As global markets navigate a landscape of mixed economic signals, including rate cuts by the Fed and a temporary trade truce between the U.S. and China, investors are keenly observing growth opportunities amid these shifting dynamics. In such an environment, companies with strong insider ownership often signal confidence in their long-term potential, making them attractive to those seeking stability and growth in uncertain times.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Pharma Mar (BME:PHM) | 12% | 44.9% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 69.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| CD Projekt (WSE:CDR) | 29.7% | 51% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 56.8% |

Here's a peek at a few of the choices from the screener.

Hoshine Silicon Industry (SHSE:603260)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hoshine Silicon Industry Co., Ltd. is involved in the production and sale of silicon-based materials both in China and internationally, with a market cap of CN¥58.46 billion.

Operations: The company's revenue is derived from the production and sale of silicon-based materials across domestic and international markets.

Insider Ownership: 32.6%

Hoshine Silicon Industry's high insider ownership suggests confidence in its growth potential despite recent financial challenges. The company reported a net loss of CNY 321.42 million for the first nine months of 2025, contrasting with a profit last year. Revenue is forecast to grow at 18.7% annually, outpacing the Chinese market average, and profitability is expected within three years. However, interest payments are not well covered by earnings, indicating financial pressures remain.

- Get an in-depth perspective on Hoshine Silicon Industry's performance by reading our analyst estimates report here.

- Our valuation report here indicates Hoshine Silicon Industry may be overvalued.

Hui Lyu Ecological Technology GroupsLtd (SZSE:001267)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hui Lyu Ecological Technology Groups Co., Ltd. operates in the ecological technology sector and has a market cap of CN¥14.86 billion.

Operations: I'm sorry, but it seems that the revenue segment information is missing from the provided text. If you can provide those details, I would be happy to help summarize them for you.

Insider Ownership: 34.8%

Hui Lyu Ecological Technology Groups Ltd. demonstrates strong growth potential with significant insider ownership, reflecting confidence in its trajectory. Recent earnings reports show a substantial rise in sales and net income for the first nine months of 2025, driven by strategic asset purchases. Revenue is forecast to grow at 36.2% annually, surpassing the market average, while earnings are expected to increase significantly over the next three years despite share price volatility.

- Click here to discover the nuances of Hui Lyu Ecological Technology GroupsLtd with our detailed analytical future growth report.

- The analysis detailed in our Hui Lyu Ecological Technology GroupsLtd valuation report hints at an inflated share price compared to its estimated value.

Ganfeng Lithium Group (SZSE:002460)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ganfeng Lithium Group Co., Ltd. is a Chinese company that manufactures and sells lithium products, with a market cap of CN¥132.70 billion.

Operations: Revenue Segments (in millions of CN¥): Lithium compounds and derivatives: 17,200; Lithium metal: 1,350; Battery products: 2,800.

