- China

- /

- Construction

- /

- SZSE:003001

Chongyi Zhangyuan Tungsten And 2 Other Promising Asian Small Caps

Reviewed by Simply Wall St

In recent weeks, Asian markets have shown resilience amid global economic fluctuations, with China's stock indices recording gains and Japan's market experiencing modest growth despite political uncertainties. As small-cap companies continue to navigate these dynamic conditions, investors are increasingly attentive to firms that demonstrate robust fundamentals and the potential for sustainable growth. In this context, Chongyi Zhangyuan Tungsten and two other promising Asian small caps stand out as intriguing opportunities for those seeking undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bonny Worldwide | 34.20% | 17.05% | 40.91% | ★★★★★★ |

| Jiangyin Haida Rubber And Plastic | 16.31% | 7.95% | -9.56% | ★★★★★★ |

| Qingdao Eastsoft Communication TechnologyLtd | NA | 5.88% | -20.71% | ★★★★★★ |

| Shenzhen Zhongheng Huafa | NA | 1.77% | 31.72% | ★★★★★★ |

| AJIS | 0.68% | 3.20% | -12.98% | ★★★★★☆ |

| Hyakugo Bank | 161.58% | 6.23% | 7.74% | ★★★★★☆ |

| Guangdong Delian Group | 28.18% | 5.07% | -36.51% | ★★★★★☆ |

| Huang Hsiang Construction | 268.99% | 13.29% | 10.70% | ★★★★☆☆ |

| Mechema Chemicals International | 55.74% | -4.23% | -5.72% | ★★★★☆☆ |

| Zhejiang Risun Intelligent TechnologyLtd | 27.20% | 20.30% | -23.01% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Chongyi Zhangyuan Tungsten (SZSE:002378)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chongyi Zhangyuan Tungsten Co., Ltd. is involved in the mining of tungsten concentrate and other metal mineral products both within China and internationally, with a market capitalization of approximately CN¥10.81 billion.

Operations: Chongyi Zhangyuan Tungsten generates revenue primarily through the sale of tungsten concentrate and other metal mineral products. The company's net profit margin has shown fluctuations over recent periods, reflecting changes in operational efficiency and market conditions.

Chongyi Zhangyuan Tungsten, a small player in the metals and mining sector, has shown impressive financial performance with earnings growth of 37.7% over the past year, outpacing the industry average. Despite a high net debt to equity ratio of 74.9%, its interest payments are well-covered by EBIT at 4.4 times coverage, indicating robust operational efficiency. The company's recent first-quarter results revealed sales of CNY 1.19 billion and net income of CNY 42.57 million, up from CNY 873.95 million and CNY 27.21 million respectively last year, highlighting strong revenue momentum that could signal further growth potential ahead.

- Click to explore a detailed breakdown of our findings in Chongyi Zhangyuan Tungsten's health report.

