Discover Shanghai Sunglow Packaging TechnologyLtd And 2 Other Undiscovered Gems

Reviewed by Simply Wall St

In the wake of a U.S. election that has buoyed investor sentiment, major benchmarks have reached record highs, with small-cap stocks like those in the Russell 2000 Index experiencing significant gains. As market dynamics shift with expectations of lower corporate taxes and deregulation, investors are increasingly on the lookout for promising small-cap opportunities that can thrive in this evolving landscape. Identifying a good stock often involves finding companies with strong fundamentals and growth potential that may not yet be fully recognized by the broader market—such as Shanghai Sunglow Packaging Technology Ltd and two other intriguing prospects featured in this article.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Wema Bank | 53.09% | 32.38% | 56.06% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Shanghai Sunglow Packaging TechnologyLtd (SHSE:603499)

Simply Wall St Value Rating: ★★★★★☆

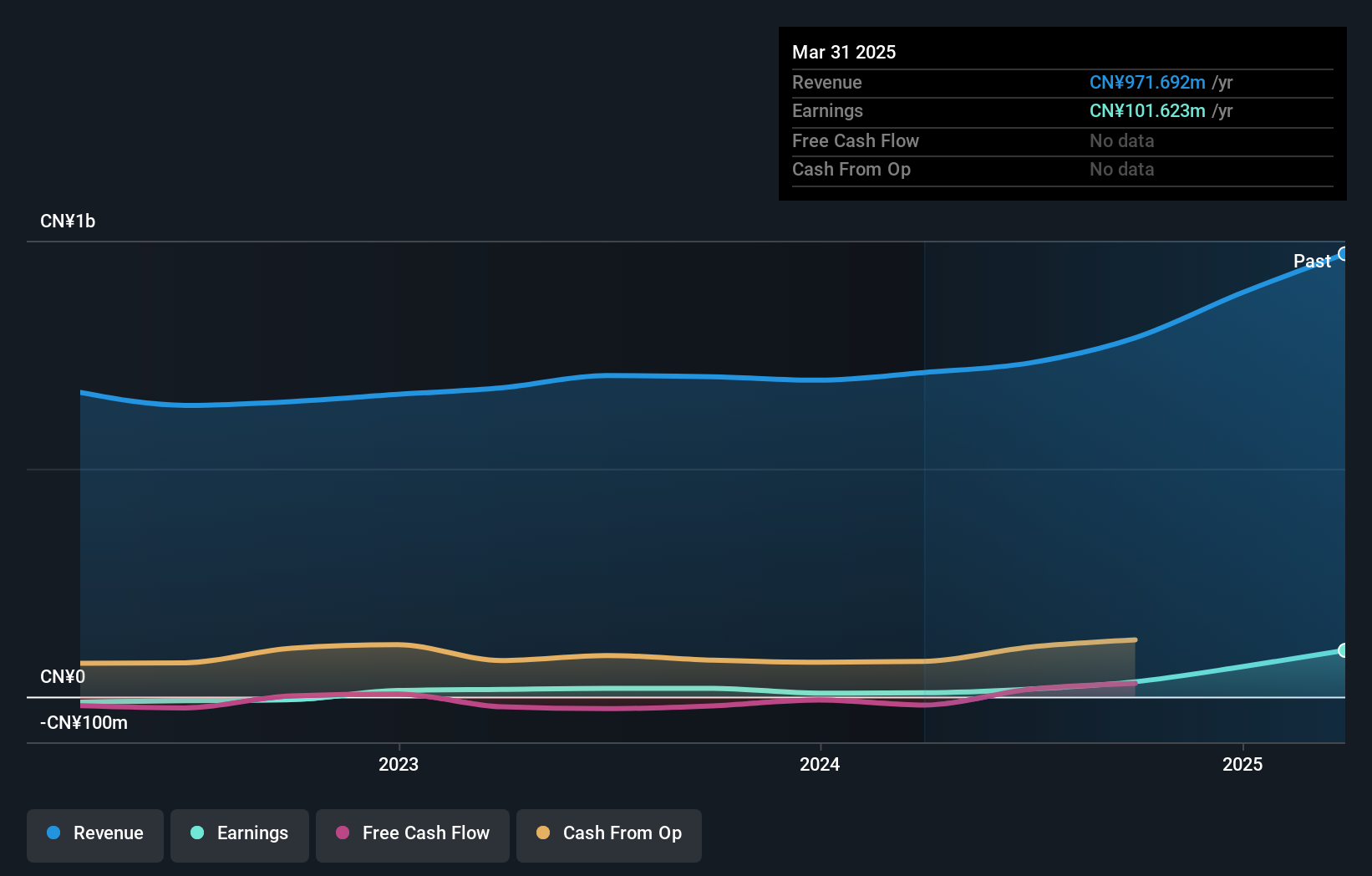

Overview: Shanghai Sunglow Packaging Technology Co., Ltd is involved in the research, development, manufacture, and sale of packaging and printing products in China, with a market cap of CN¥6.82 billion.

Operations: Sunglow Packaging generates revenue primarily from the sale of packaging and printing products. The company's net profit margin has shown variability, reflecting changes in cost management and market conditions.

Shanghai Sunglow Packaging Technology has shown impressive earnings growth of 78% over the past year, outpacing the packaging industry's 18%. Despite a volatile share price in recent months, its net debt to equity ratio stands at a satisfactory 23%, with interest payments well-covered by EBIT at 4.2 times. The company is profitable and doesn't face cash runway issues, though shareholders experienced dilution recently. With high-quality earnings and strategic financial management, this emerging player in the packaging sector seems poised for potential opportunities despite market fluctuations.

Sichuan Guoguang Agrochemical (SZSE:002749)

Simply Wall St Value Rating: ★★★★★☆

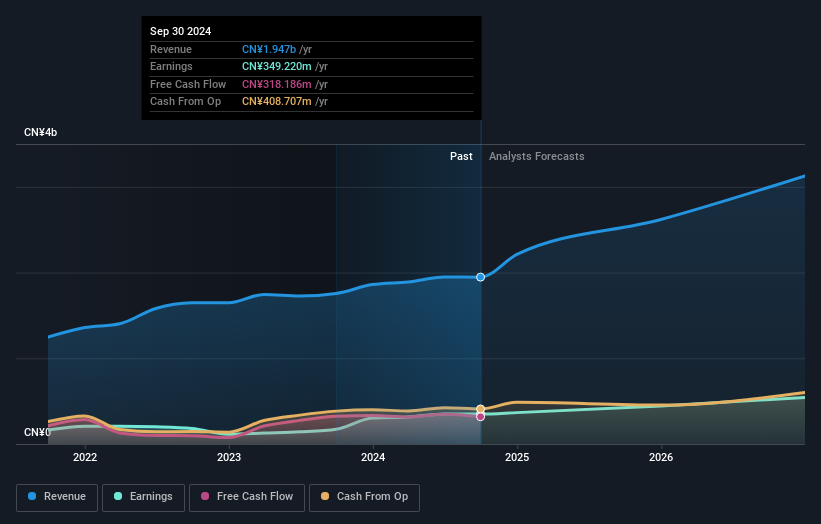

Overview: Sichuan Guoguang Agrochemical Co., Ltd. is involved in the research, development, manufacture, marketing, and distribution of agrochemical products and materials both in China and internationally with a market capitalization of CN¥6.27 billion.

Operations: Guoguang Agrochemical generates revenue primarily from the sale of agrochemical products and materials. The company's financial performance is characterized by its gross profit margin, which has shown variability over recent periods.

Sichuan Guoguang Agrochemical, a nimble player in the agrochemical sector, has been making waves with its robust earnings growth of 102% over the past year, outpacing the industry average. The company's debt to equity ratio has moved from 0.3 to 0.8 over five years, indicating a cautious increase in leverage while maintaining more cash than total debt. Recent earnings for nine months ending September 2024 showed sales at CNY 1.44 billion and net income at CNY 270 million, both up from last year’s figures. Trading below estimated fair value by about 18%, it offers potential upside for investors seeking value opportunities in this space.

Inrom Construction Industries (TASE:INRM)

Simply Wall St Value Rating: ★★★★★★

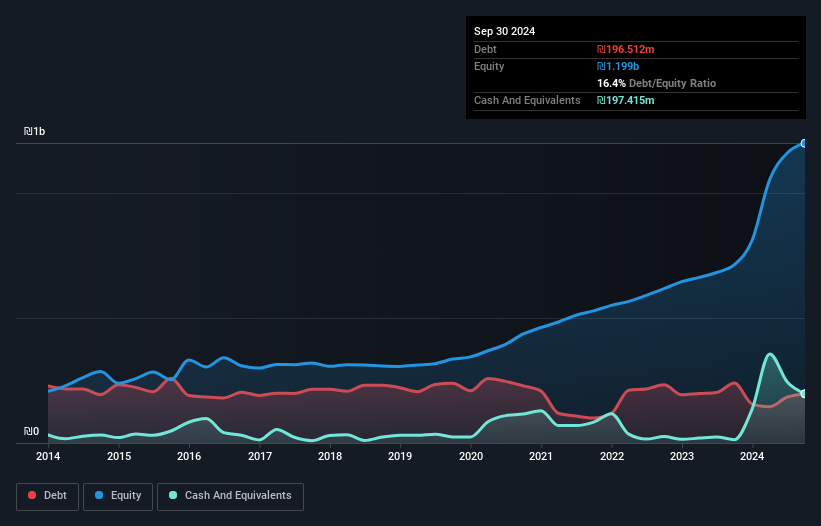

Overview: Inrom Construction Industries Ltd is engaged in the production, marketing, and sale of a wide range of products and solutions for the construction, renovation, and infrastructure sectors in Israel, with a market cap of ₪2.11 billion.

Operations: Inrom generates revenue primarily from four segments: Construction Solutions (₪328.21 million), Finishing Products for Construction (₪302.42 million), The Color Products (₪257.78 million), and Plumbing Systems (₪75.14 million).

Inrom Construction Industries, a smaller player in the building sector, showcases robust financial health with its debt to equity ratio dropping from 74% to 16% over five years. The company's earnings growth of 29% outpaces the industry's 3%, reflecting strong operational performance. Despite recent shareholder dilution and a significant ₪60M one-off gain affecting results, Inrom trades at a substantial discount of around 90% below estimated fair value. While sales dipped slightly in recent quarters, net income improved to ILS 39M from ILS 36M year-over-year for Q3, indicating resilience amid fluctuating market conditions.

- Navigate through the intricacies of Inrom Construction Industries with our comprehensive health report here.

Understand Inrom Construction Industries' track record by examining our Past report.

Make It Happen

- Access the full spectrum of 4664 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002749

Sichuan Guoguang Agrochemical

Engages in the research and development, manufacture, marketing, and distribution of agrochemical products and materials in China and internationally.

Solid track record with excellent balance sheet and pays a dividend.