- China

- /

- Metals and Mining

- /

- SZSE:001337

Sichuan Gold Co., Ltd.'s (SZSE:001337) Stock Has Been Sliding But Fundamentals Look Strong: Is The Market Wrong?

With its stock down 7.1% over the past three months, it is easy to disregard Sichuan Gold (SZSE:001337). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. In this article, we decided to focus on Sichuan Gold's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Sichuan Gold

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Sichuan Gold is:

16% = CN¥226m ÷ CN¥1.4b (Based on the trailing twelve months to March 2024).

The 'return' refers to a company's earnings over the last year. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.16 in profit.

What Has ROE Got To Do With Earnings Growth?

So far, we've learned that ROE is a measure of a company's profitability. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Sichuan Gold's Earnings Growth And 16% ROE

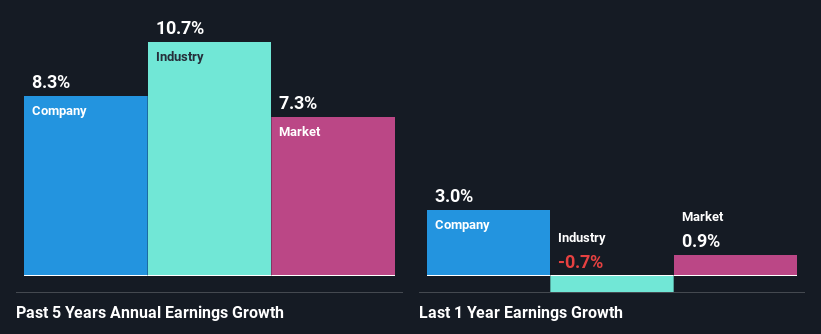

To begin with, Sichuan Gold seems to have a respectable ROE. On comparing with the average industry ROE of 7.4% the company's ROE looks pretty remarkable. This probably laid the ground for Sichuan Gold's moderate 8.3% net income growth seen over the past five years.

Next, on comparing with the industry net income growth, we found that Sichuan Gold's reported growth was lower than the industry growth of 11% over the last few years, which is not something we like to see.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about Sichuan Gold's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is Sichuan Gold Making Efficient Use Of Its Profits?

Sichuan Gold has a three-year median payout ratio of 43%, which implies that it retains the remaining 57% of its profits. This suggests that its dividend is well covered, and given the decent growth seen by the company, it looks like management is reinvesting its earnings efficiently.

While Sichuan Gold has been growing its earnings, it only recently started to pay dividends which likely means that the company decided to impress new and existing shareholders with a dividend.

Summary

In total, we are pretty happy with Sichuan Gold's performance. Specifically, we like that the company is reinvesting a huge chunk of its profits at a high rate of return. This of course has caused the company to see a good amount of growth in its earnings. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard will have the 1 risk we have identified for Sichuan Gold.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001337

Flawless balance sheet with acceptable track record.