- China

- /

- Specialty Stores

- /

- SZSE:002024

Chinese Growth Companies With High Insider Ownership For September 2024

Reviewed by Simply Wall St

In September 2024, Chinese equities saw a positive shift as the Fed's interest rate cuts provided a supportive backdrop, despite some underwhelming economic data. With this market environment in mind, identifying growth companies with high insider ownership can offer valuable insights into potential investment opportunities. High insider ownership often signals confidence from those closest to the company and aligns their interests with shareholders, making these stocks particularly noteworthy in today's market conditions.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 25.2% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's take a closer look at a couple of our picks from the screened companies.

Suning.com (SZSE:002024)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suning.com Co., Ltd. operates a retail business in China with a market cap of CN¥13.01 billion.

Operations: The company's revenue segments include the Mainland Retail Division with CN¥53.28 billion, the Mainland Logistics Division at CN¥3.43 billion, and the Hong Kong and Other Regions Division contributing CN¥1.26 billion.

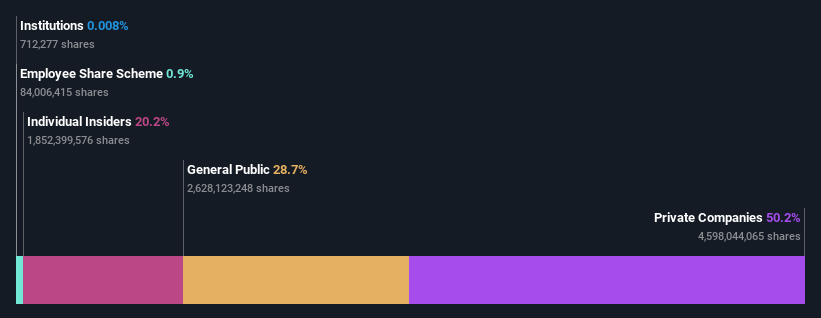

Insider Ownership: 20.2%

Revenue Growth Forecast: 18.4% p.a.

Suning.com has shown significant improvement in profitability, reporting a net income of CNY 14.75 million for the first half of 2024 compared to a substantial loss last year. The company is trading at a significant discount to its estimated fair value and is expected to grow earnings by over 100% per year, with revenue growth forecasted at 18.4% annually, outpacing the Chinese market average. Recent share buybacks and insider ownership further align management interests with shareholders'.

- Dive into the specifics of Suning.com here with our thorough growth forecast report.

- Our valuation report here indicates Suning.com may be undervalued.

Sichuan Development LomonLtd (SZSE:002312)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sichuan Development Lomon Co., Ltd. engages in the research, development, production, and sale of phosphorus chemical products in China with a market cap of CN¥14.72 billion.

Operations: The company's revenue segments include CN¥6.87 billion from Phosphorus Chemicals and CN¥1.20 billion from Segment Adjustment.

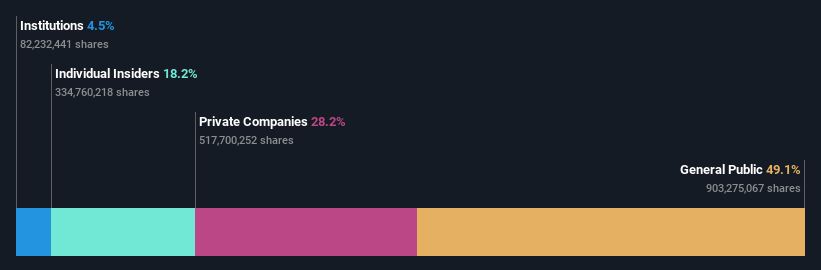

Insider Ownership: 18.2%

Revenue Growth Forecast: 14.8% p.a.

Sichuan Development Lomon Ltd. reported first-half 2024 earnings with a net income of CNY 293.62 million, up from CNY 231.78 million last year, and revenue of CNY 4.03 billion compared to CNY 3.66 billion previously. Despite this growth, its forecasted annual profit growth (23.5%) and revenue growth (14.8%) are slower than some peers but still above the market average in China. The company recently announced a private placement of restricted shares, indicating strong insider confidence in future prospects despite low return on equity forecasts and unsustainable dividend coverage by free cash flows.

