Growth Companies With High Insider Ownership To Watch In November 2024

Reviewed by Simply Wall St

As global markets react to the recent U.S. election results, with major indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are closely monitoring how potential policy changes might impact growth prospects and corporate earnings. Amid this backdrop, companies with high insider ownership can be particularly appealing as they often signal confidence from those who know the business best; such stocks may offer intriguing opportunities in an environment characterized by anticipated regulatory shifts and tax reforms.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 42.1% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Pharma Mar (BME:PHM) | 11.8% | 56.4% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

We'll examine a selection from our screener results.

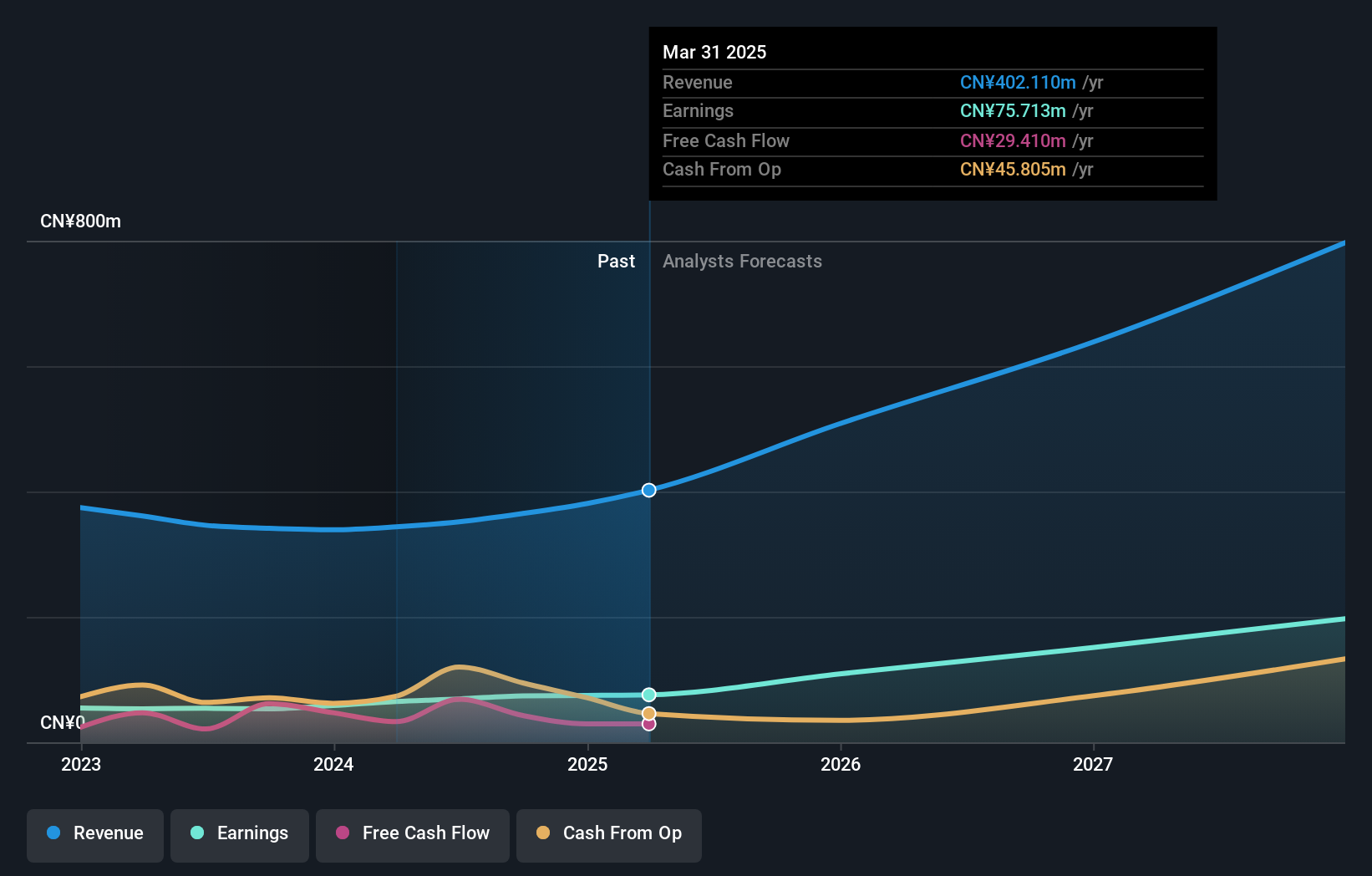

Guangdong Skychem Technology (SHSE:688603)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangdong Skychem Technology Co., Ltd. focuses on the research, development, and manufacturing of electronic materials for the printed circuit board, semiconductor and packaging, and touch screen industries, with a market cap of CN¥7.36 billion.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, amounting to CN¥364.94 million.

Insider Ownership: 31.8%

Revenue Growth Forecast: 31.2% p.a.

Guangdong Skychem Technology demonstrates strong growth potential with earnings forecasted to increase by 39.8% annually, outpacing the Chinese market's 26.2%. Revenue is also projected to grow significantly at 31.2% per year, surpassing the broader market's growth rate. Recent financial results show an increase in net income from CNY 41.65 million to CNY 57.17 million for the nine months ending September 2024, reflecting robust operational performance despite no recent insider trading activity or share buybacks in Q3 2024.

- Get an in-depth perspective on Guangdong Skychem Technology's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report Guangdong Skychem Technology implies its share price may be too high.

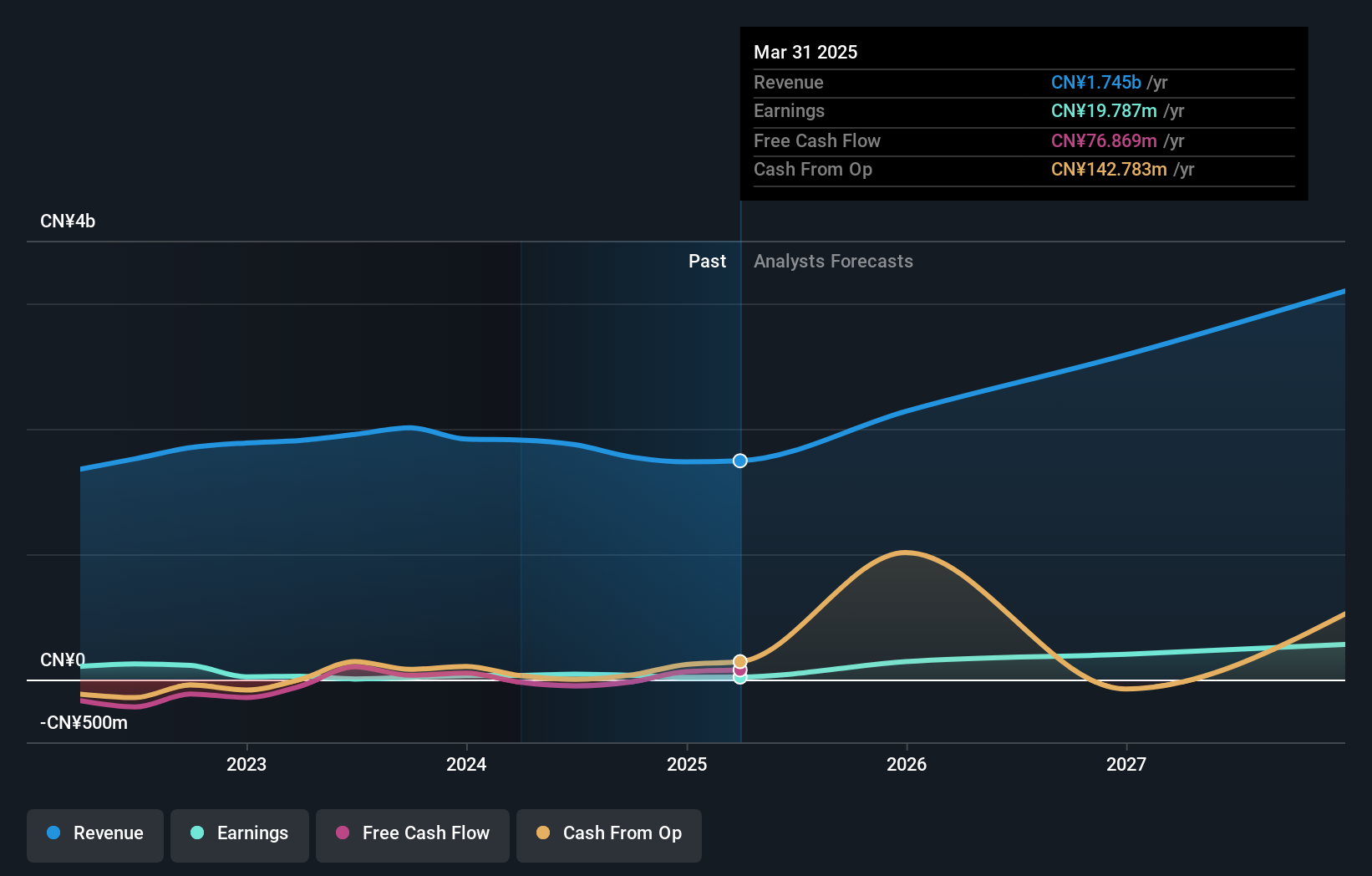

Shenzhen Sunline Tech (SZSE:300348)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunline Tech Co., Ltd. offers banking software and technology services to global banking and finance clients, with a market cap of CN¥14.75 billion.

Operations: Shenzhen Sunline Tech Co., Ltd.'s revenue is primarily derived from providing software and technology services to clients in the banking and finance sectors worldwide.

Insider Ownership: 21.8%

Revenue Growth Forecast: 18.6% p.a.

Shenzhen Sunline Tech shows promising growth, with earnings projected to rise significantly by 44.5% annually, surpassing the Chinese market's average. However, recent financials reveal a decline in revenue to CNY 1.04 billion for the nine months ending September 2024 compared to the previous year, though net income improved from CNY 1.64 million to CNY 3.98 million. Despite shareholder dilution over the past year and volatile share prices, no substantial insider trading activity was reported recently.

- Unlock comprehensive insights into our analysis of Shenzhen Sunline Tech stock in this growth report.

- Upon reviewing our latest valuation report, Shenzhen Sunline Tech's share price might be too optimistic.

Auras Technology (TPEX:3324)

Simply Wall St Growth Rating: ★★★★★★

Overview: Auras Technology Co., Ltd. is involved in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across China, Taiwan, Ireland, Singapore, the United States, and other international markets with a market cap of NT$60.65 billion.

Operations: Auras Technology Co., Ltd. generates revenue through its operations in the manufacturing, processing, and retailing of electronic materials and computer cooling modules across various international markets.

Insider Ownership: 20%

Revenue Growth Forecast: 25.3% p.a.

Auras Technology demonstrates strong growth potential, with earnings forecasted to increase by 36.3% annually, outpacing the Taiwanese market average. Recent financial results show a rise in nine-month sales to TWD 11.65 billion from TWD 9.37 billion year-over-year, though quarterly net income decreased slightly. Despite past shareholder dilution and high share price volatility, the stock is trading below its estimated fair value and analysts anticipate a 22.8% price increase.

- Navigate through the intricacies of Auras Technology with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Auras Technology's share price might be too pessimistic.

Make It Happen

- Get an in-depth perspective on all 1530 Fast Growing Companies With High Insider Ownership by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688603

Guangdong Skychem Technology

Engages in research and development and manufacturing of electronic materials in the printed circuit board, semiconductor and packaging, and touch screen industries.

Flawless balance sheet with high growth potential.