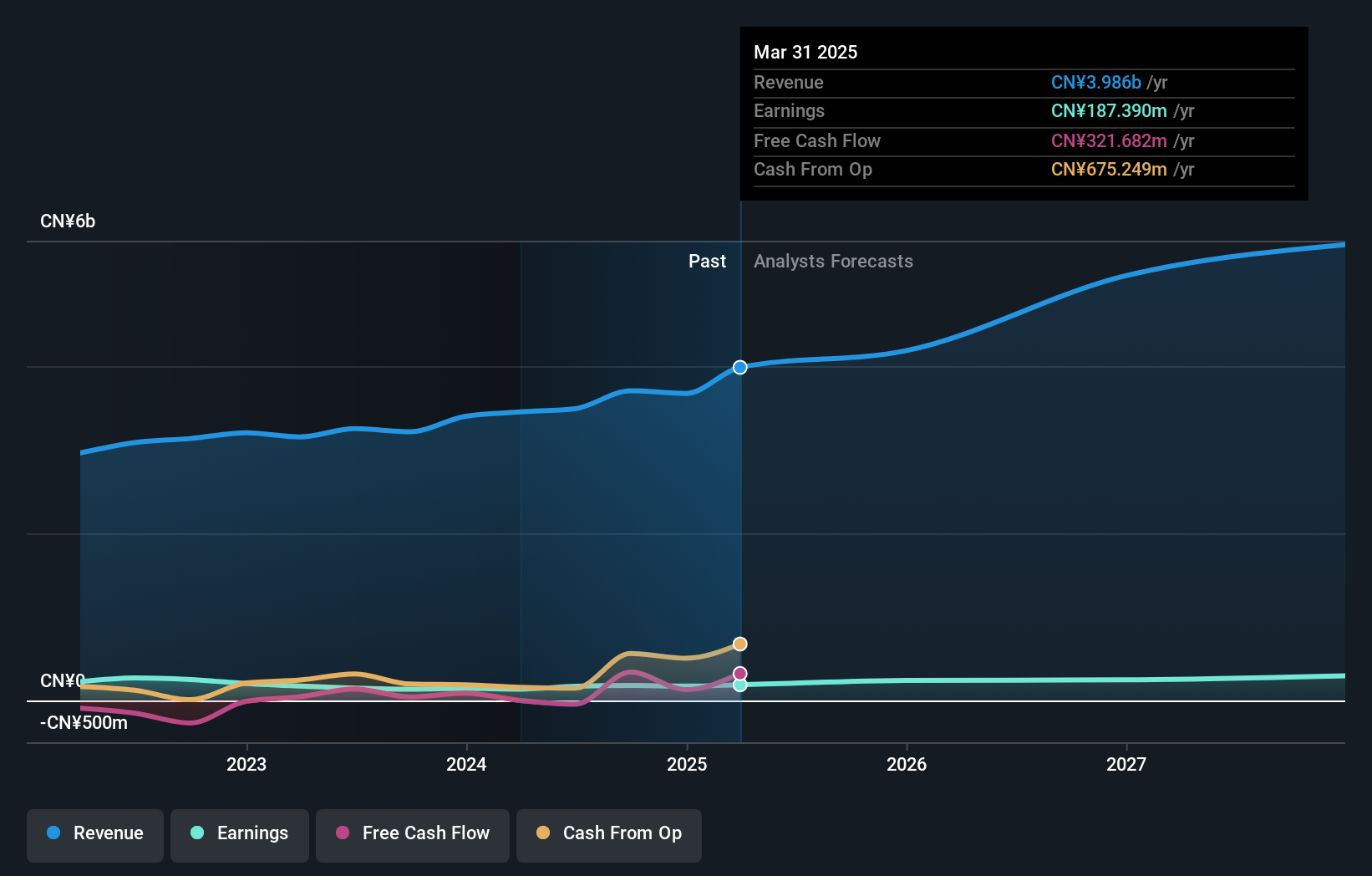

Shenzhen King Explorer Science and Technology (SZSE:002917)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen King Explorer Science and Technology Corporation engages in the research, design, development, manufacture, and sale of intelligent equipment systems for civil explosive production and blasting service companies both in China and internationally, with a market cap of CN¥5.83 billion.

Operations: King Explorer generates revenue primarily through the sale of intelligent equipment systems to civil explosive production and blasting service companies. The company's cost structure includes expenses related to research, design, development, and manufacturing processes. It is important to note that financial data such as gross profit margin or net profit margin are not provided for further analysis.

Shenzhen King Explorer Science and Technology has demonstrated impressive earnings growth of 31.1% over the past year, outpacing the Chemicals industry at 3.5%. This company is trading at a notable discount of 31.6% below its estimated fair value, indicating potential undervaluation. Despite an increase in its debt to equity ratio from 15.4% to 28.7% over five years, it maintains a satisfactory net debt to equity ratio of 4.3%. Recent financials reveal a strong performance with first-quarter sales reaching CNY 362 million and net income climbing to CNY 35 million from last year's CNY 14 million, reflecting robust profitability improvements.

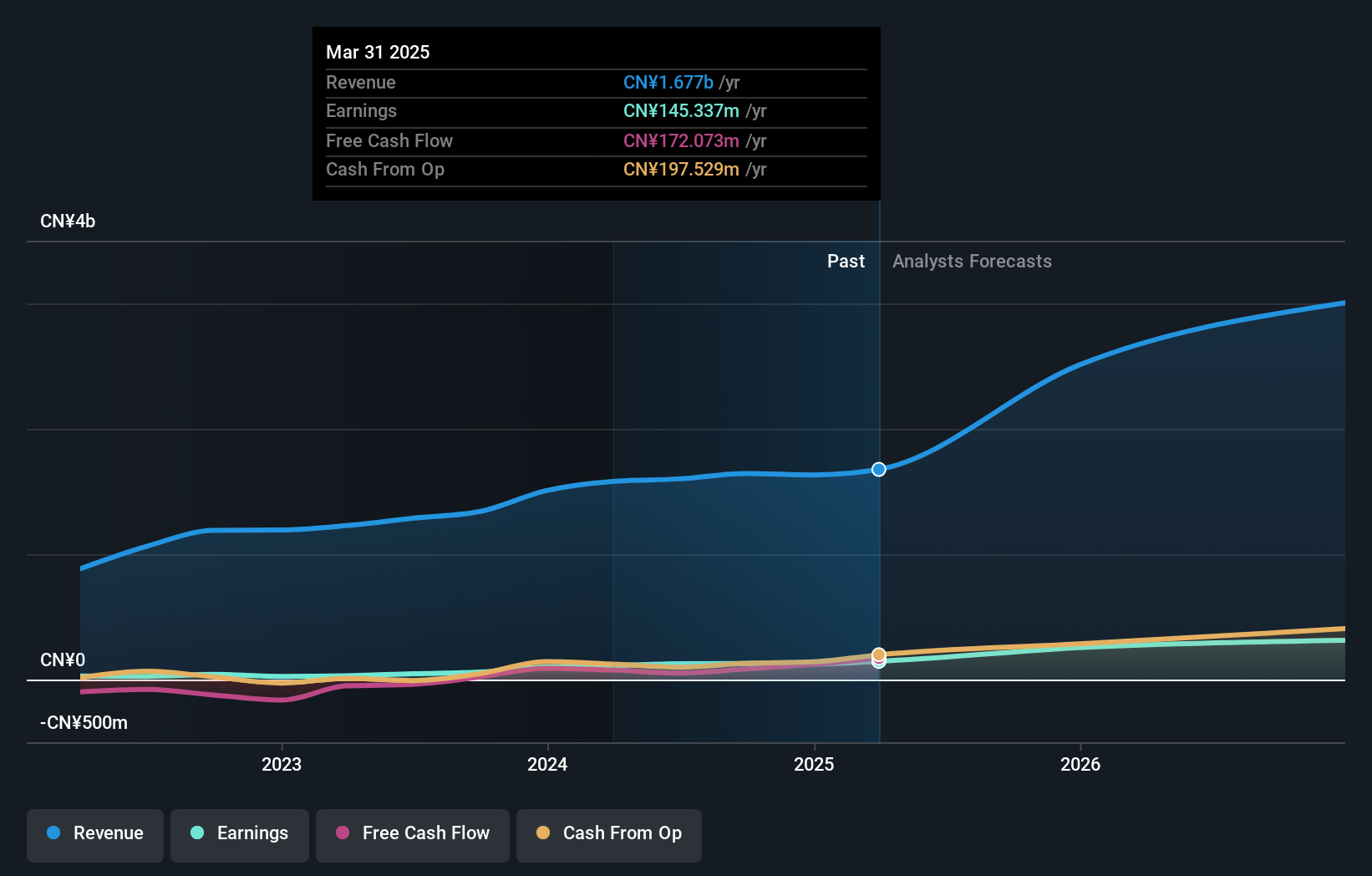

Zhongyan Technology (SZSE:003001)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhongyan Technology Co., Ltd. is a geotechnical technology company based in China with a market cap of CN¥5.84 billion.

Operations: Zhongyan Technology generates revenue primarily through its geotechnical technology services in China. The company's net profit margin has shown variation, reflecting changes in operational efficiency and cost management over time.

