Shandong Kaisheng New Materials Co.,Ltd.'s (SZSE:301069) Shares Climb 27% But Its Business Is Yet to Catch Up

Shandong Kaisheng New Materials Co.,Ltd. (SZSE:301069) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 28% in the last twelve months.

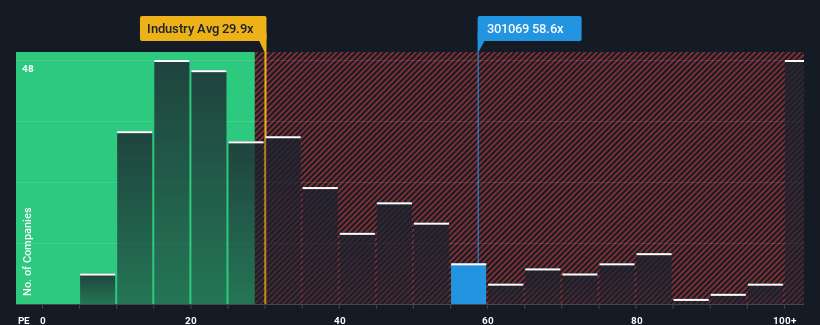

After such a large jump in price, Shandong Kaisheng New MaterialsLtd may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 58.6x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that Shandong Kaisheng New MaterialsLtd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Shandong Kaisheng New MaterialsLtd

Does Growth Match The High P/E?

In order to justify its P/E ratio, Shandong Kaisheng New MaterialsLtd would need to produce outstanding growth well in excess of the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. As a result, earnings from three years ago have also fallen 42% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Shandong Kaisheng New MaterialsLtd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

What We Can Learn From Shandong Kaisheng New MaterialsLtd's P/E?

The strong share price surge has got Shandong Kaisheng New MaterialsLtd's P/E rushing to great heights as well. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Shandong Kaisheng New MaterialsLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. Right now we are increasingly uncomfortable with the high P/E as this earnings performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 3 warning signs for Shandong Kaisheng New MaterialsLtd (1 can't be ignored!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Shandong Kaisheng New MaterialsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301069

Shandong Kaisheng New MaterialsLtd

Engages in the research and development, production, and sale of fine chemical products and new polymer materials in Mainland China, Japan, South Korea, the United States, and internationally.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives