- Japan

- /

- Construction

- /

- TSE:1719

Undiscovered Gems Three Promising Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets react to recent political shifts and economic policies, the U.S. stock market has seen a notable rally, with small-cap indices like the Russell 2000 leading gains but still shy of record highs. Amidst these dynamic conditions, identifying promising stocks involves looking for companies that can capitalize on potential regulatory changes and economic growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

China Catalyst Holding (SHSE:688267)

Simply Wall St Value Rating: ★★★★★★

Overview: China Catalyst Holding Co., Ltd. focuses on the research and development, production, and sale of zeolite catalysts, customized process package solutions, and fine chemicals both in China and internationally with a market capitalization of CN¥3.82 billion.

Operations: The primary revenue stream for China Catalyst Holding comes from its Chemical Reagent and Auxiliary Manufacturing segment, generating CN¥708.63 million.

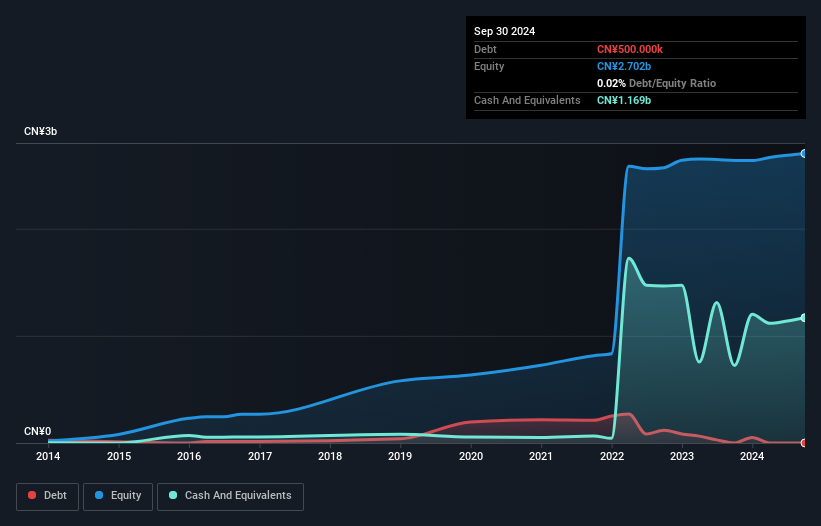

China Catalyst Holding, a company with a promising profile, has seen its debt-to-equity ratio plummet from 24.9% to just 0.02% over five years. This financial prudence is complemented by earnings growth of 35.5%, outpacing the Chemicals industry's -5.3%. The company's price-to-earnings ratio at 26x is attractive compared to the broader Chinese market's 36.3x, suggesting potential value for investors. Recent results show net income climbing to CNY 113.66 million from CNY 43.28 million year-on-year, with basic earnings per share rising from CNY 0.25 to CNY 0.65, indicating robust profitability and operational efficiency improvements.

- Click here and access our complete health analysis report to understand the dynamics of China Catalyst Holding.

Assess China Catalyst Holding's past performance with our detailed historical performance reports.

Anhui Huaertai Chemical (SZSE:001217)

Simply Wall St Value Rating: ★★★★★☆

Overview: Anhui Huaertai Chemical Co., Ltd. is involved in the research, development, production, and sale of chemical products with a market capitalization of CN¥3.57 billion.

Operations: Huaertai Chemical's revenue streams primarily originate from the production and sale of chemical products. The company's financial performance includes a focus on managing costs to optimize profitability, with a notable trend in its net profit margin.

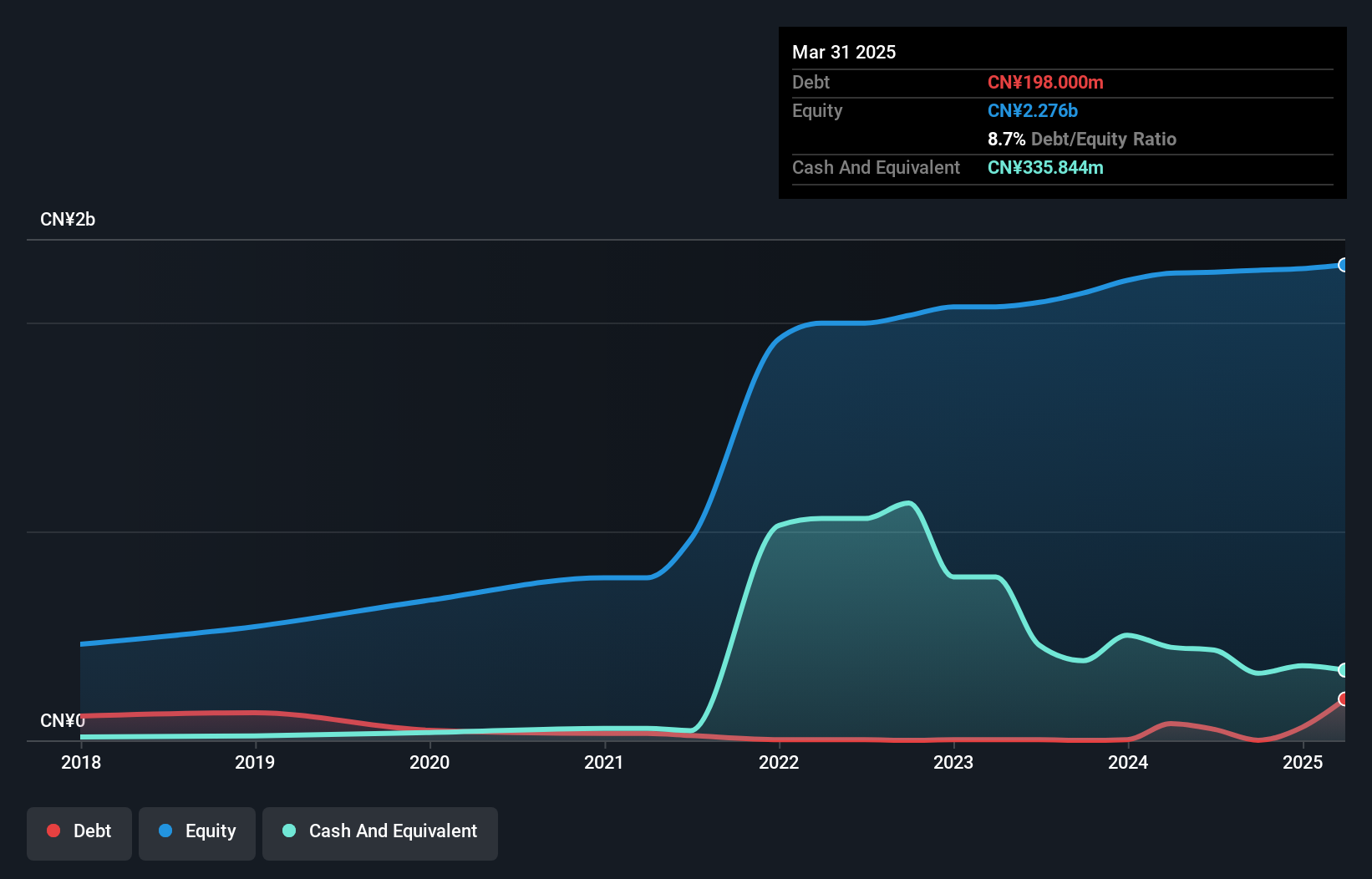

Anhui Huaertai Chemical, a smaller player in the market, showcases high-quality earnings despite some challenges. Over the past year, its earnings growth of 0.01% outpaced the chemicals industry's -5.3%, indicating resilience. The company is debt-free now compared to five years ago when it had a debt-to-equity ratio of 10.9%. However, over five years, earnings have seen an average annual decrease of 11.6%. Recent reports show sales at CNY 1.21 billion and net income at CNY 80 million for nine months ending September 2024, reflecting a dip from last year's figures but still trading well below estimated fair value by about 80%.

- Dive into the specifics of Anhui Huaertai Chemical here with our thorough health report.

Learn about Anhui Huaertai Chemical's historical performance.

Hazama Ando (TSE:1719)

Simply Wall St Value Rating: ★★★★★★

Overview: Hazama Ando Corporation operates in the construction and construction-related sectors both domestically in Japan and internationally, with a market cap of ¥181.84 billion.

Operations: Hazama Ando generates revenue primarily from its construction and construction-related activities in Japan and abroad. The company's net profit margin shows notable variations, reflecting changes in cost management and project execution efficiency over time.

