- China

- /

- Metals and Mining

- /

- SZSE:000923

HBIS Resources And 2 Other Top Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets reach record highs, buoyed by China's robust stimulus measures and optimism surrounding artificial intelligence, investors are increasingly looking for reliable income sources amid fluctuating economic signals. In this environment, dividend stocks can offer a stable return, making them an attractive option for those seeking consistent income.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.81% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.19% | ★★★★★★ |

| Globeride (TSE:7990) | 4.33% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.36% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.85% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| CVB Financial (NasdaqGS:CVBF) | 4.51% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.73% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.87% | ★★★★★★ |

Click here to see the full list of 2040 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

HBIS Resources (SZSE:000923)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HBIS Resources Co., Ltd. engages in the mining, processing, selling, and servicing of mineral products across multiple continents with a market cap of CN¥9.99 billion.

Operations: HBIS Resources Co., Ltd. generates revenue primarily from copper (CN¥1.24 billion), magnetite (CN¥5.01 billion), and vermiculite (CN¥365.69 million).

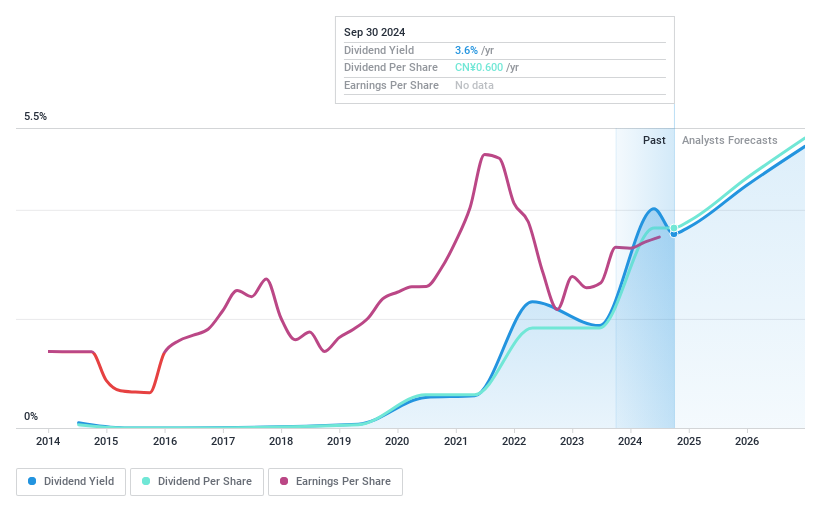

Dividend Yield: 3.6%

HBIS Resources has shown a significant increase in earnings, reporting CNY 477.48 million for the first half of 2024, up from CNY 380.9 million a year ago. Its dividend yield stands at 3.56%, placing it in the top quartile of CN market dividend payers. However, its dividend history is unstable and has been volatile over the past decade despite being well-covered by earnings (38.8% payout ratio) and cash flows (77.8% cash payout ratio).

- Click to explore a detailed breakdown of our findings in HBIS Resources' dividend report.

- In light of our recent valuation report, it seems possible that HBIS Resources is trading behind its estimated value.

Boai NKY Medical Holdings (SZSE:300109)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boai NKY Medical Holdings Ltd. operates in the fine chemical and medical care sectors both in China and internationally, with a market cap of CN¥5.57 billion.

Operations: Boai NKY Medical Holdings Ltd. generates revenue through its fine chemical and medical care businesses, serving both domestic and international markets.

