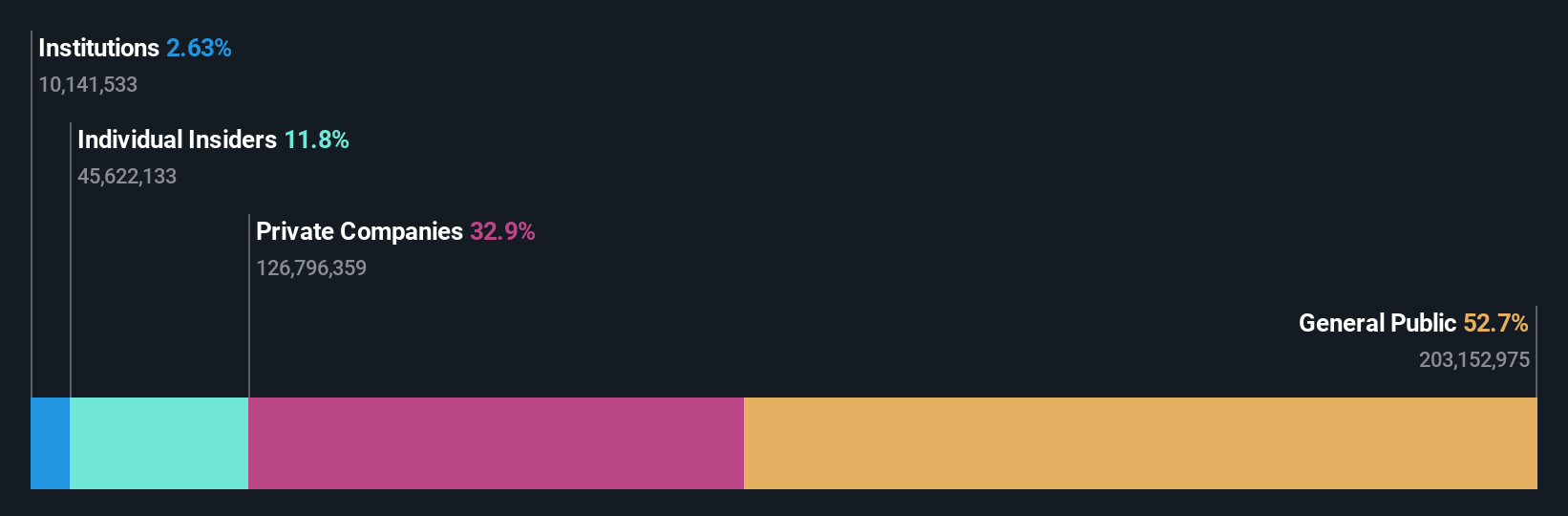

Insider Ownership: 35%

Earnings Growth Forecast: 28.7% p.a.

Hangzhou Bio-Sincerity Pharma-Tech Ltd. is set for strong growth, with earnings projected to rise 28.7% annually, outpacing the Chinese market's 23.8%. Revenue is also expected to grow faster than the market at 25.8% per year. Recent half-year results show sales reaching CNY 525.06 million and net income of CNY 134.21 million, reflecting robust performance despite a volatile share price and a low dividend coverage by free cash flows.

- Click here to discover the nuances of Hangzhou Bio-Sincerity Pharma-TechLtd with our detailed analytical future growth report.

- The analysis detailed in our Hangzhou Bio-Sincerity Pharma-TechLtd valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Embark on your investment journey to our 1485 Fast Growing Companies With High Insider Ownership selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Bio-Sincerity Pharma-TechLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301096

Hangzhou Bio-Sincerity Pharma-TechLtd

Hangzhou Bio-Sincerity Pharma-Tech Co.,Ltd.

High growth potential with adequate balance sheet.