3 High Insider Ownership Growth Companies On Chinese Exchange With Earnings Rising Up To 108%

Reviewed by Simply Wall St

As global markets navigate through varying economic signals, Chinese equities have faced challenges with underwhelming manufacturing data highlighting concerns about the economy's momentum. In such a landscape, identifying growth companies with high insider ownership on Chinese exchanges could offer investors distinct advantages, as these firms often benefit from aligned interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

| Suzhou Shijing Environmental TechnologyLtd (SZSE:301030) | 22% | 54.9% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

| Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

| KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 25.8% |

| Ningbo Deye Technology Group (SHSE:605117) | 23.4% | 29.0% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

| UTour Group (SZSE:002707) | 23% | 33.1% |

Underneath we present a selection of stocks filtered out by our screen.

Bio-Thera Solutions (SHSE:688177)

Simply Wall St Growth Rating: ★★★★★★

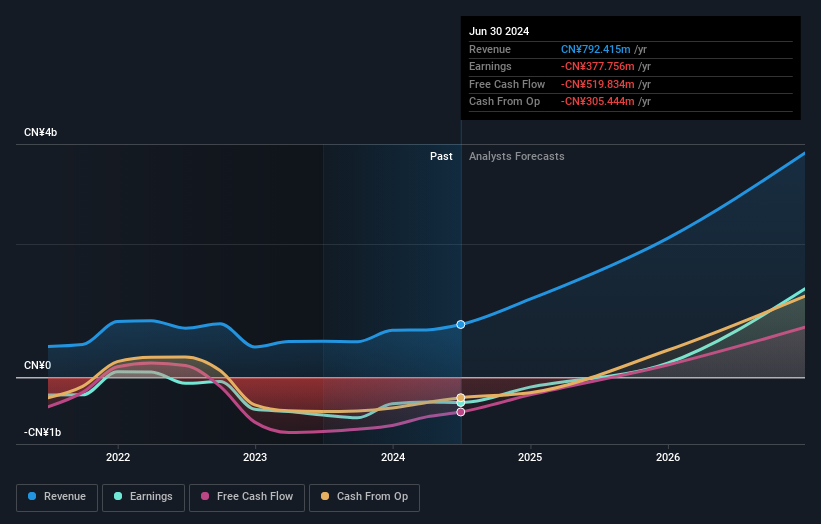

Overview: Bio-Thera Solutions, Ltd. is a biopharmaceutical company focused on researching and developing novel therapeutics for cancer, autoimmune, cardiovascular, and other serious diseases globally, with a market capitalization of approximately CN¥8.86 billion.

Operations: The company generates CN¥711.46 million in revenue from its biopharmaceutical segment.

Insider Ownership: 18.2%

Earnings Growth Forecast: 105.4% p.a.

Bio-Thera Solutions, a growth company with significant insider ownership in China, is making strides in the biopharmaceutical sector. Recent developments include a positive CHMP opinion for its biosimilar Avzivi and promising Phase 1 results for BAT8006 in treating advanced solid tumors. Despite a current net loss of CNY 118.96 million, revenue is growing at 27.9% per year, with profitability expected within three years. The firm's strategic partnerships and robust pipeline underscore its potential amidst financial challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Bio-Thera Solutions.

- Our valuation report unveils the possibility Bio-Thera Solutions' shares may be trading at a premium.

Suzhou Zelgen BiopharmaceuticalsLtd (SHSE:688266)

Simply Wall St Growth Rating: ★★★★★☆

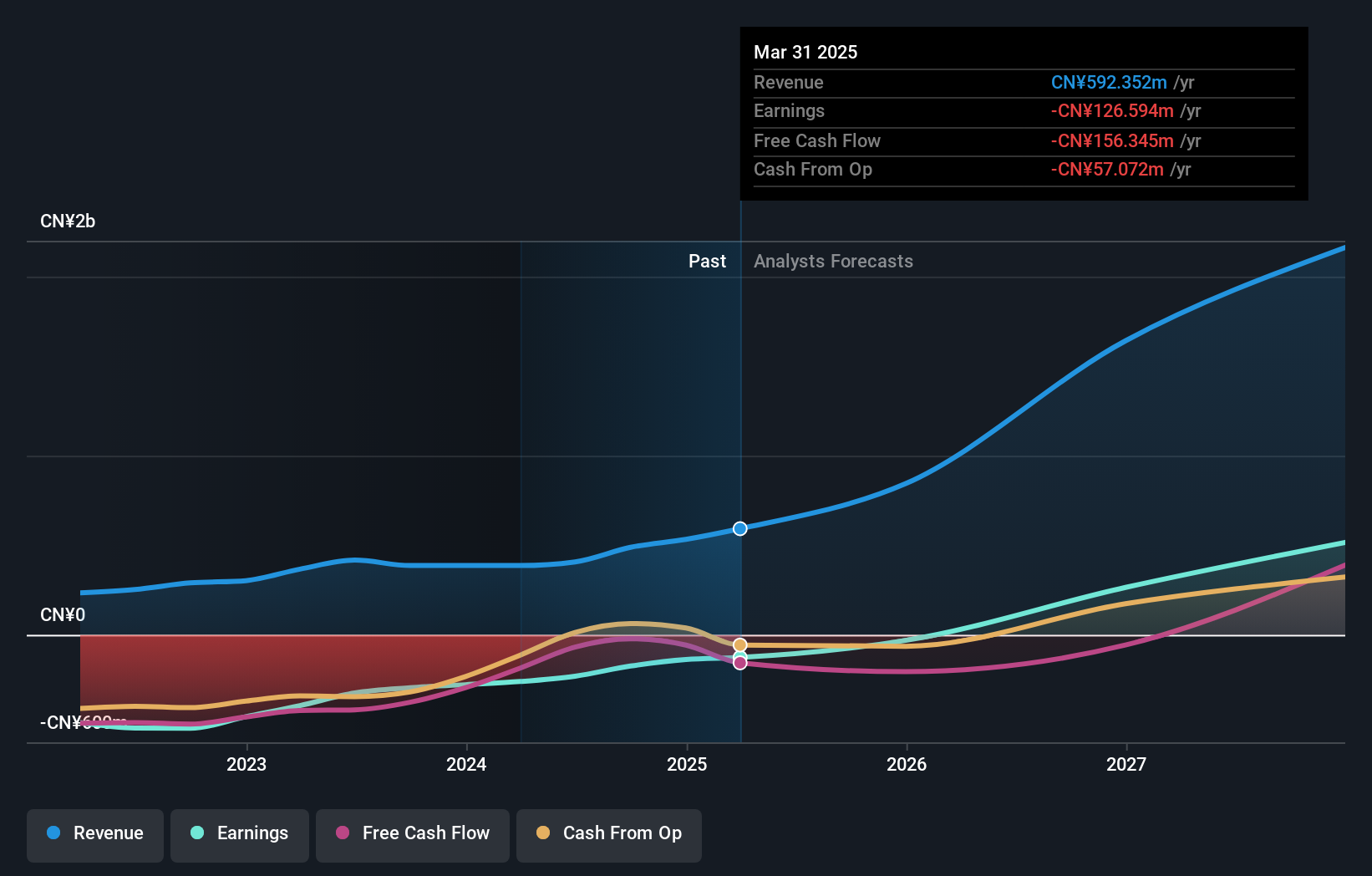

Overview: Suzhou Zelgen Biopharmaceuticals Ltd, operating under the ticker SHSE:688266, is a biopharmaceutical company with a market capitalization of approximately CN¥14.39 billion, focusing on the research and development of novel medications.

Operations: Suzhou Zelgen Biopharmaceuticals generates its revenue primarily from the pharmaceuticals segment, totaling CN¥386.57 million.

Insider Ownership: 29.4%

Earnings Growth Forecast: 108.2% p.a.

Suzhou Zelgen Biopharmaceuticals, a Chinese growth company with significant insider ownership, is poised for substantial growth with revenue forecasted to increase by 55.7% annually. Despite trading at 67.9% below its estimated fair value and a current net loss of CNY 39.5 million in Q1 2024, improvements are evident as this loss narrowed from CNY 57.23 million year-over-year. The company is expected to become profitable within three years, outpacing average market expectations, although its projected return on equity remains modest at 9.6%.

- Take a closer look at Suzhou Zelgen BiopharmaceuticalsLtd's potential here in our earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of Suzhou Zelgen BiopharmaceuticalsLtd shares in the market.

ApicHope Pharmaceutical (SZSE:300723)

