Investors Appear Satisfied With Shanghai Ailu Package Co., Ltd.'s (SZSE:301062) Prospects As Shares Rocket 26%

Despite an already strong run, Shanghai Ailu Package Co., Ltd. (SZSE:301062) shares have been powering on, with a gain of 26% in the last thirty days. Taking a wider view, although not as strong as the last month, the full year gain of 25% is also fairly reasonable.

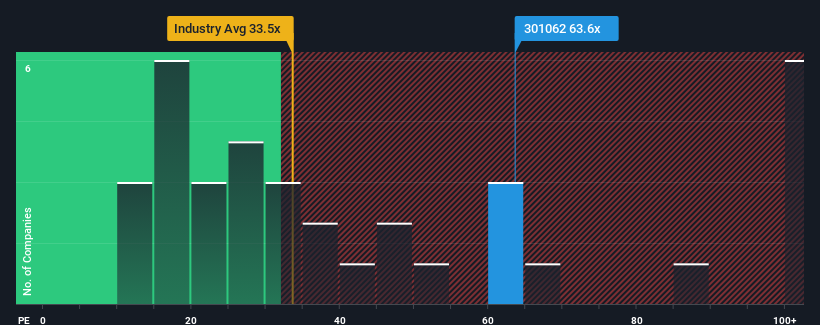

Since its price has surged higher, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 36x, you may consider Shanghai Ailu Package as a stock to avoid entirely with its 63.6x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Shanghai Ailu Package certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Shanghai Ailu Package

Is There Enough Growth For Shanghai Ailu Package?

In order to justify its P/E ratio, Shanghai Ailu Package would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 17% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 51% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 46% over the next year. That's shaping up to be materially higher than the 39% growth forecast for the broader market.

In light of this, it's understandable that Shanghai Ailu Package's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shanghai Ailu Package's P/E

The strong share price surge has got Shanghai Ailu Package's P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai Ailu Package maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Shanghai Ailu Package (1 shouldn't be ignored) you should be aware of.

Of course, you might also be able to find a better stock than Shanghai Ailu Package. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301062

Shanghai Ailu Package

Engages in the research and development, design, production, and sale of industrial paper packaging products, plastic packaging products, and intelligent packaging systems in China.

Reasonable growth potential with imperfect balance sheet.

Market Insights

Community Narratives