3 Growth Companies With High Insider Ownership And 123% Earnings Growth

Reviewed by Simply Wall St

As global markets continue to reach record highs, buoyed by robust gains in major indices like the Dow Jones Industrial Average and S&P 500, investors are navigating a landscape shaped by domestic policy shifts and geopolitical developments. In this environment, growth companies with high insider ownership can present intriguing opportunities, as they often indicate strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 32.4% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.4% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here's a peek at a few of the choices from the screener.

Seojin SystemLtd (KOSDAQ:A178320)

Simply Wall St Growth Rating: ★★★★★★

Overview: Seojin System Co., Ltd, with a market cap of ₩1.54 trillion, offers telecom equipment, repeaters, mechanical products, and LED and other equipment.

Operations: The company's revenue segments include the EMS Sector, generating ₩1.79 billion, and the Semiconductor Sector, contributing ₩187.83 million.

Insider Ownership: 30.9%

Earnings Growth Forecast: 39.9% p.a.

Seojin System Ltd. presents a compelling case for growth, trading at 83% below its estimated fair value. Despite substantial shareholder dilution in the past year, the company's earnings and revenue are forecast to grow significantly faster than the Korean market over the next three years. However, debt coverage by operating cash flow is weak and non-cash earnings are high. Analysts agree on a potential stock price increase of 38.7%.

- Navigate through the intricacies of Seojin SystemLtd with our comprehensive analyst estimates report here.

- The analysis detailed in our Seojin SystemLtd valuation report hints at an deflated share price compared to its estimated value.

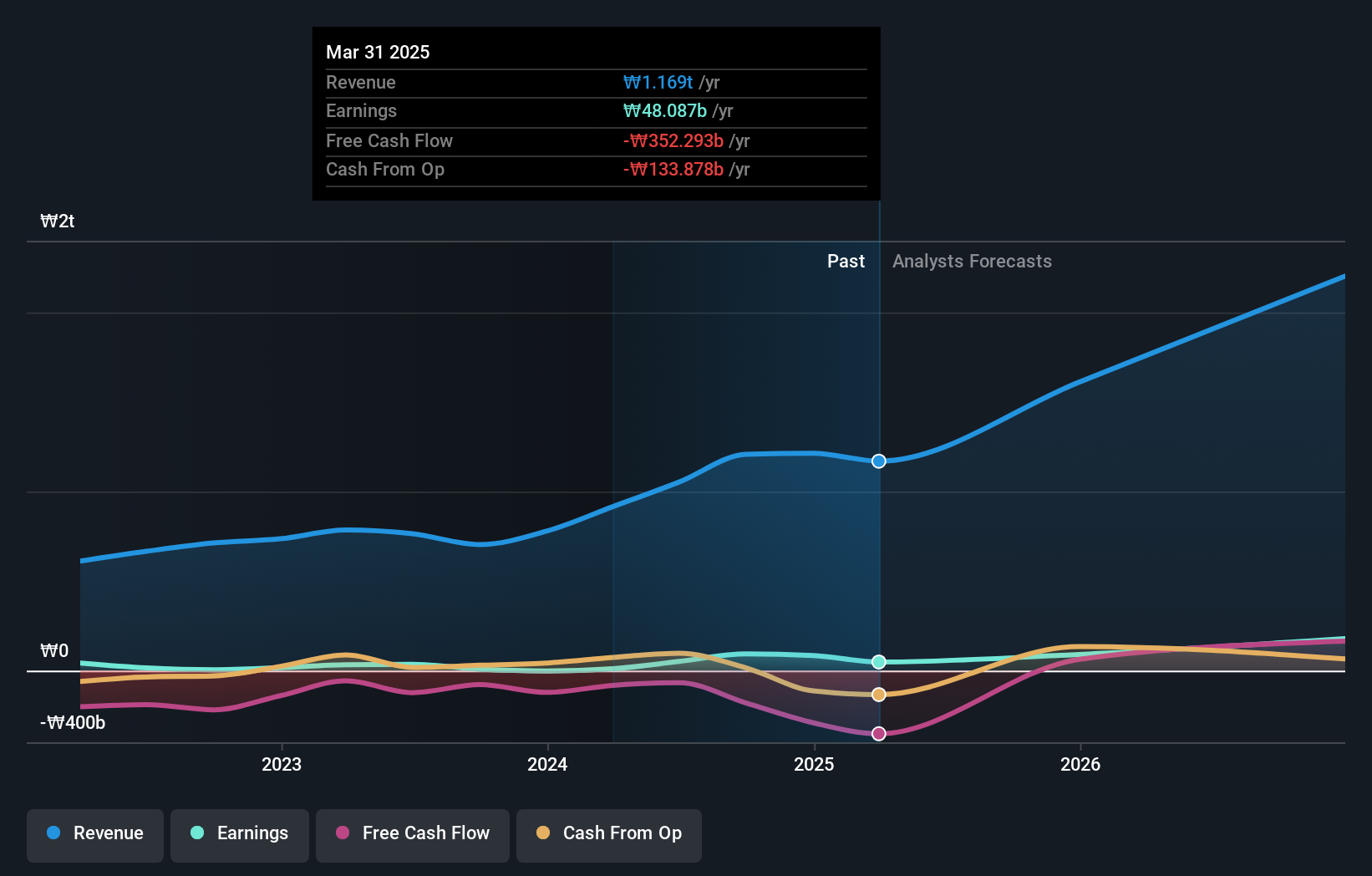

Porton Pharma Solutions (SZSE:300363)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Porton Pharma Solutions Ltd. manufactures and sells small molecule active pharmaceutical ingredients, dosage forms, and biologics to pharmaceutical companies in China, the United States, and Europe, with a market cap of CN¥9.51 billion.

