- China

- /

- Consumer Durables

- /

- SZSE:000921

3 Dividend Stocks In China With Up To 4.4% Yield

Reviewed by Simply Wall St

As Chinese equities rise amid a holiday-shortened week and the Fed's recent rate cut, investors are closely watching how these changes impact market dynamics. In this environment, dividend stocks offer a compelling option for those seeking stable returns, especially in light of the current economic data suggesting slowing momentum in China's economy. When evaluating dividend stocks, it's crucial to consider factors such as yield stability and the company's financial health. Here are three Chinese dividend stocks with yields of up to 4.4% that may be worth your attention.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.54% | ★★★★★★ |

| Anhui Anke Biotechnology (Group) (SZSE:300009) | 3.29% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.12% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 7.26% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.31% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 4.23% | ★★★★★★ |

| Kweichow Moutai (SHSE:600519) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.70% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.66% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.78% | ★★★★★★ |

Click here to see the full list of 273 stocks from our Top Chinese Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

G-bits Network Technology (Xiamen) (SHSE:603444)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: G-bits Network Technology (Xiamen) Co., Ltd. operates in the online gaming industry, developing and publishing games with a market cap of approximately CN¥14.51 billion.

Operations: G-bits Network Technology (Xiamen) Co., Ltd. generates revenue primarily from developing and publishing online games.

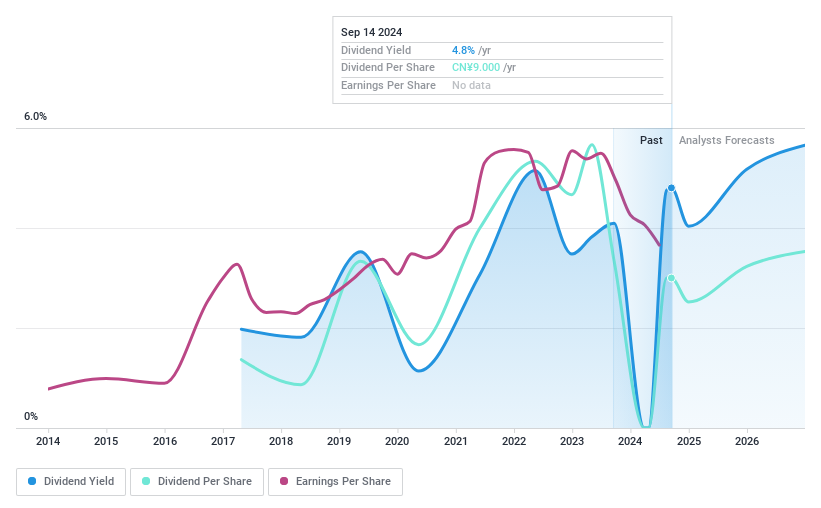

Dividend Yield: 4.5%

G-bits Network Technology (Xiamen) has a dividend payout ratio of 33.5%, indicating dividends are well-covered by earnings, while its cash payout ratio stands at 56.2%. The company offers a high dividend yield of 4.45%, placing it in the top quartile of Chinese dividend payers. However, G-bits' dividend payments have been volatile over the past seven years and its recent financial performance shows a decline in net income and sales for H1 2024 compared to the previous year.

- Click here to discover the nuances of G-bits Network Technology (Xiamen) with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, G-bits Network Technology (Xiamen)'s share price might be too pessimistic.

LBX Pharmacy Chain (SHSE:603883)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LBX Pharmacy Chain Joint Stock Company operates a pharmacy store chain in China and has a market cap of approximately CN¥10.78 billion.

Operations: LBX Pharmacy Chain Joint Stock Company generates revenue primarily through its pharmacy store chain operations in China.

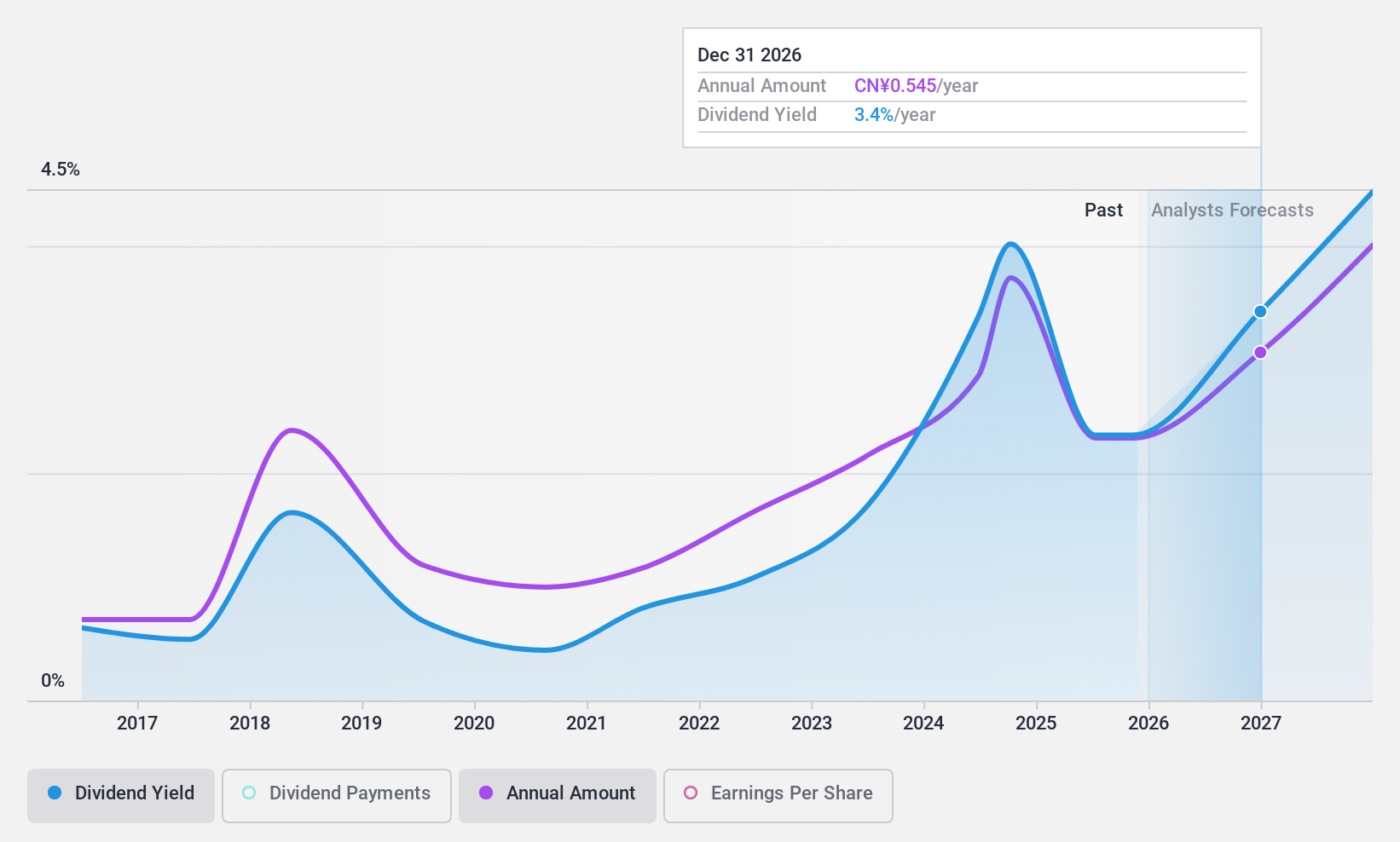

Dividend Yield: 3.6%

LBX Pharmacy Chain's dividend yield of 3.59% ranks in the top 25% of Chinese dividend payers, supported by a low cash payout ratio of 23.5%. However, its dividends have been volatile over the past eight years and its recent financials show a slight decline in net income to CNY 502.7 million for H1 2024 from CNY 513.25 million a year ago. Despite trading at good value compared to peers, LBX's unstable dividend history raises concerns about sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of LBX Pharmacy Chain.

- Our expertly prepared valuation report LBX Pharmacy Chain implies its share price may be lower than expected.

Hisense Home Appliances Group (SZSE:000921)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hisense Home Appliances Group Co., Ltd. manufactures and sells household electrical appliances under the Hisense, Ronshen, Kelon, Hitachi and York brands in China and internationally, with a market cap of approximately CN¥34.48 billion.

Operations: Hisense Home Appliances Group Co., Ltd. generates revenue primarily from HVAC (CN¥40.26 billion) and Ice Washing (CN¥29.20 billion) segments.

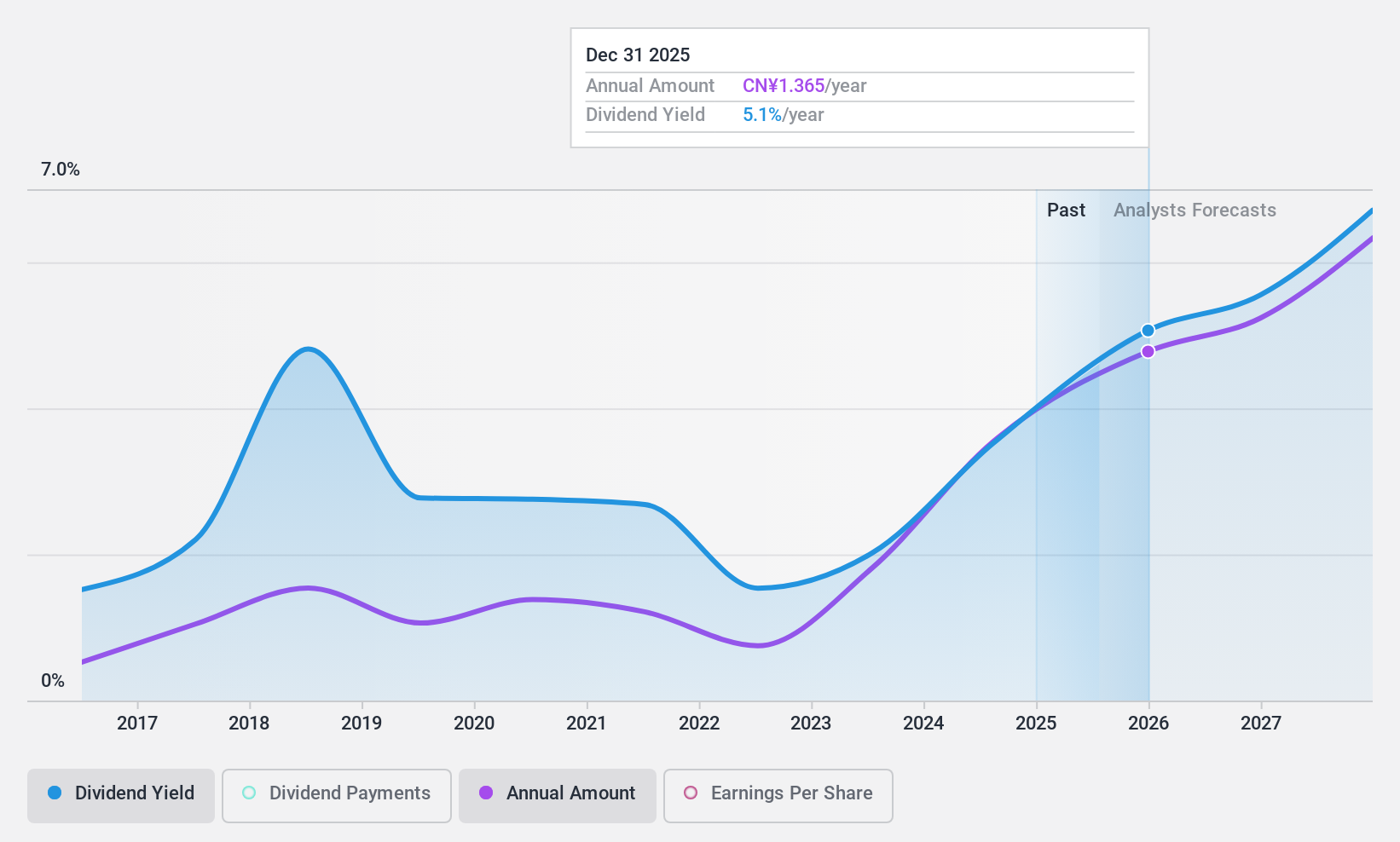

Dividend Yield: 3.7%

Hisense Home Appliances Group's dividend yield of 3.71% is among the top 25% in China, with a low cash payout ratio of 17.9%, indicating strong coverage by cash flows. However, its dividend history is less stable, having been paid for only eight years and showing volatility. Despite this, the company reported significant earnings growth for H1 2024 with net income rising to CNY 2.02 billion from CNY 1.50 billion a year ago, suggesting potential for future payouts.

- Take a closer look at Hisense Home Appliances Group's potential here in our dividend report.

- In light of our recent valuation report, it seems possible that Hisense Home Appliances Group is trading behind its estimated value.

Taking Advantage

- Take a closer look at our Top Chinese Dividend Stocks list of 273 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hisense Home Appliances Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000921

Hisense Home Appliances Group

Manufactures and sells household electrical appliances under the Hisense, Ronshen, Kelon, Hitachi and York brands in the People’s Republic of China and internationally.

Undervalued with solid track record and pays a dividend.