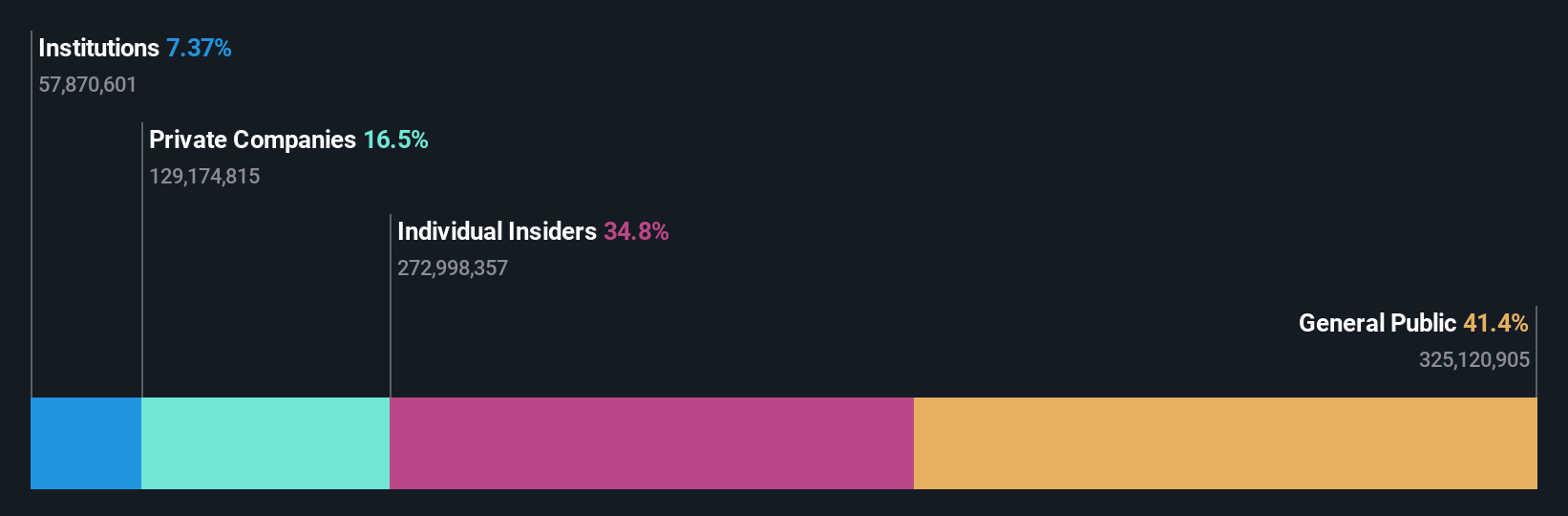

Insider Ownership: 27.2%

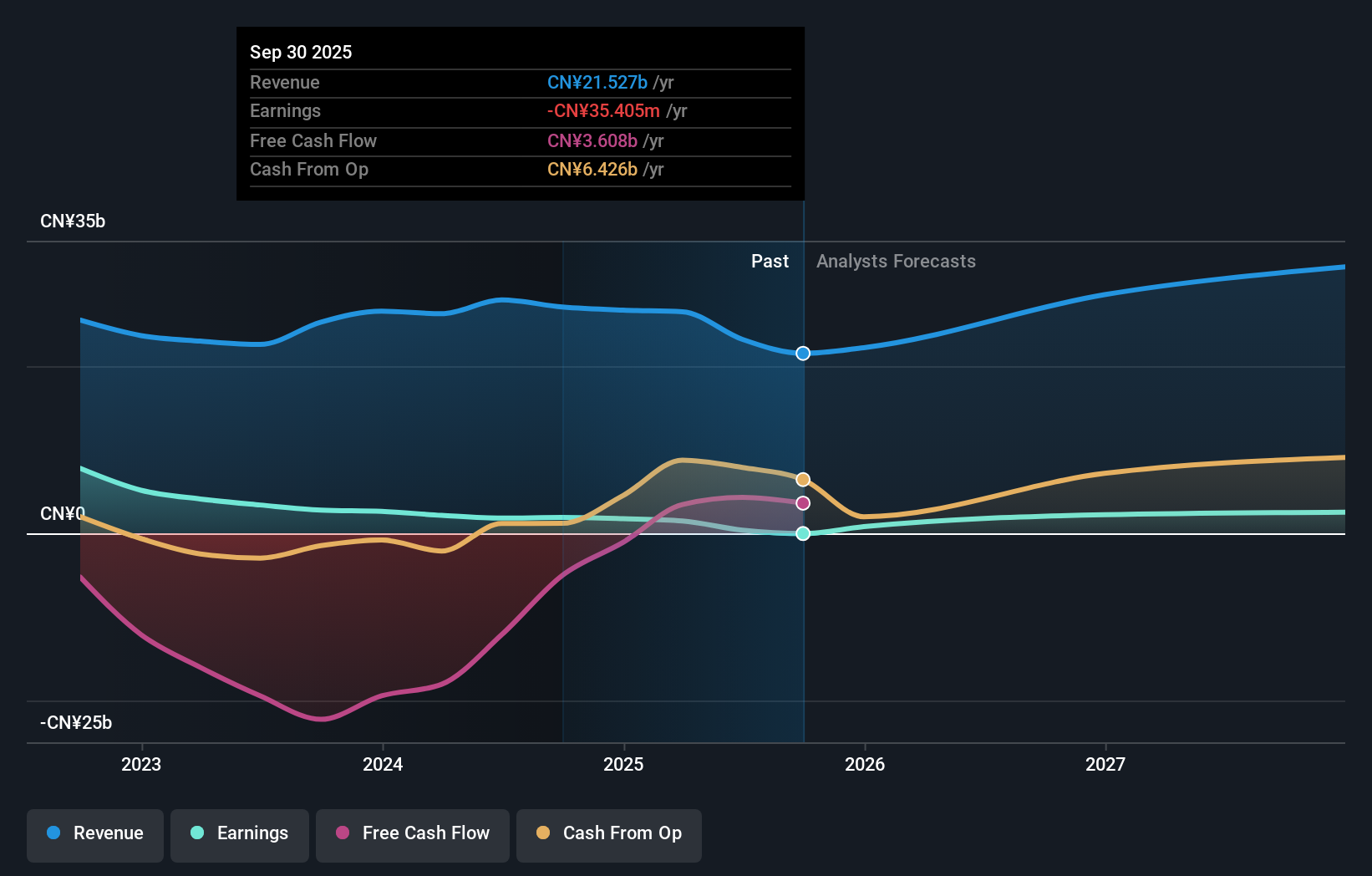

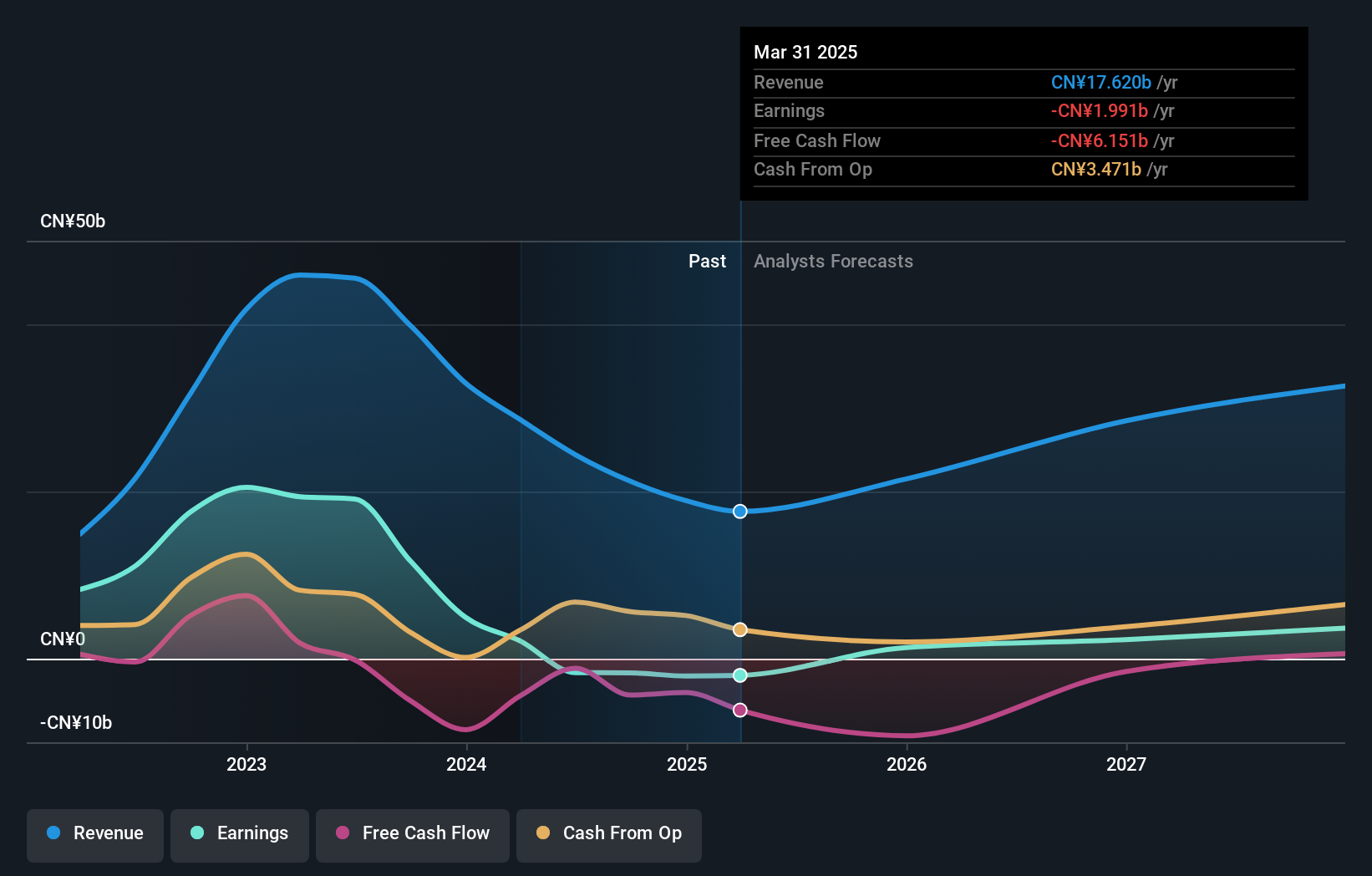

Ganfeng Lithium Group shows promising growth potential, with revenue expected to increase over 20% annually, outpacing the market. The company recently reported a return to profitability for the first nine months of 2025, with net income reaching CNY 25.52 million from a previous loss. Despite share price volatility and interest payments not well-covered by earnings, insider ownership remains stable, reflecting confidence in its strategic direction and future profitability within three years.

- Delve into the full analysis future growth report here for a deeper understanding of Ganfeng Lithium Group.

- According our valuation report, there's an indication that Ganfeng Lithium Group's share price might be on the expensive side.

Key Takeaways

- Navigate through the entire inventory of 825 Fast Growing Global Companies With High Insider Ownership here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002460

Exceptional growth potential with very low risk.

Similar Companies

Market Insights

Community Narratives