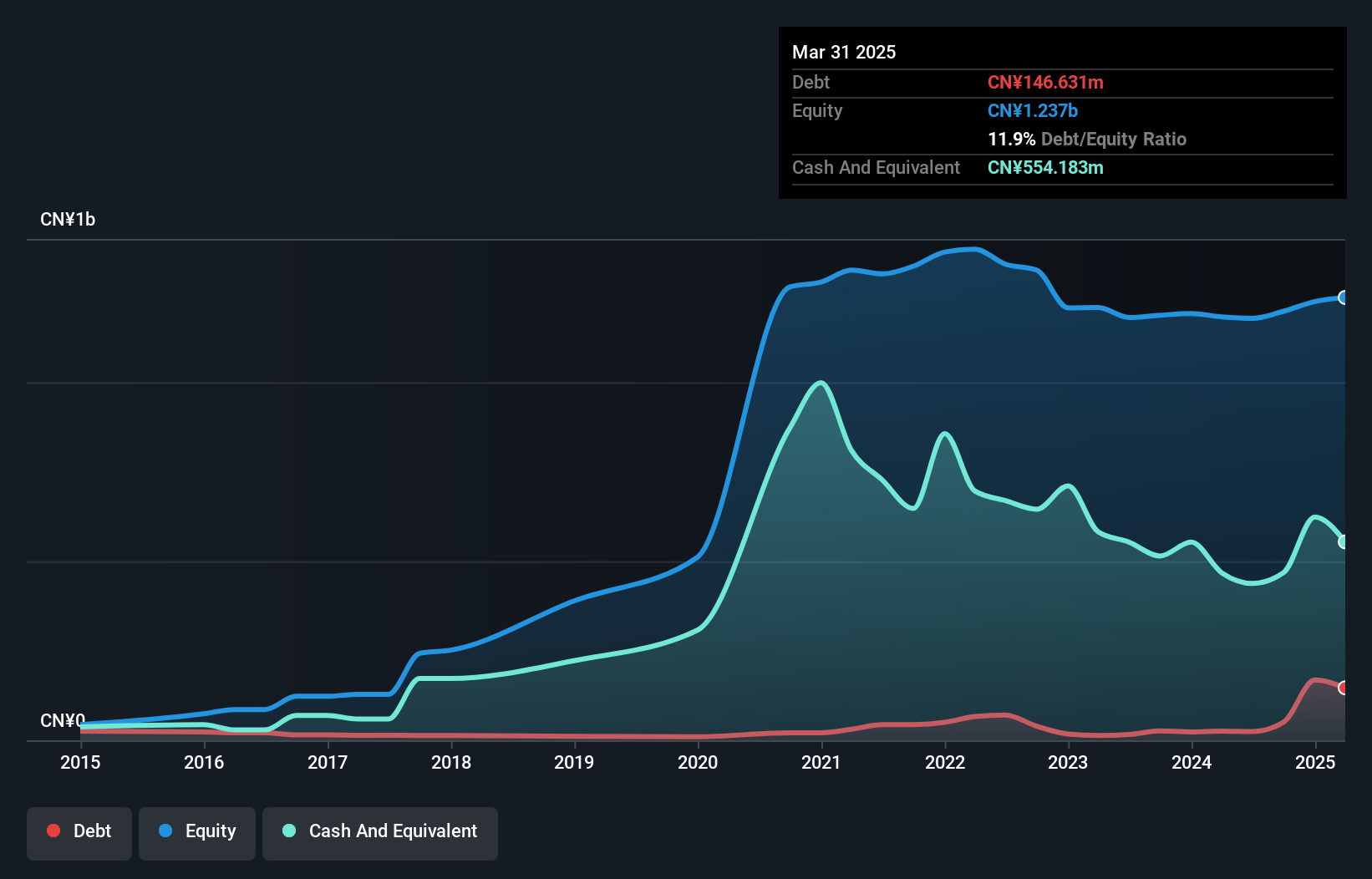

Zhongyan Technology, a relatively small player in its field, has demonstrated impressive financial metrics recently. For the first quarter of 2025, sales rose to CNY 162.03 million from CNY 136.73 million the previous year, while net income increased to CNY 10.37 million from CNY 4.1 million. This company is trading at a significant discount of over 70% below its estimated fair value and boasts high-quality earnings with free cash flow positivity. Despite experiencing share price volatility recently, Zhongyan's robust cash position surpasses its total debt, indicating solid financial health and potential for growth in the coming years.

Turning Ideas Into Actions

- Gain an insight into the universe of 2605 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhongyan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:003001

Zhongyan Technology

Operates as a geotechnical technology company in China.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives