3 High Yield Dividend Stocks From China With Yields Up To 4.6%

Reviewed by Simply Wall St

As global markets navigate through fluctuating inflation rates and monetary policies, Chinese stocks have shown resilience, marked by a notable uptick in exports that has somewhat offset domestic economic pressures. In this context, high-yield dividend stocks from China could offer investors a blend of income potential and exposure to the evolving dynamics of the world's second-largest economy.

Top 10 Dividend Stocks In China

| Name | Dividend Yield | Dividend Rating |

| Midea Group (SZSE:000333) | 4.67% | ★★★★★★ |

| Changhong Meiling (SZSE:000521) | 3.86% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| Ping An Bank (SZSE:000001) | 6.98% | ★★★★★★ |

| Inner Mongolia Yili Industrial Group (SHSE:600887) | 4.70% | ★★★★★★ |

| Huangshan NovelLtd (SZSE:002014) | 5.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.66% | ★★★★★★ |

| Chacha Food Company (SZSE:002557) | 3.68% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.80% | ★★★★★★ |

| Zhejiang Jiaxin SilkLtd (SZSE:002404) | 5.69% | ★★★★★★ |

Click here to see the full list of 257 stocks from our Top Chinese Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Changhong Meiling (SZSE:000521)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Changhong Meiling Co., Ltd. is a company based in China, engaging in the manufacturing of electrical machinery and equipment, with operations extending internationally and a market capitalization of approximately CN¥7.36 billion.

Operations: Changhong Meiling Co., Ltd. generates its revenue primarily from the manufacturing of electrical machinery and equipment in both domestic and international markets.

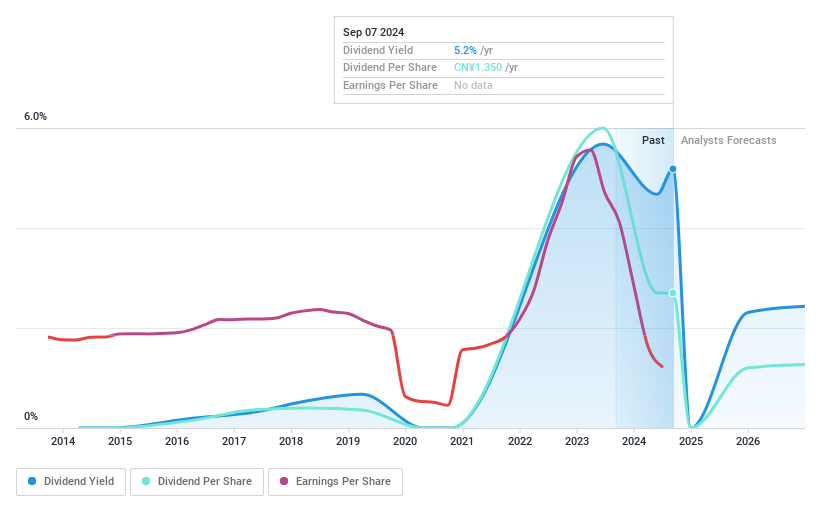

Dividend Yield: 3.9%

Changhong Meiling Co., Ltd. recently declared a final cash dividend of CNY 3.00 per 10 shares for both A and B shares in 2023, reflecting a stable dividend policy amid growing earnings, which increased by 113.9% from the previous year. The company's dividends are well-covered by earnings with a payout ratio of 39.9% and by cash flows with an even lower cash payout ratio of 15%, indicating sustainability and reliability over the past decade. Despite trading at a significant discount to its estimated fair value, recent corporate governance changes could influence future performance and investor sentiment.

- Unlock comprehensive insights into our analysis of Changhong Meiling stock in this dividend report.

- The valuation report we've compiled suggests that Changhong Meiling's current price could be quite moderate.

Beijing Oriental Yuhong Waterproof Technology (SZSE:002271)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Beijing Oriental Yuhong Waterproof Technology Co., Ltd. focuses on the research, development, production, and sale of waterproof materials mainly in China, with a market capitalization of approximately CN¥30.52 billion.

Operations: Beijing Oriental Yuhong Waterproof Technology Co., Ltd. generates its revenue primarily from the sale of waterproof materials in China.

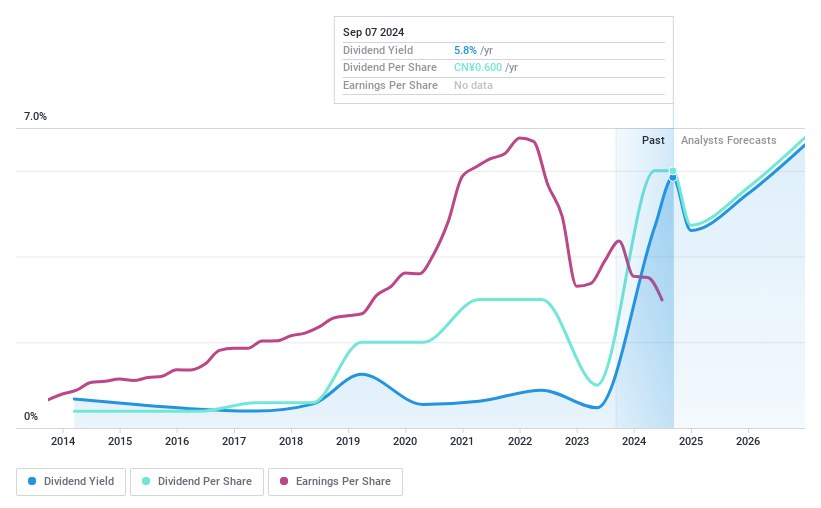

Dividend Yield: 4.7%

Beijing Oriental Yuhong Waterproof Technology Co., Ltd. maintains a reasonable earnings payout ratio of 66.5% and a cash payout ratio of 56.9%, supporting its dividend sustainability despite a volatile track record over the past decade. The company's recent increase in dividends, announced on May 15, 2024, aligns with its modest earnings growth of 2.1% last year and projected annual growth of 22.3%. Trading at a P/E ratio of 13.7x, below the market average, it offers relative value though dividends have been inconsistent historically.

- Dive into the specifics of Beijing Oriental Yuhong Waterproof Technology here with our thorough dividend report.

- Our valuation report here indicates Beijing Oriental Yuhong Waterproof Technology may be undervalued.

Tianqi Lithium (SZSE:002466)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tianqi Lithium Corporation specializes in the production, processing, and sale of lithium concentrate and chemical products across Australia, Chile, the United Kingdom, and China, with a market capitalization of approximately CN¥46.21 billion.

Operations: Tianqi Lithium Corporation generates its revenues primarily through the production and sales of lithium concentrate and chemical products across key markets including Australia, Chile, the United Kingdom, and China.

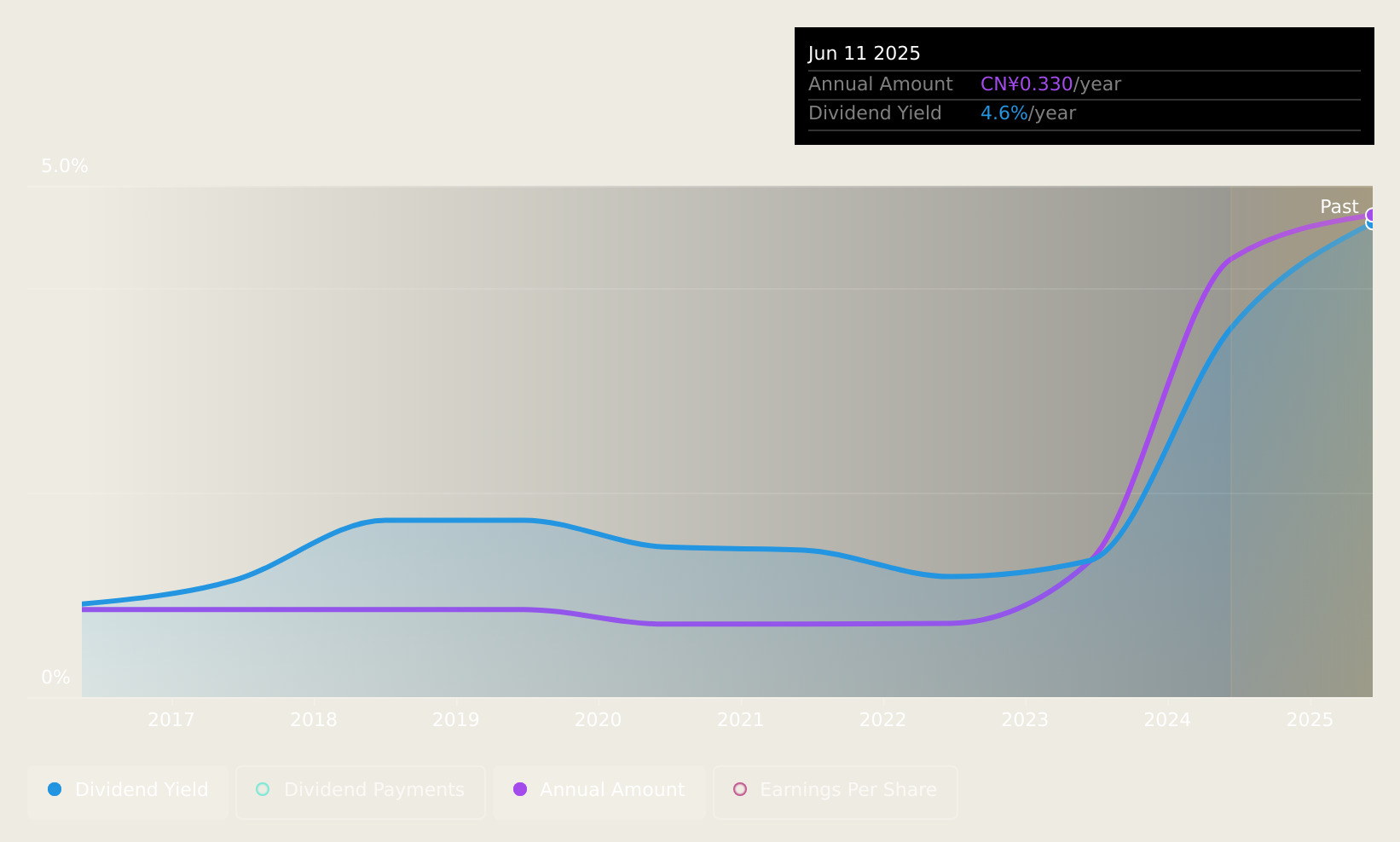

Dividend Yield: 4.6%

Tianqi Lithium, despite a dividend yield in the top 25% for the Chinese market, faces challenges with its financial stability. Recent guidance indicates a significant net loss of RMB 4.88 billion to RMB 5.53 billion for the first half of 2024, contrasting sharply with a net profit in the previous year. Dividend payments have been volatile and not fully covered by earnings or cash flows, raising concerns about their sustainability despite recent cuts to dividend amounts.

- Click here to discover the nuances of Tianqi Lithium with our detailed analytical dividend report.

- Our valuation report unveils the possibility Tianqi Lithium's shares may be trading at a discount.

Seize The Opportunity

- Unlock more gems! Our Top Chinese Dividend Stocks screener has unearthed 254 more companies for you to explore.Click here to unveil our expertly curated list of 257 Top Chinese Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianqi Lithium might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002466

Tianqi Lithium

Tianqi Lithium Corporation produce, process, and sale of lithium concreate and chemical products in Australia, Chile, the United Kingdom, and China.

Flawless balance sheet, undervalued and pays a dividend.