Is Sunflower Pharmaceutical Group Co.,Ltd's (SZSE:002737) Latest Stock Performance Being Led By Its Strong Fundamentals?

Most readers would already know that Sunflower Pharmaceutical GroupLtd's (SZSE:002737) stock increased by 4.0% over the past week. Given its impressive performance, we decided to study the company's key financial indicators as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Sunflower Pharmaceutical GroupLtd's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Sunflower Pharmaceutical GroupLtd

How To Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sunflower Pharmaceutical GroupLtd is:

19% = CN¥883m ÷ CN¥4.7b (Based on the trailing twelve months to September 2024).

The 'return' is the amount earned after tax over the last twelve months. One way to conceptualize this is that for each CN¥1 of shareholders' capital it has, the company made CN¥0.19 in profit.

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Sunflower Pharmaceutical GroupLtd's Earnings Growth And 19% ROE

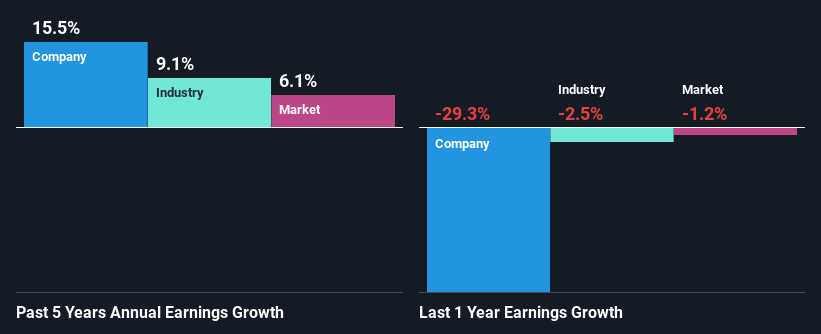

At first glance, Sunflower Pharmaceutical GroupLtd seems to have a decent ROE. Especially when compared to the industry average of 7.7% the company's ROE looks pretty impressive. This certainly adds some context to Sunflower Pharmaceutical GroupLtd's decent 15% net income growth seen over the past five years.

We then compared Sunflower Pharmaceutical GroupLtd's net income growth with the industry and we're pleased to see that the company's growth figure is higher when compared with the industry which has a growth rate of 9.1% in the same 5-year period.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Sunflower Pharmaceutical GroupLtd is trading on a high P/E or a low P/E, relative to its industry.

Is Sunflower Pharmaceutical GroupLtd Making Efficient Use Of Its Profits?

While Sunflower Pharmaceutical GroupLtd has a three-year median payout ratio of 58% (which means it retains 42% of profits), the company has still seen a fair bit of earnings growth in the past, meaning that its high payout ratio hasn't hampered its ability to grow.

Additionally, Sunflower Pharmaceutical GroupLtd has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

Conclusion

In total, we are pretty happy with Sunflower Pharmaceutical GroupLtd's performance. Especially the high ROE, Which has contributed to the impressive growth seen in earnings. Despite the company reinvesting only a small portion of its profits, it still has managed to grow its earnings so that is appreciable. Until now, we have only just grazed the surface of the company's past performance by looking at the company's fundamentals. So it may be worth checking this free detailed graph of Sunflower Pharmaceutical GroupLtd's past earnings, as well as revenue and cash flows to get a deeper insight into the company's performance.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002737

Sunflower Pharmaceutical GroupLtd

Engages in the research and development, manufacturing, and marketing of Chinese patent medicines in China and internationally.

Flawless balance sheet and good value.