1.3% earnings growth over 3 years has not materialized into gains for Changchun High-Tech Industry (Group) (SZSE:000661) shareholders over that period

Investing in stocks inevitably means buying into some companies that perform poorly. But the last three years have been particularly tough on longer term Changchun High-Tech Industry (Group) Co., Ltd. (SZSE:000661) shareholders. Sadly for them, the share price is down 68% in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 42% lower in that time. Shareholders have had an even rougher run lately, with the share price down 23% in the last 90 days. Of course, this share price action may well have been influenced by the 11% decline in the broader market, throughout the period.

With the stock having lost 3.6% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Changchun High-Tech Industry (Group)

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Although the share price is down over three years, Changchun High-Tech Industry (Group) actually managed to grow EPS by 4.0% per year in that time. Given the share price reaction, one might suspect that EPS is not a good guide to the business performance during the period (perhaps due to a one-off loss or gain). Alternatively, growth expectations may have been unreasonable in the past.

It's pretty reasonable to suspect the market was previously to bullish on the stock, and has since moderated expectations. But it's possible a look at other metrics will be enlightening.

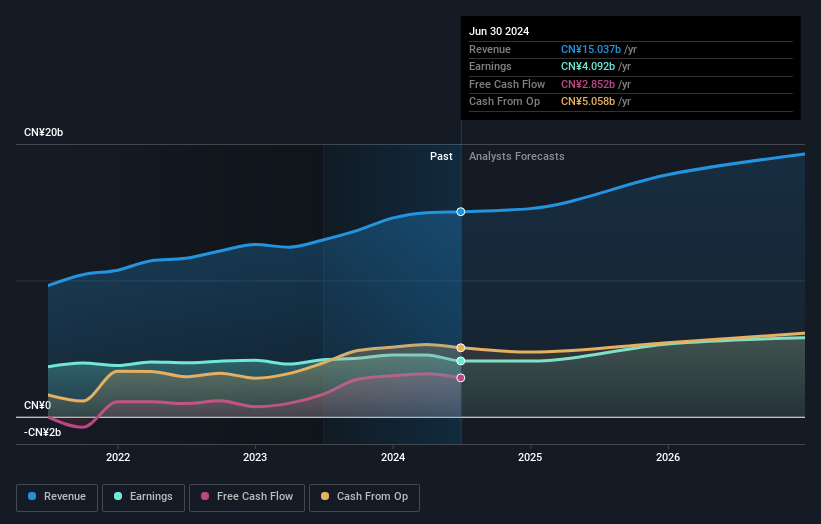

Given the healthiness of the dividend payments, we doubt that they've concerned the market. We like that Changchun High-Tech Industry (Group) has actually grown its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We regret to report that Changchun High-Tech Industry (Group) shareholders are down 39% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 18%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Before forming an opinion on Changchun High-Tech Industry (Group) you might want to consider the cold hard cash it pays as a dividend. This free chart tracks its dividend over time.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000661

Changchun High-Tech Industry (Group)

Researches, develops, manufactures, and sells biopharmaceuticals and traditional Chinese medicines products in China.

6 star dividend payer and undervalued.