Private equity firms in Heilongjiang ZBD Pharmaceutical Co., Ltd. (SHSE:603567) are its biggest bettors, and their bets paid off as stock gained 6.7% last week

Key Insights

- The considerable ownership by private equity firms in Heilongjiang ZBD Pharmaceutical indicates that they collectively have a greater say in management and business strategy

- Heilongjiang Chuangda Group Co., Ltd. owns 50% of the company

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

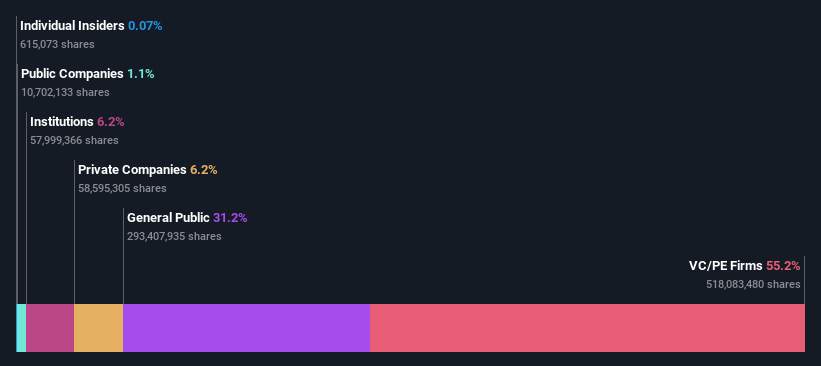

If you want to know who really controls Heilongjiang ZBD Pharmaceutical Co., Ltd. (SHSE:603567), then you'll have to look at the makeup of its share registry. With 55% stake, private equity firms possess the maximum shares in the company. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, private equity firms were the biggest beneficiaries of last week’s 6.7% gain.

Let's delve deeper into each type of owner of Heilongjiang ZBD Pharmaceutical, beginning with the chart below.

View our latest analysis for Heilongjiang ZBD Pharmaceutical

What Does The Institutional Ownership Tell Us About Heilongjiang ZBD Pharmaceutical?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

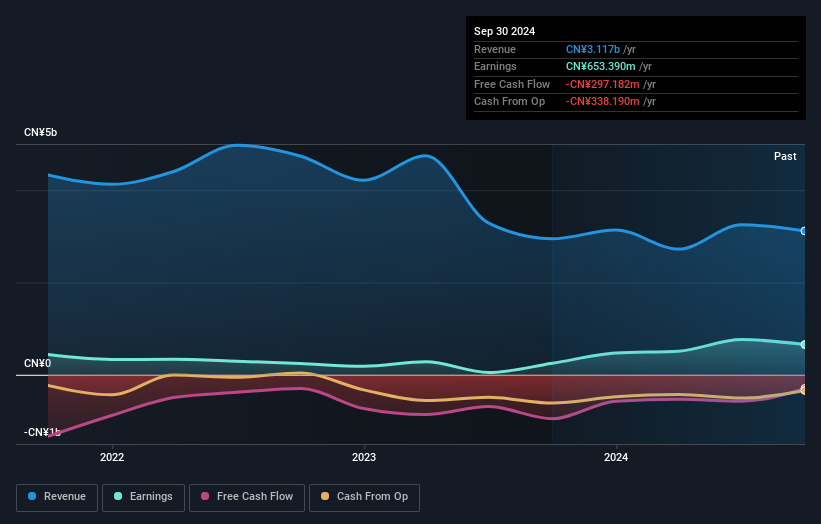

As you can see, institutional investors have a fair amount of stake in Heilongjiang ZBD Pharmaceutical. This implies the analysts working for those institutions have looked at the stock and they like it. But just like anyone else, they could be wrong. When multiple institutions own a stock, there's always a risk that they are in a 'crowded trade'. When such a trade goes wrong, multiple parties may compete to sell stock fast. This risk is higher in a company without a history of growth. You can see Heilongjiang ZBD Pharmaceutical's historic earnings and revenue below, but keep in mind there's always more to the story.

We note that hedge funds don't have a meaningful investment in Heilongjiang ZBD Pharmaceutical. Our data shows that Heilongjiang Chuangda Group Co., Ltd. is the largest shareholder with 50% of shares outstanding. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. With 5.9% and 5.0% of the shares outstanding respectively, Hulin Longpeng Investment Center and Huzhou Saishi Investment Management Co., Ltd. are the second and third largest shareholders.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Heilongjiang ZBD Pharmaceutical

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Our data suggests that insiders own under 1% of Heilongjiang ZBD Pharmaceutical Co., Ltd. in their own names. We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. Keep in mind that it's a big company, and the insiders own CN¥7.5m worth of shares. The absolute value might be more important than the proportional share. It is good to see board members owning shares, but it might be worth checking if those insiders have been buying.

General Public Ownership

With a 31% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Heilongjiang ZBD Pharmaceutical. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Private Equity Ownership

Private equity firms hold a 55% stake in Heilongjiang ZBD Pharmaceutical. This suggests they can be influential in key policy decisions. Sometimes we see private equity stick around for the long term, but generally speaking they have a shorter investment horizon and -- as the name suggests -- don't invest in public companies much. After some time they may look to sell and redeploy capital elsewhere.

Private Company Ownership

We can see that Private Companies own 6.2%, of the shares on issue. It's hard to draw any conclusions from this fact alone, so its worth looking into who owns those private companies. Sometimes insiders or other related parties have an interest in shares in a public company through a separate private company.

Next Steps:

It's always worth thinking about the different groups who own shares in a company. But to understand Heilongjiang ZBD Pharmaceutical better, we need to consider many other factors. Be aware that Heilongjiang ZBD Pharmaceutical is showing 1 warning sign in our investment analysis , you should know about...

Of course this may not be the best stock to buy. So take a peek at this free free list of interesting companies.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Heilongjiang ZBD Pharmaceutical might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603567

Heilongjiang ZBD Pharmaceutical

Heilongjiang ZBD Pharmaceutical Co., Ltd.

Solid track record with excellent balance sheet.