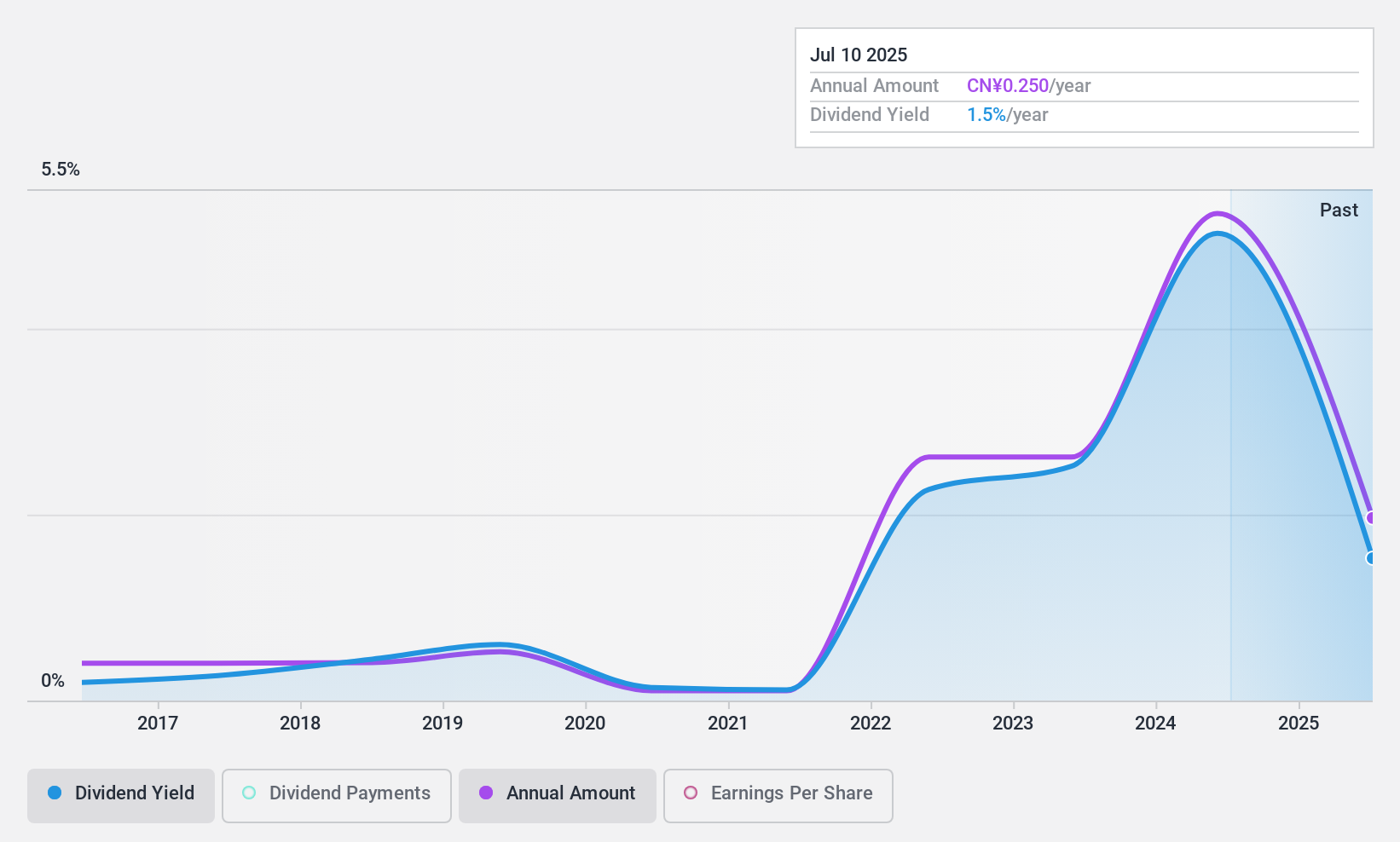

Dividend Yield: 4.9%

Boai NKY Medical Holdings' dividend yield of 4.92% ranks in the top 25% of CN market dividend payers, but its sustainability is questionable due to a high cash payout ratio (206.3%) and dividends not being well covered by free cash flows. The company’s earnings grew by 8.9% last year, yet recent half-year results show a decline in net income to CNY 212.93 million from CNY 262.21 million, raising concerns about future dividend reliability and growth potential.

- Click here and access our complete dividend analysis report to understand the dynamics of Boai NKY Medical Holdings.

- The analysis detailed in our Boai NKY Medical Holdings valuation report hints at an inflated share price compared to its estimated value.

Chengdu Kanghua Biological Products (SZSE:300841)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chengdu Kanghua Biological Products Co., Ltd. (SZSE:300841) operates in the biotechnology sector, focusing on the development and production of vaccines and immunological products, with a market cap of CN¥7.23 billion.

Operations: Chengdu Kanghua Biological Products Co., Ltd. generates its revenue primarily from the development and production of vaccines and immunological products.

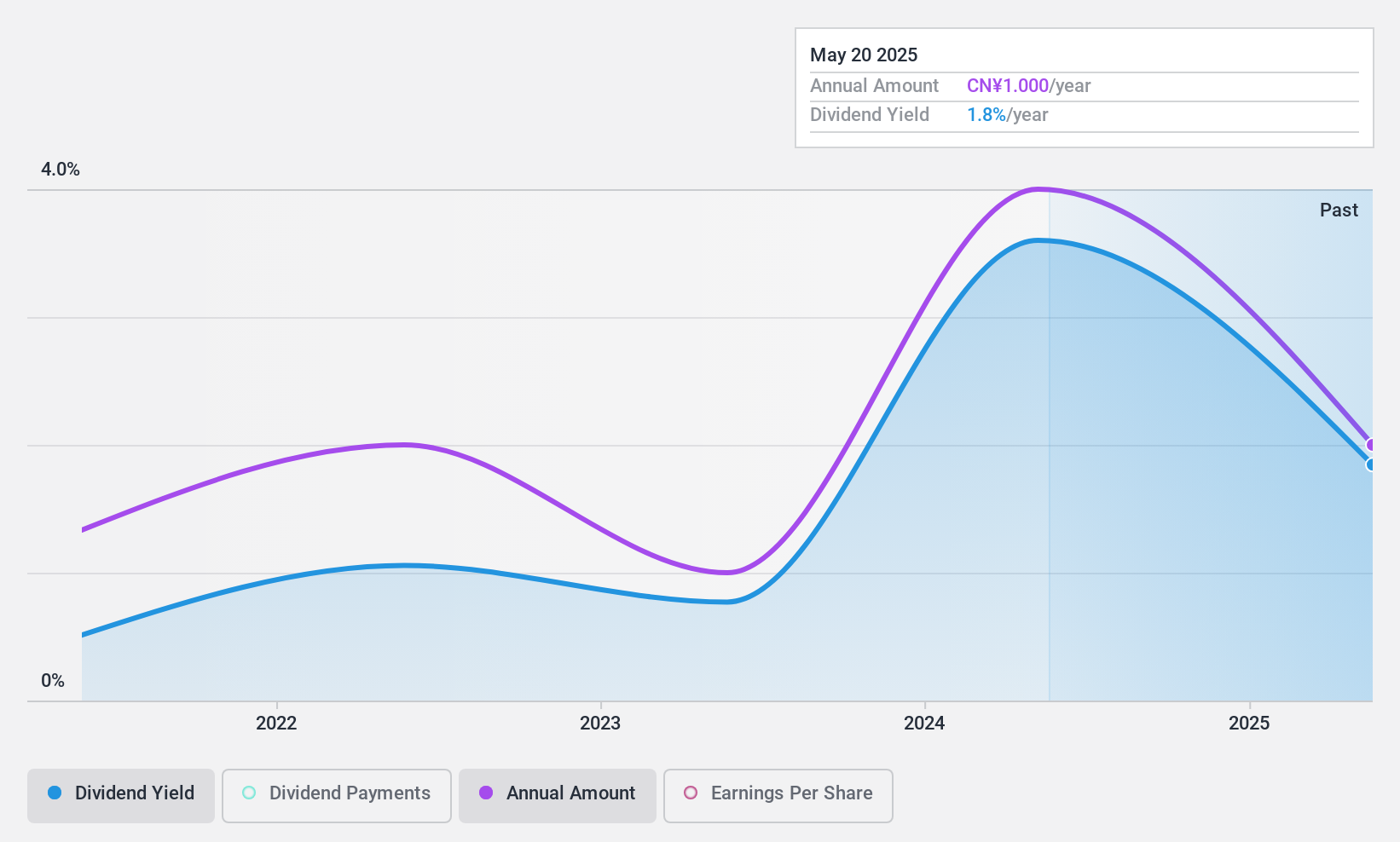

Dividend Yield: 3%

Chengdu Kanghua Biological Products' dividend payout ratio is 47%, indicating dividends are well-covered by earnings and cash flows (53.4%). Despite a top-tier yield of 3.04% in the CN market, its dividend track record is volatile, having been paid for only three years. Recent buybacks totaling CNY 200 million and a significant M&A transaction suggest active capital management but do not mitigate concerns about dividend stability.

- Click here to discover the nuances of Chengdu Kanghua Biological Products with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Chengdu Kanghua Biological Products' current price could be quite moderate.

Next Steps

- Investigate our full lineup of 2040 Top Dividend Stocks right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HBIS Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000923

HBIS Resources

Engages in the mining, processing, selling, and servicing of mineral products in Asia, Africa, Europe, and the Americas.

Flawless balance sheet established dividend payer.