Hylink Digital Solutions Co.,Ltd's (SHSE:603825) Shares Bounce 38% But Its Business Still Trails The Industry

Hylink Digital Solutions Co.,Ltd (SHSE:603825) shares have had a really impressive month, gaining 38% after a shaky period beforehand. The last month tops off a massive increase of 132% in the last year.

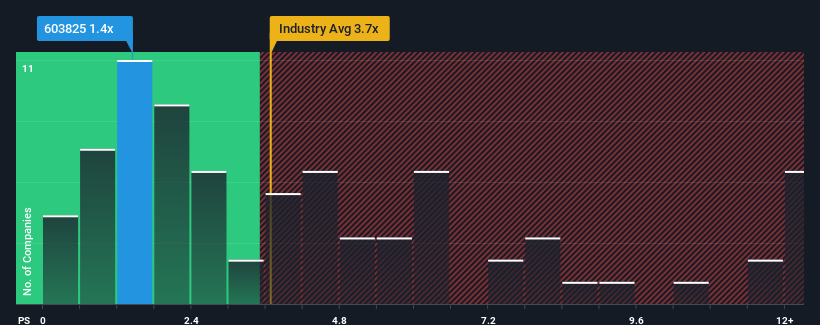

In spite of the firm bounce in price, Hylink Digital SolutionsLtd may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.4x, since almost half of all companies in the Media industry in China have P/S ratios greater than 3.7x and even P/S higher than 7x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hylink Digital SolutionsLtd

What Does Hylink Digital SolutionsLtd's P/S Mean For Shareholders?

For instance, Hylink Digital SolutionsLtd's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Hylink Digital SolutionsLtd will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hylink Digital SolutionsLtd will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Hylink Digital SolutionsLtd would need to produce anemic growth that's substantially trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 58%. This means it has also seen a slide in revenue over the longer-term as revenue is down 74% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 11% shows it's an unpleasant look.

With this information, we are not surprised that Hylink Digital SolutionsLtd is trading at a P/S lower than the industry. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Hylink Digital SolutionsLtd's P/S Mean For Investors?

Shares in Hylink Digital SolutionsLtd have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Hylink Digital SolutionsLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Given the current circumstances, it seems unlikely that the share price will experience any significant movement in either direction in the near future if recent medium-term revenue trends persist.

Having said that, be aware Hylink Digital SolutionsLtd is showing 2 warning signs in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hylink Digital SolutionsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603825

Hylink Digital SolutionsLtd

Provides digital marketing services worldwide.

Slightly overvalued with very low risk.

Market Insights

Community Narratives