- China

- /

- Metals and Mining

- /

- SZSE:000825

Shanxi Taigang Stainless Steel (SZSE:000825) shareholders have endured a 56% loss from investing in the stock three years ago

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But the last three years have been particularly tough on longer term Shanxi Taigang Stainless Steel Co., Ltd. (SZSE:000825) shareholders. So they might be feeling emotional about the 60% share price collapse, in that time. The falls have accelerated recently, with the share price down 12% in the last three months. But this could be related to the weak market, which is down 13% in the same period.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Shanxi Taigang Stainless Steel

Because Shanxi Taigang Stainless Steel made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Shanxi Taigang Stainless Steel grew revenue at 7.5% per year. That's not a very high growth rate considering it doesn't make profits. This uninspiring revenue growth has no doubt helped send the share price lower; it dropped 17% during the period. It can be well worth keeping an eye on growth stocks that disappoint the market, because sometimes they re-accelerate. Keep in mind it isn't unusual for good businesses to have a tough time or a couple of uninspiring years.

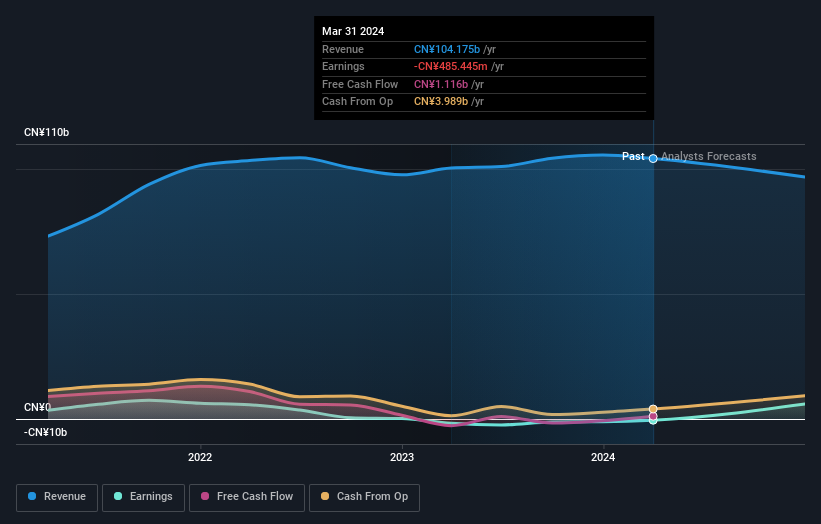

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for Shanxi Taigang Stainless Steel in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We've already covered Shanxi Taigang Stainless Steel's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Shanxi Taigang Stainless Steel shareholders, and that cash payout explains why its total shareholder loss of 56%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

Shanxi Taigang Stainless Steel shareholders are down 16% over twelve months, which isn't far from the market return of -16%. The silver lining is that longer term investors would have made a total return of 0.9% per year over half a decade. If the fundamental data remains strong, and the share price is simply down on sentiment, then this could be an opportunity worth investigating. It's always interesting to track share price performance over the longer term. But to understand Shanxi Taigang Stainless Steel better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Shanxi Taigang Stainless Steel you should be aware of.

But note: Shanxi Taigang Stainless Steel may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000825

Shanxi Taigang Stainless Steel

Engages in the production and sales of steel products in China and internationally.

Adequate balance sheet and fair value.