- China

- /

- Electrical

- /

- SZSE:002130

Discover Three High Growth Chinese Stocks With Significant Insider Ownership

Reviewed by Simply Wall St

As the Chinese market experiences a modest uptick amid global economic shifts and interest rate adjustments, investors are increasingly looking toward growth companies with substantial insider ownership. Such stocks often indicate strong confidence from those who know the business best, making them attractive options in today's fluctuating economic landscape.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 22.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 25.2% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Let's review some notable picks from our screened stocks.

ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130)

Simply Wall St Growth Rating: ★★★★★★

Overview: ShenZhen Woer Heat-Shrinkable Material Ltd (ticker: SZSE:002130) specializes in the production of heat-shrinkable materials and has a market cap of approximately CN¥14.46 billion.

Operations: ShenZhen Woer Heat-Shrinkable Material Ltd (ticker: SZSE:002130) specializes in the production of heat-shrinkable materials and has a market cap of approximately CN¥14.46 billion. The company's revenue segments are as follows (in millions of CN¥):

Insider Ownership: 18%

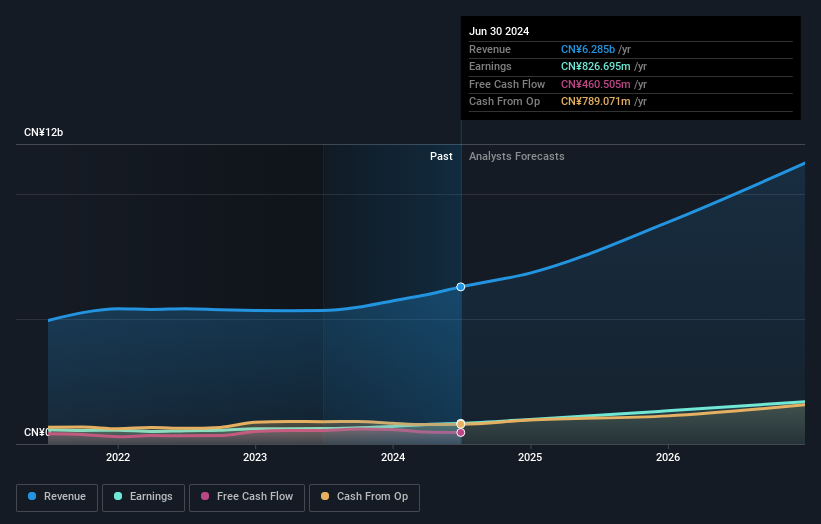

ShenZhen Woer Heat-Shrinkable Material Ltd. demonstrates strong growth potential with forecasted annual earnings growth of 28.71% and revenue expected to grow 24.2% per year, outpacing the Chinese market average. Recent earnings for the half-year ended June 30, 2024, showed significant improvement with sales reaching CNY 3.10 billion and net income at CNY 419.42 million. Despite a volatile share price, its Price-to-Earnings ratio of 17.5x suggests good value compared to peers in the industry.

- Click here and access our complete growth analysis report to understand the dynamics of ShenZhen Woer Heat-Shrinkable MaterialLtd.

- According our valuation report, there's an indication that ShenZhen Woer Heat-Shrinkable MaterialLtd's share price might be on the cheaper side.

Baowu Magnesium Technology (SZSE:002182)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baowu Magnesium Technology Co., Ltd. engages in mining and non-ferrous metal smelting and processing in China and internationally, with a market cap of CN¥9.45 billion.

Operations: The company's revenue from Non-Ferrous Metal Smelting and Rolling Processing amounts to CN¥7.93 billion.

Insider Ownership: 17%

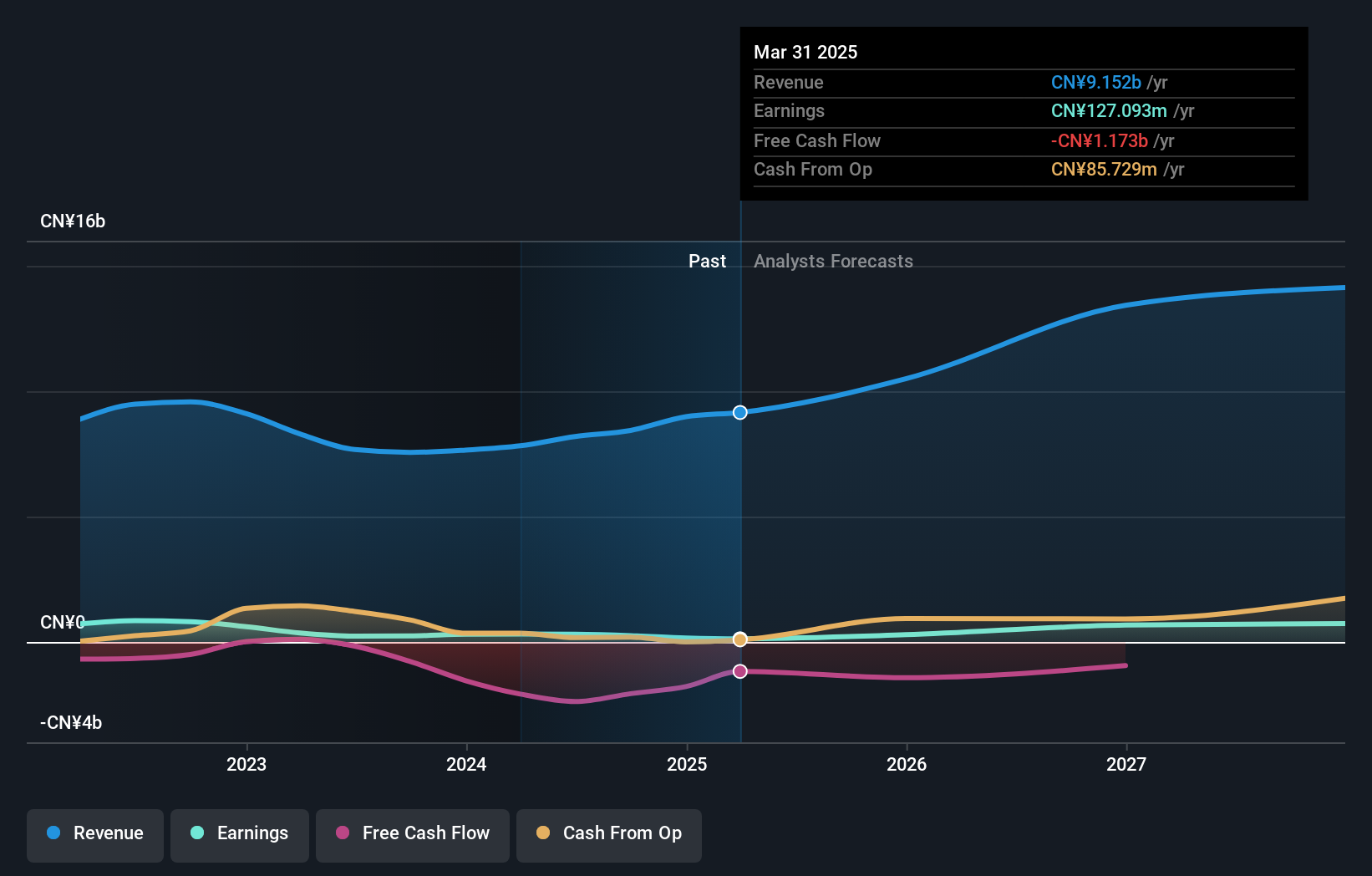

Baowu Magnesium Technology shows promising growth with forecasted annual earnings growth of 50.68% and revenue expected to grow 24.3% per year, both surpassing the Chinese market averages. Recent amendments to the company's articles of association and a private placement approved in August 2024 indicate strategic moves for expansion. However, net income for H1 2024 was slightly down at CNY 119.79 million compared to CNY 121.34 million last year, reflecting some financial challenges despite robust sales growth from CNY 3,532.56 million to CNY 4,075.44 million.

- Take a closer look at Baowu Magnesium Technology's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Baowu Magnesium Technology is priced higher than what may be justified by its financials.

Shenzhen Yinghe Technology (SZSE:300457)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Yinghe Technology Co., Ltd specializes in the research, development, production, and sale of lithium-ion battery automation equipment in China, with a market cap of approximately CN¥9.57 billion.

Operations: The company generates revenue from the research, development, production, and sale of lithium-ion battery automation equipment in China.

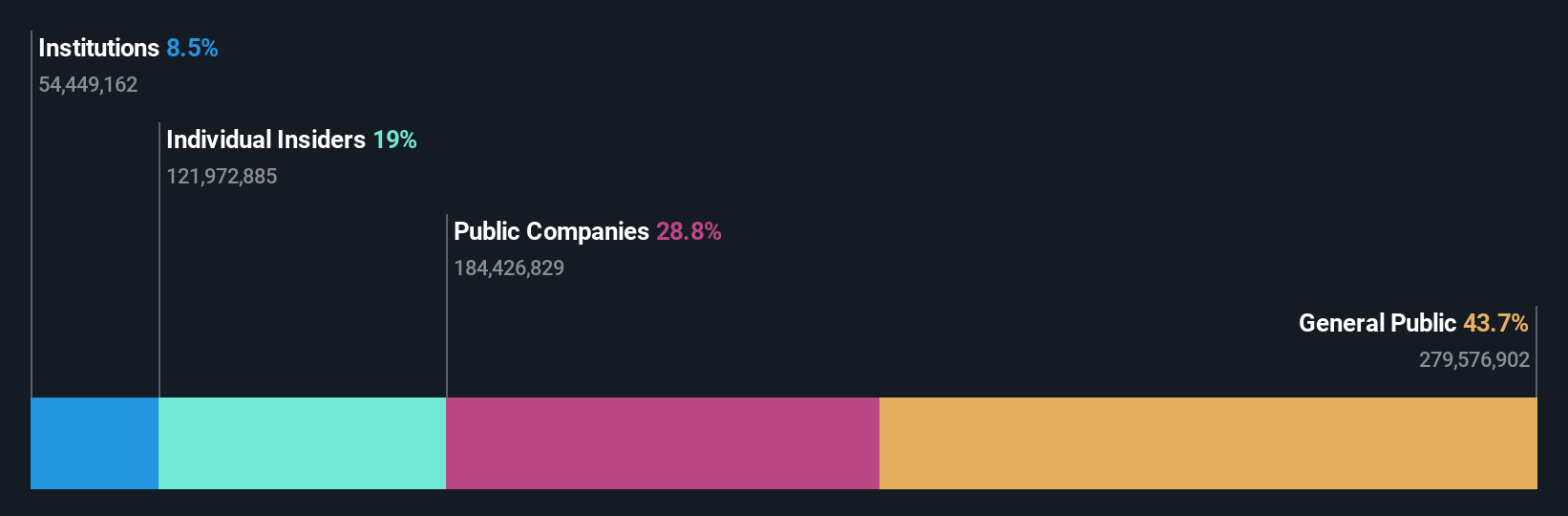

Insider Ownership: 19.3%

Shenzhen Yinghe Technology demonstrates strong growth potential with forecasted annual revenue growth of 17.3% and earnings growth of 32.4%, both outpacing the Chinese market averages. Despite a slight dip in sales and revenue for H1 2024, net income increased to CNY 338.12 million from CNY 298.01 million, reflecting improved profitability. The company’s recent shareholders meeting addressed stock repurchase and amendments to its articles, indicating active management engagement in strategic adjustments.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Yinghe Technology.

- Our valuation report here indicates Shenzhen Yinghe Technology may be undervalued.

Seize The Opportunity

- Unlock our comprehensive list of 384 Fast Growing Chinese Companies With High Insider Ownership by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002130

ShenZhen Woer Heat-Shrinkable MaterialLtd

ShenZhen Woer Heat-Shrinkable Material Co.,Ltd.

Exceptional growth potential with flawless balance sheet and pays a dividend.