As global markets navigate a complex landscape marked by fluctuating trade policies and easing inflation, smaller-cap indexes have shown resilience despite lagging behind their larger counterparts. Amidst this backdrop of cautious optimism, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors seeking opportunities in less explored segments of the market.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Amanat Holdings PJSC | 11.28% | 31.80% | 1.00% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| National Corporation for Tourism and Hotels | 19.25% | 0.67% | 4.89% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shenyang Xingqi PharmaceuticalLtd (SZSE:300573)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenyang Xingqi Pharmaceutical Co., Ltd. focuses on the research, development, production, and sale of ophthalmic drugs in China with a market cap of CN¥13.28 billion.

Operations: Xingqi Pharmaceutical generates revenue primarily through the sale of ophthalmic drugs. The company's financial performance is characterized by a focus on research and development, which impacts its cost structure. Gross profit margin trends provide insight into the company's pricing strategy and cost efficiency over time.

Shenyang Xingqi Pharma, a nimble player in the pharmaceutical sector, showcases robust financial health with high-quality earnings and a price-to-earnings ratio of 30.7x, notably below the CN market average of 38x. Their impressive earnings growth of 75.9% last year outpaced the industry's -1.5%, highlighting their competitive edge. The company has effectively managed its debt, reducing its debt-to-equity ratio from 16% to 10.3% over five years while maintaining more cash than total debt. Recent developments include a private placement aiming to raise CNY 850 million and an approved dividend payout reflecting shareholder confidence amidst strategic expansions.

Poly Plastic Masterbatch (SuZhou)Ltd (SZSE:300905)

Simply Wall St Value Rating: ★★★★★☆

Overview: Poly Plastic Masterbatch (SuZhou) Co., Ltd specializes in the R&D, production, and sale of chemical fiber solution colorings and advanced functional modified materials globally, with a market cap of CN¥5.23 billion.