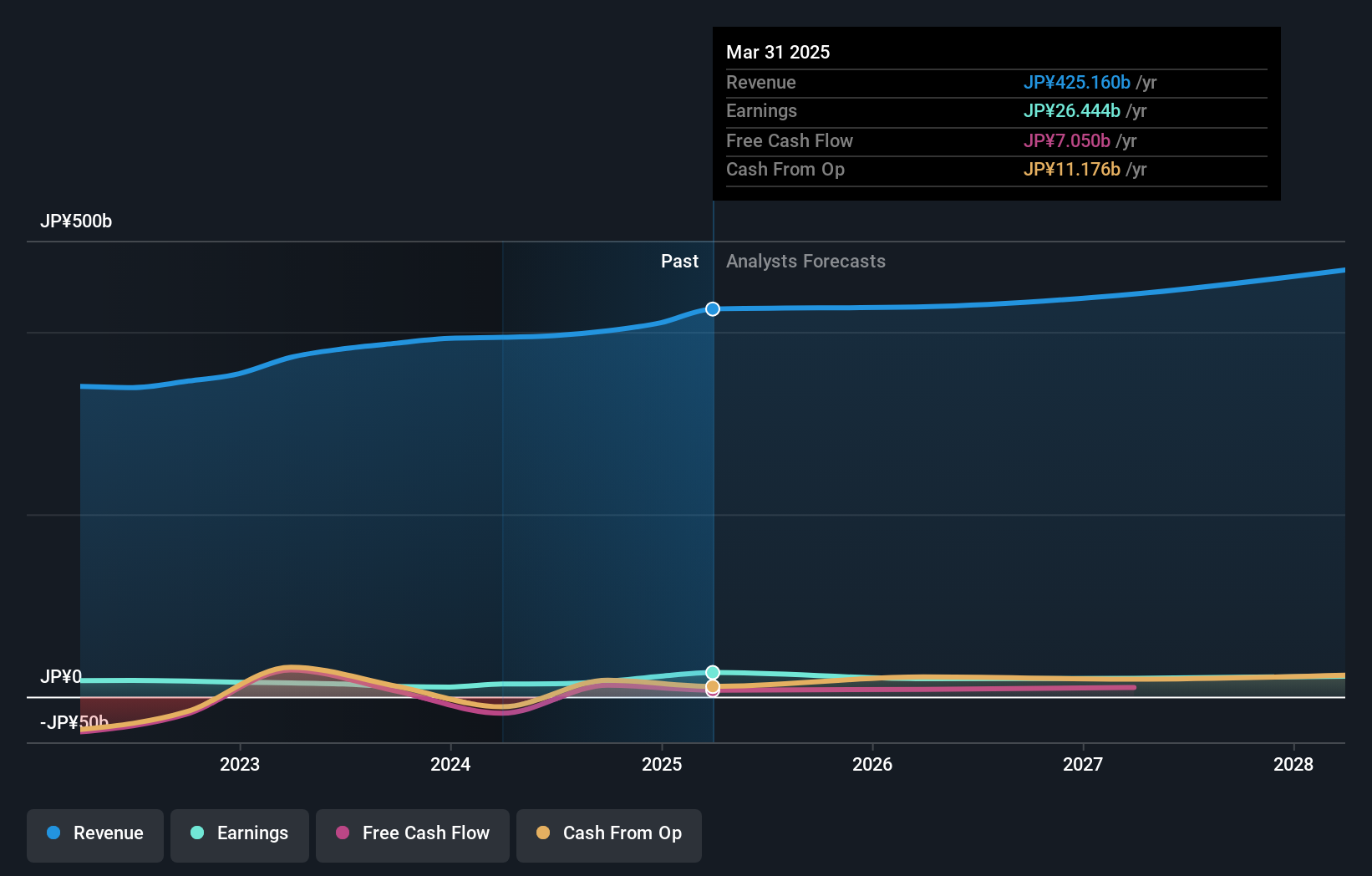

Hazama Ando, a notable player in the construction sector, has shown impressive earnings growth of 50% over the past year, outpacing the industry average of 24%. The company is financially sound with a debt-to-equity ratio reduced to 19% from 22% over five years. Despite its price-to-earnings ratio standing at 11x—lower than Japan's market average of 14x—the firm remains profitable and free cash flow positive. Recent guidance revisions indicate improved profitability prospects, with operating profit expectations raised to ¥9.72 billion (US$65 million), reflecting strong operational performance and potential for value realization.

- Get an in-depth perspective on Hazama Ando's performance by reading our health report here.

Explore historical data to track Hazama Ando's performance over time in our Past section.

Next Steps

- Click here to access our complete index of 4664 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hazama Ando might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1719

Hazama Ando

Engages in the construction and construction-related business in Japan and internationally.

Flawless balance sheet established dividend payer.