Stock Analysis

Shareholders in Sailong Pharmaceutical GroupLtd (SZSE:002898) have lost 34%, as stock drops 14% this past week

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But even the best stock picker will only win with some selections. At this point some shareholders may be questioning their investment in Sailong Pharmaceutical Group Co.,Ltd. (SZSE:002898), since the last five years saw the share price fall 35%. The falls have accelerated recently, with the share price down 27% in the last three months.

Since Sailong Pharmaceutical GroupLtd has shed CN¥282m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Sailong Pharmaceutical GroupLtd

Sailong Pharmaceutical GroupLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over half a decade Sailong Pharmaceutical GroupLtd reduced its trailing twelve month revenue by 10% for each year. That puts it in an unattractive cohort, to put it mildly. It seems pretty reasonable to us that the share price dipped 6% per year in that time. We doubt many shareholders are delighted with this share price performance. It is possible for businesses to bounce back but as Buffett says, 'turnarounds seldom turn'.

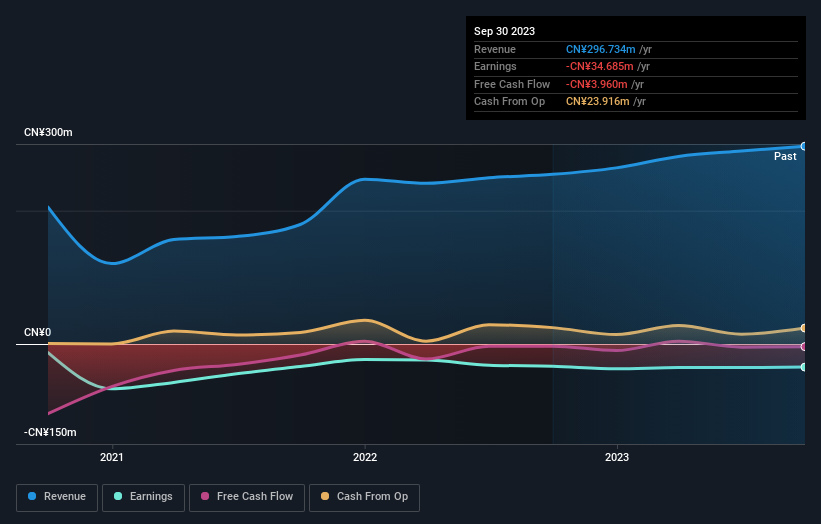

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Sailong Pharmaceutical GroupLtd's financial health with this free report on its balance sheet.

A Different Perspective

While it's certainly disappointing to see that Sailong Pharmaceutical GroupLtd shares lost 5.8% throughout the year, that wasn't as bad as the market loss of 17%. What is more upsetting is the 6% per annum loss investors have suffered over the last half decade. This sort of share price action isn't particularly encouraging, but at least the losses are slowing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should learn about the 2 warning signs we've spotted with Sailong Pharmaceutical GroupLtd (including 1 which is significant) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sailong Pharmaceutical GroupLtd is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002898

Sailong Pharmaceutical GroupLtd

Sailong Pharmaceutical Group Co., Ltd. researches, develops, produces, markets, and services pharmaceutical intermediates, raw materials, and preparations in China.

Excellent balance sheet with poor track record.