Operations: Porton Pharma Solutions Ltd.'s revenue is derived from the production and distribution of small molecule active pharmaceutical ingredients, dosage forms, and biologics to pharmaceutical companies across China, the United States, and Europe.

Insider Ownership: 26.7%

Earnings Growth Forecast: 123.9% p.a.

Porton Pharma Solutions shows potential for growth with expected annual revenue increases of 20.6%, outpacing the Chinese market's average. Despite recent financial setbacks, including a net loss of CNY 206.43 million for the first nine months of 2024, analysts forecast profitability within three years. The company's return on equity is projected to remain low at 5.3%. Insider trading activity has been minimal recently, and its dividend sustainability is questionable due to earnings coverage issues.

- Dive into the specifics of Porton Pharma Solutions here with our thorough growth forecast report.

- According our valuation report, there's an indication that Porton Pharma Solutions' share price might be on the expensive side.

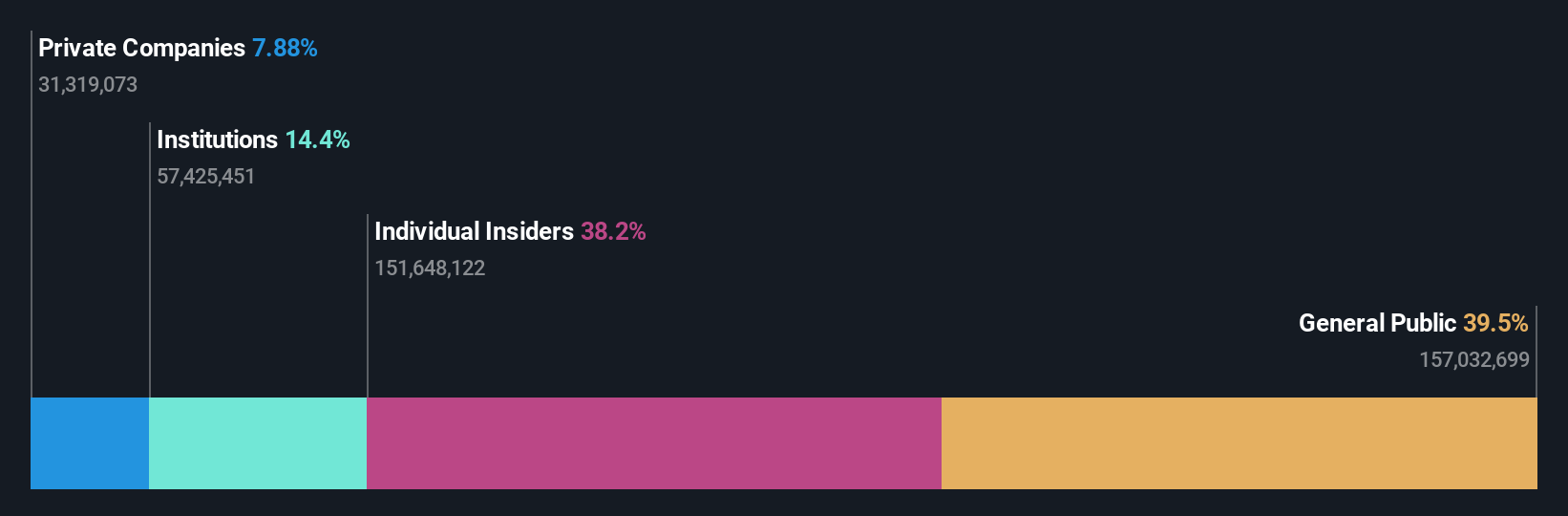

Ginlong Technologies (SZSE:300763)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ginlong Technologies Co., Ltd. is involved in the research, development, production, service, and sale of string inverters globally and has a market cap of approximately CN¥25.99 billion.

Operations: Ginlong Technologies Co., Ltd. generates revenue primarily through its global operations focused on the research, development, production, service, and sale of string inverters.

Insider Ownership: 38.2%

Earnings Growth Forecast: 33.6% p.a.

Ginlong Technologies is poised for growth with projected annual earnings and revenue increases of 33.55% and 26.5%, respectively, surpassing market averages. Despite recent profit margin declines from 17.4% to 10.5%, its financial outlook remains strong with significant forecasted growth over the next three years. Recent board appointments may influence strategic direction, while past shareholder dilution could impact investor sentiment despite no substantial insider trading activity recently reported.

- Click here to discover the nuances of Ginlong Technologies with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Ginlong Technologies is trading beyond its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 1512 Fast Growing Companies With High Insider Ownership right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300363

Porton Pharma Solutions

Engages in the manufacture and sale of small molecule active pharmaceutical ingredients, dosage forms, and biologics to the pharmaceutical companies in China, the United States, and Europe.

High growth potential with mediocre balance sheet.