Stock Analysis

Exploring High Growth Tech Stocks For December 2024

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by geopolitical tensions and economic fluctuations, U.S. small-cap stocks have joined their larger peers in reaching record highs, driven by robust consumer spending and positive sentiment from key policy announcements. In this dynamic environment, identifying promising high-growth tech stocks involves considering factors such as innovation potential, market adaptability, and resilience to external economic pressures.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| CD Projekt | 21.20% | 28.62% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.34% | ★★★★★★ |

Click here to see the full list of 1288 stocks from our High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Foshan Yowant TechnologyLtd (SZSE:002291)

Simply Wall St Growth Rating: ★★★★☆☆

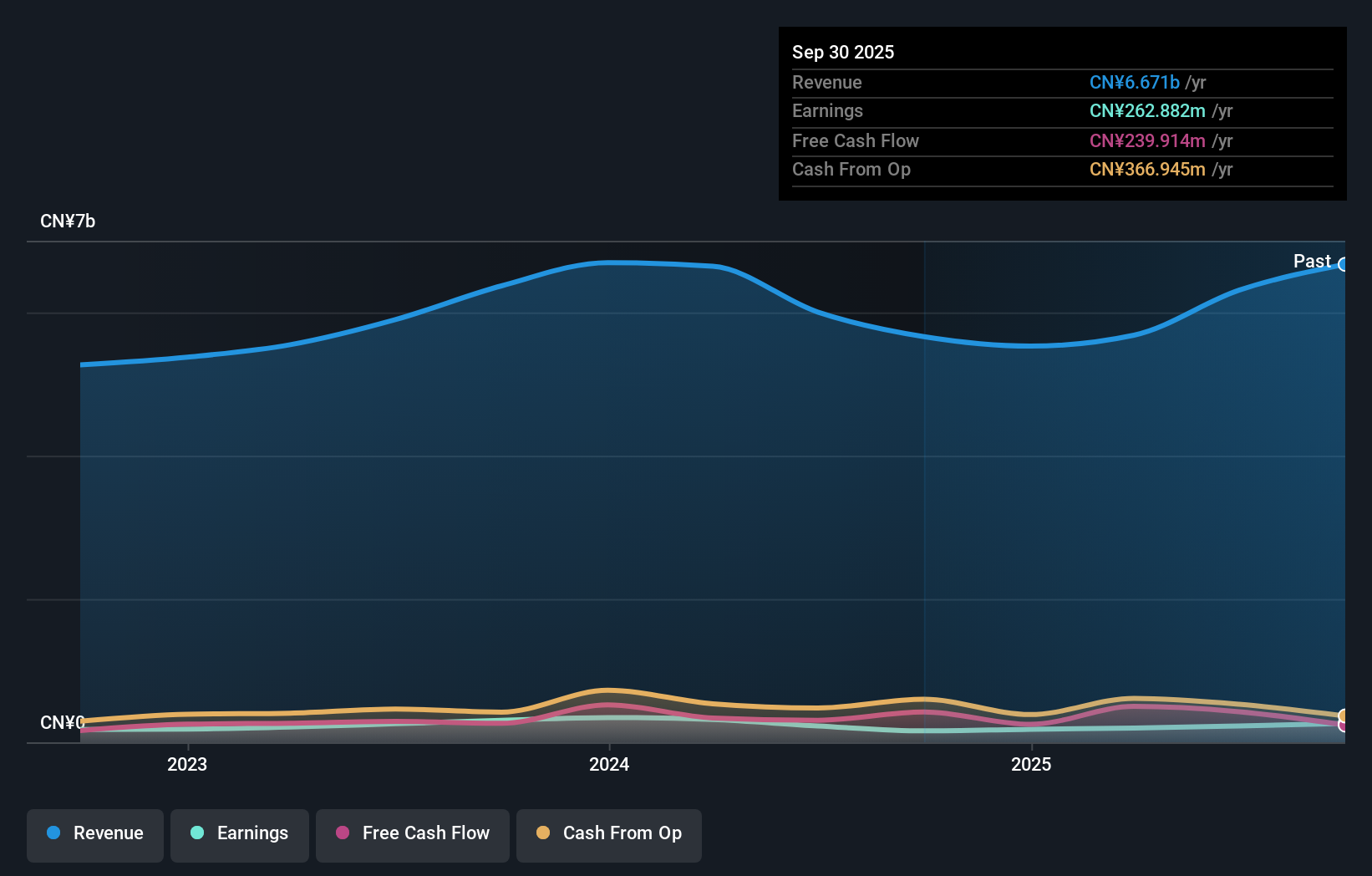

Overview: Foshan Yowant Technology Co., Ltd operates in the digital marketing sector within China and has a market capitalization of CN¥6.68 billion.

Operations: Yowant Technology specializes in digital marketing services across China. The company generates revenue primarily through its comprehensive digital advertising solutions, leveraging technology to enhance client engagement and brand visibility.

Despite being currently unprofitable, Foshan Yowant TechnologyLtd is positioned for significant growth with earnings expected to surge by 171.7% annually. This potential turnaround is underscored by a revenue growth forecast of 14% per year, outpacing the Chinese market's projection of 13.8%. The company's commitment to innovation is evident in its substantial R&D investments, which are crucial for sustaining long-term competitiveness in the fast-evolving tech landscape. Recent financial statements reveal an improvement in net losses — CNY 408.29 million down from CNY 449.61 million year-over-year — indicating effective cost management and operational adjustments that could lead to profitability within three years. These factors combined suggest a promising horizon for Foshan Yowant TechnologyLtd, albeit with inherent risks due to current unprofitability and market competition pressures.

Hanwang TechnologyLtd (SZSE:002362)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hanwang Technology Co., Ltd. is engaged in the design and development of handwriting recognition, optical character recognition, and handwriting input products globally, with a market cap of CN¥5.84 billion.

Operations: Hanwang Technology Co., Ltd. focuses on the global market with its core offerings in handwriting recognition, optical character recognition, and handwriting input solutions.

Hanwang TechnologyLtd, despite its current unprofitability, is on a path to robust growth with an impressive revenue increase of 25.3% per year, outstripping the broader Chinese market's average of 13.9%. This surge in sales from CNY 972.71 million to CNY 1,146.56 million underscores a strong market demand for its offerings. The company's dedication to innovation is reflected in its R&D spending, crucial for maintaining competitiveness in the dynamic tech sector. Moreover, earnings are projected to grow by a substantial 86.3% annually, positioning Hanwang for potential profitability within three years and highlighting its capacity to adapt and evolve in a rapidly changing industry landscape.

- Take a closer look at Hanwang TechnologyLtd's potential here in our health report.

Gain insights into Hanwang TechnologyLtd's past trends and performance with our Past report.

Xiamen Jihong Technology (SZSE:002803)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector in Southeast Asia, with a market cap of CN¥6.19 billion.

Operations: Xiamen Jihong Technology focuses on cross-border social e-commerce in Southeast Asia, leveraging digital platforms to facilitate transactions and engagement. The company generates revenue primarily through its e-commerce operations, which cater to a diverse customer base in the region. It strategically invests in technology and logistics to enhance operational efficiency, impacting cost structures positively.

Xiamen Jihong Technology, amidst a challenging market, is navigating with strategic agility. The company's R&D commitment is evident from its significant expenditure, underscoring a focus on sustaining innovation and competitive edge. Notably, its revenue growth at 22.2% annually surpasses the Chinese market average of 13.8%, reflecting robust business dynamics despite recent earnings contraction to CN¥134.67 million from last year's CN¥320.71 million. Additionally, the firm has initiated a share repurchase program valued at CNY 100 million to bolster shareholder value and support long-term incentives for employees—a move indicating confidence in future prospects and stability.

Turning Ideas Into Actions

- Discover the full array of 1288 High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002291

Foshan Yowant TechnologyLtd

Engages in the digital marketing business in China.