- Navigate through the intricacies of Sichuan Development LomonLtd with our comprehensive analyst estimates report here.

- Our valuation report here indicates Sichuan Development LomonLtd may be overvalued.

Estun Automation (SZSE:002747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Estun Automation Co., Ltd. focuses on the research, development, production, and sale of intelligent equipment and its control components in China, with a market cap of CN¥10.84 billion.

Operations: Revenue from Instrument and Meter Manufacturing amounts to CN¥4.58 billion.

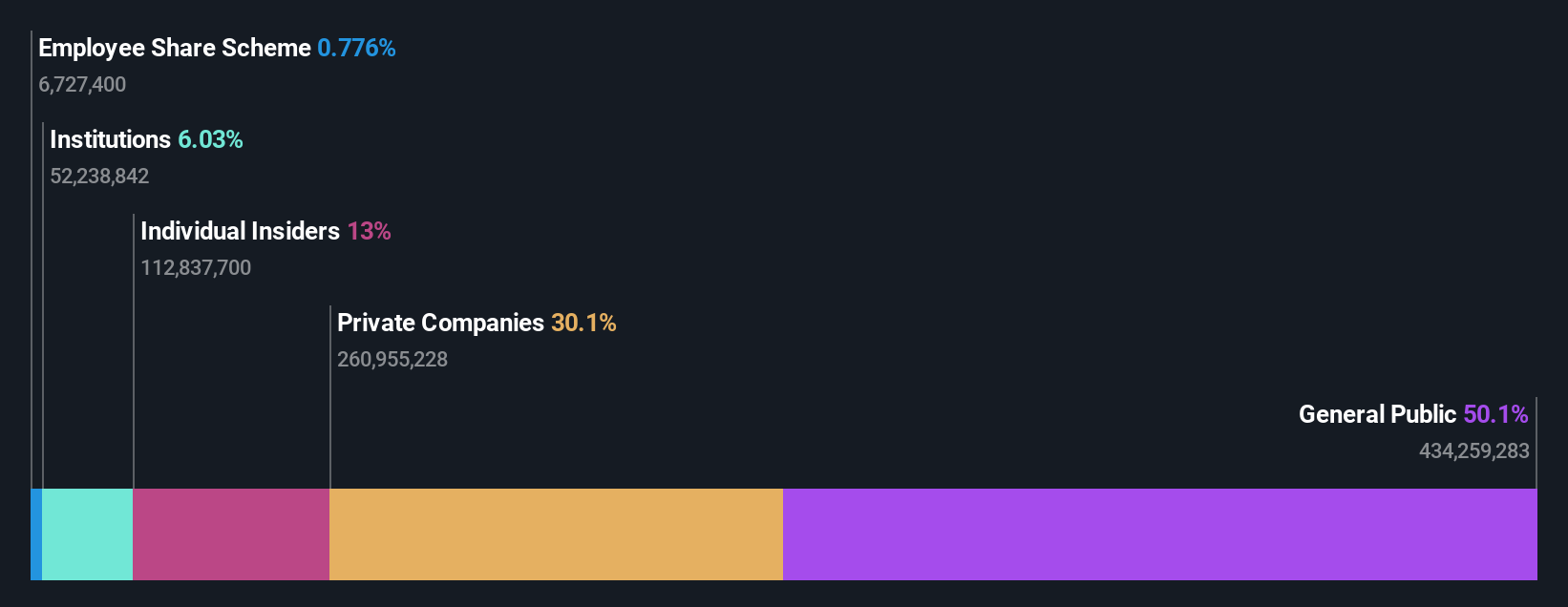

Insider Ownership: 12.9%

Revenue Growth Forecast: 14.3% p.a.

Estun Automation, a growth company with high insider ownership in China, is forecasted to see earnings grow by 50.48% annually and become profitable within three years, outpacing the market average. However, its recent half-year results show a net loss of CNY 73.42 million compared to last year's net income of CNY 97.4 million, indicating challenges in financial performance despite expected revenue growth of 14.3% per year being faster than the CN market's average.

- Take a closer look at Estun Automation's potential here in our earnings growth report.

- The analysis detailed in our Estun Automation valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Investigate our full lineup of 384 Fast Growing Chinese Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002024

Undervalued with reasonable growth potential.