Stock Analysis

High Growth Tech Stocks in China to Watch This September 2024

Reviewed by Simply Wall St

As Chinese equities have shown resilience amid broader economic challenges, the recent Fed rate cut has provided a supportive backdrop for market sentiment. In this context, identifying high-growth tech stocks in China can be particularly rewarding, especially those that demonstrate strong fundamentals and innovative capabilities.

Top 10 High Growth Tech Companies In China

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 32.61% | 31.67% | ★★★★★★ |

| Xi'an NovaStar Tech | 27.95% | 31.01% | ★★★★★★ |

| Zhejiang Meorient Commerce Exhibition | 26.41% | 32.59% | ★★★★★★ |

| Shanghai BOCHU Electronic Technology | 27.74% | 28.58% | ★★★★★★ |

| Zhongji Innolight | 32.37% | 31.70% | ★★★★★★ |

| Xiamen Amoytop Biotech | 28.03% | 30.85% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 23.53% | 29.96% | ★★★★★★ |

| Eoptolink Technology | 43.76% | 42.52% | ★★★★★★ |

| Bio-Thera Solutions | 26.85% | 117.16% | ★★★★★★ |

| Huayi Brothers Media | 40.13% | 103.97% | ★★★★★★ |

We'll examine a selection from our screener results.

Bloomage BioTechnology (SHSE:688363)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bloomage BioTechnology Corporation Limited researches, develops, produces, and sells bioactive materials with a market cap of CN¥23.49 billion.

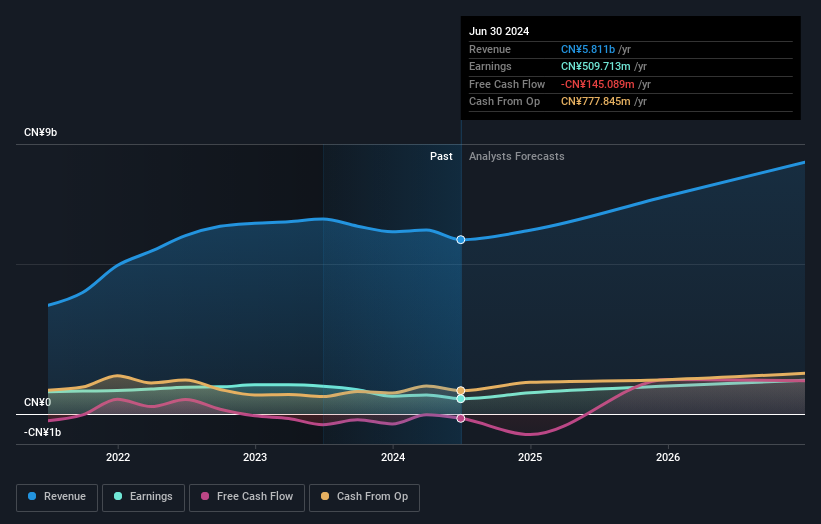

Operations: The company's primary revenue stream is from its pharmaceutical manufacturing segment, generating CN¥5.81 billion.

Bloomage BioTechnology, a key player in the biotech sector, is leveraging its expertise in bioactive substances to expand into high-growth markets such as functional foods and medical-grade products. With a robust R&D focus, evidenced by a significant investment of approximately USD 138 million in a new health food headquarters, the company is poised to enhance its product offerings and market reach. Recent showcases at international expos have highlighted innovative products like MitoPQQ™ and Bloomcolla Recombinant Human Collagen III, underscoring Bloomage's commitment to cutting-edge solutions for aging and health. Despite challenges like a 44.7% dip in earnings over the past year compared to an industry average growth of 10.1%, forecasts indicate an impressive revenue increase at 15.3% per year, outpacing the Chinese market's growth rate of 13.1%. Moreover, anticipated earnings growth stands at an encouraging 29.5% annually, signaling potential recovery and profitability ahead.

- Navigate through the intricacies of Bloomage BioTechnology with our comprehensive health report here.

Gain insights into Bloomage BioTechnology's past trends and performance with our Past report.

Beijing E-Hualu Information Technology (SZSE:300212)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing E-Hualu Information Technology Co., Ltd. specializes in providing digital solutions and services, with a market cap of CN¥11.84 billion.

Operations: E-Hualu focuses on offering digital solutions and services, generating significant revenue from these segments. Its market cap stands at CN¥11.84 billion.

Despite recent financial setbacks, Beijing E-Hualu Information Technology is making strides in the tech sector with its robust R&D investments, which have surged to 52.0% of revenue. This aggressive focus on innovation is crucial as the company seeks to navigate through a challenging phase marked by a net loss of CNY 368.4 million in the first half of 2024, up from CNY 298.04 million the previous year. The firm's commitment to development is further evidenced by its forecasted earnings growth at an impressive rate of 142.2% per year, positioning it for a potential turnaround in profitability despite current hardships like considering bankruptcy liquidation for a subsidiary and significant unrecovered losses that prompted extraordinary shareholder meetings this year.

COL GroupLtd (SZSE:300364)

Simply Wall St Growth Rating: ★★★★★☆

Overview: COL Group Co., Ltd. operates in the digital publishing industry in China and has a market cap of CN¥13.88 billion.

Operations: COL Group Co., Ltd. focuses on digital publishing in China. The company generates revenue from various digital content services and products, catering to a diverse audience.

With its R&D expenses soaring to 20.6% of revenue, COL GroupLtd is channeling significant resources into innovation, despite a challenging financial landscape marked by a net loss of CNY 150.09 million in the first half of 2024. This investment strategy aligns with the broader tech industry's shift towards high-value software and AI solutions, positioning COL potentially for recovery as it aims to grow revenues at an impressive rate of 66.9% annually. Moreover, the company repurchased shares worth CNY 30 million, signaling confidence in its future prospects and commitment to enhancing shareholder value through strategic capital allocation.

- Click to explore a detailed breakdown of our findings in COL GroupLtd's health report.

Examine COL GroupLtd's past performance report to understand how it has performed in the past.

Make It Happen

- Navigate through the entire inventory of 261 Chinese High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bloomage BioTechnology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688363

Bloomage BioTechnology

Bloomage BioTechnology Corporation Limited researchers, develops, produces, and sells bioactive materials.