Simply Wall St Growth Rating: ★★★★☆☆

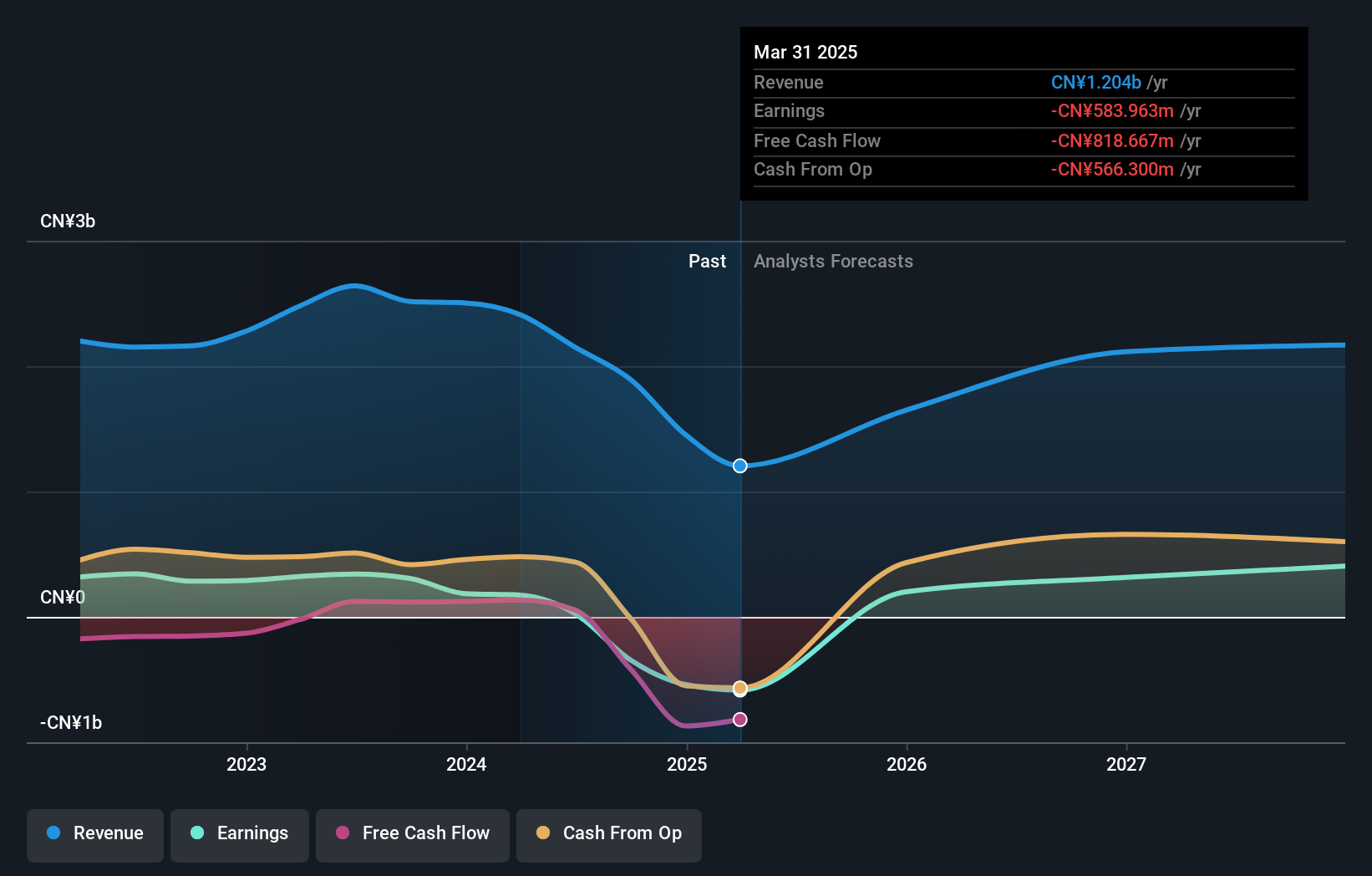

Overview: ApicHope Pharmaceutical Co., Ltd focuses on the research, development, production, and sale of pharmaceutical drugs, with a market capitalization of approximately CN¥8.94 billion.

Operations: The company's revenue is primarily derived from the research, development, production, and sales of pharmaceutical drugs.

Insider Ownership: 19.2%

Earnings Growth Forecast: 29.3% p.a.

ApicHope Pharmaceutical, despite a challenging year with reduced net income and profit margins, remains a growth-focused entity in China's pharmaceutical sector. The company's earnings are expected to grow by 29.3% annually, outstripping the market average. However, financial results have been impacted by significant one-off items and shareholder dilution over the past year. Recent corporate actions include dividend distributions and amendments to company bylaws, signaling active management engagement.

- Click to explore a detailed breakdown of our findings in ApicHope Pharmaceutical's earnings growth report.

- According our valuation report, there's an indication that ApicHope Pharmaceutical's share price might be on the expensive side.

Taking Advantage

- Click this link to deep-dive into the 367 companies within our Fast Growing Chinese Companies With High Insider Ownership screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688266

Suzhou Zelgen BiopharmaceuticalsLtd

Suzhou Zelgen Biopharmaceuticals Co.,Ltd.

High growth potential with adequate balance sheet.