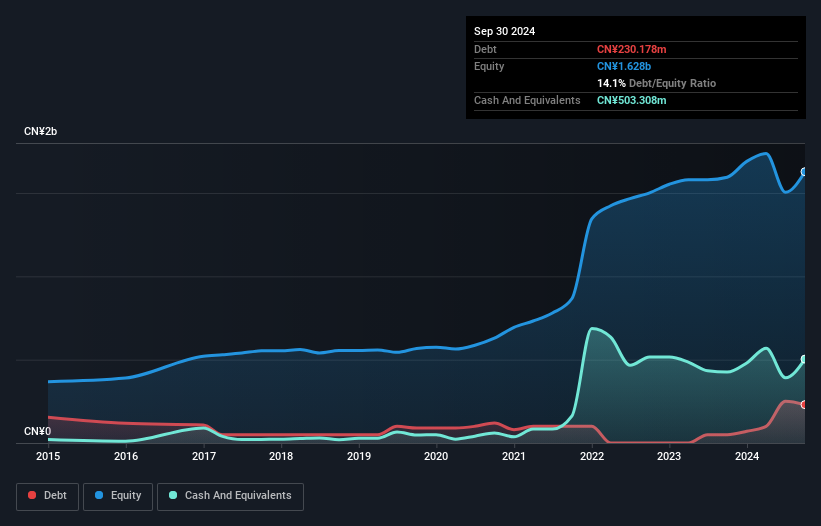

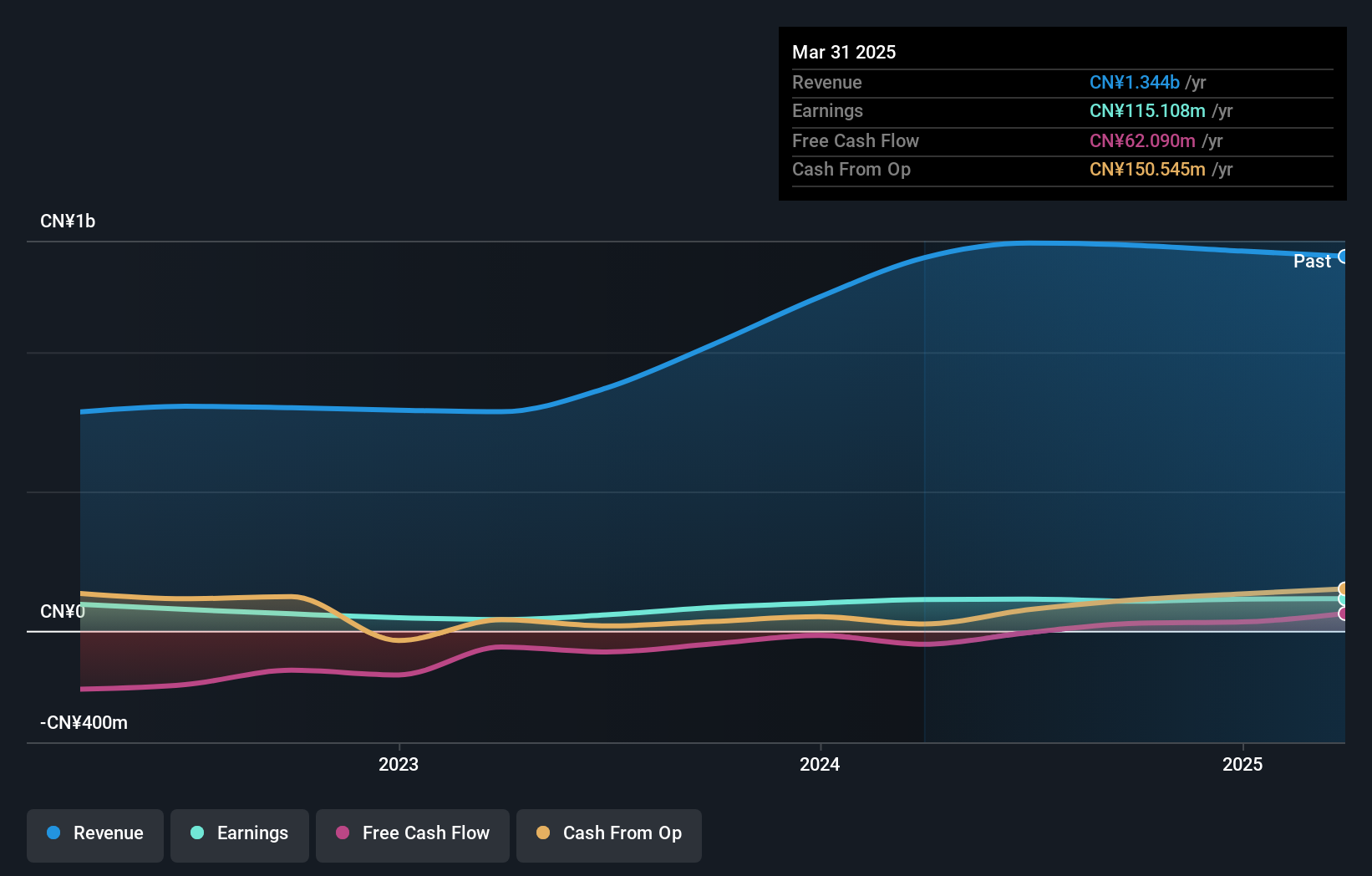

Operations: Poly Plastic Masterbatch (SuZhou) Co., Ltd generates revenue primarily from its industrial segment, amounting to CN¥1.34 billion. The company's financial performance is characterized by its focus on chemical fiber solution colorings and advanced functional modified materials.

Poly Plastic Masterbatch (SuZhou) Ltd., a nimble player in the industry, has shown mixed financial performance recently. For the first quarter of 2025, sales were CNY 307.63 million, slightly down from CNY 326.53 million in the previous year, yet net income rose to CNY 26.9 million from CNY 25.81 million. Over five years, earnings have grown at a modest rate of 0.1% annually, indicating steady progress despite challenges like increased debt-to-equity ratio now at 3.7%. The company is profitable with high-quality earnings and strong interest coverage but faces volatility in share price and slower growth compared to industry peers.

Qingdao Baheal Medical (SZSE:301015)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Baheal Medical INC. focuses on the research, development, production, and sale of pharmaceutical products with a market cap of CN¥9.84 billion.

Operations: Qingdao Baheal Medical INC. generates revenue through its pharmaceutical product sales, supported by research and development activities. The company's financial performance is influenced by its ability to manage production costs effectively while investing in R&D to drive future growth.

Qingdao Baheal Medical, a smaller player in the healthcare sector, has been navigating some financial challenges. Its net income for 2024 was CNY 691.59 million, slightly down from CNY 712.06 million the previous year, while earnings per share dipped from CNY 1.36 to CNY 1.32. The company's interest payments are not well covered by EBIT at just 1.4 times coverage, indicating potential stress on its financial obligations despite a satisfactory net debt to equity ratio of 22.1%. However, trading at a discount of about 27% below estimated fair value might present an opportunity for investors willing to take on some risk given its forecasted earnings growth of over 20% annually.

- Click here and access our complete health analysis report to understand the dynamics of Qingdao Baheal Medical.

Explore historical data to track Qingdao Baheal Medical's performance over time in our Past section.

Key Takeaways

- Click this link to deep-dive into the 3165 companies within our Global Undiscovered Gems With Strong Fundamentals screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300573

Shenyang Xingqi PharmaceuticalLtd

Engages in the research and development, production, and sale of ophthalmic medications in the People’s Republic of China.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives