As October 2024 unfolds, the global markets are navigating a complex landscape marked by rising U.S. Treasury yields and tepid economic growth, which have influenced both large-cap and small-cap stocks differently. While larger companies have shown resilience, small-cap stocks face unique challenges amid these conditions, making it an intriguing time to explore lesser-known opportunities in this segment. In such an environment, identifying promising stocks often involves looking for companies with strong fundamentals and potential for growth that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

| Waja | 23.81% | 98.44% | 14.54% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shanghai Zijiang Enterprise Group (SHSE:600210)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Zijiang Enterprise Group Co., Ltd. (SHSE:600210) operates in diversified sectors, including packaging and real estate, with a market cap of CN¥9.02 billion.

Operations: Shanghai Zijiang Enterprise Group generates revenue primarily from its operations in packaging and real estate sectors. The company has a market capitalization of CN¥9.02 billion.

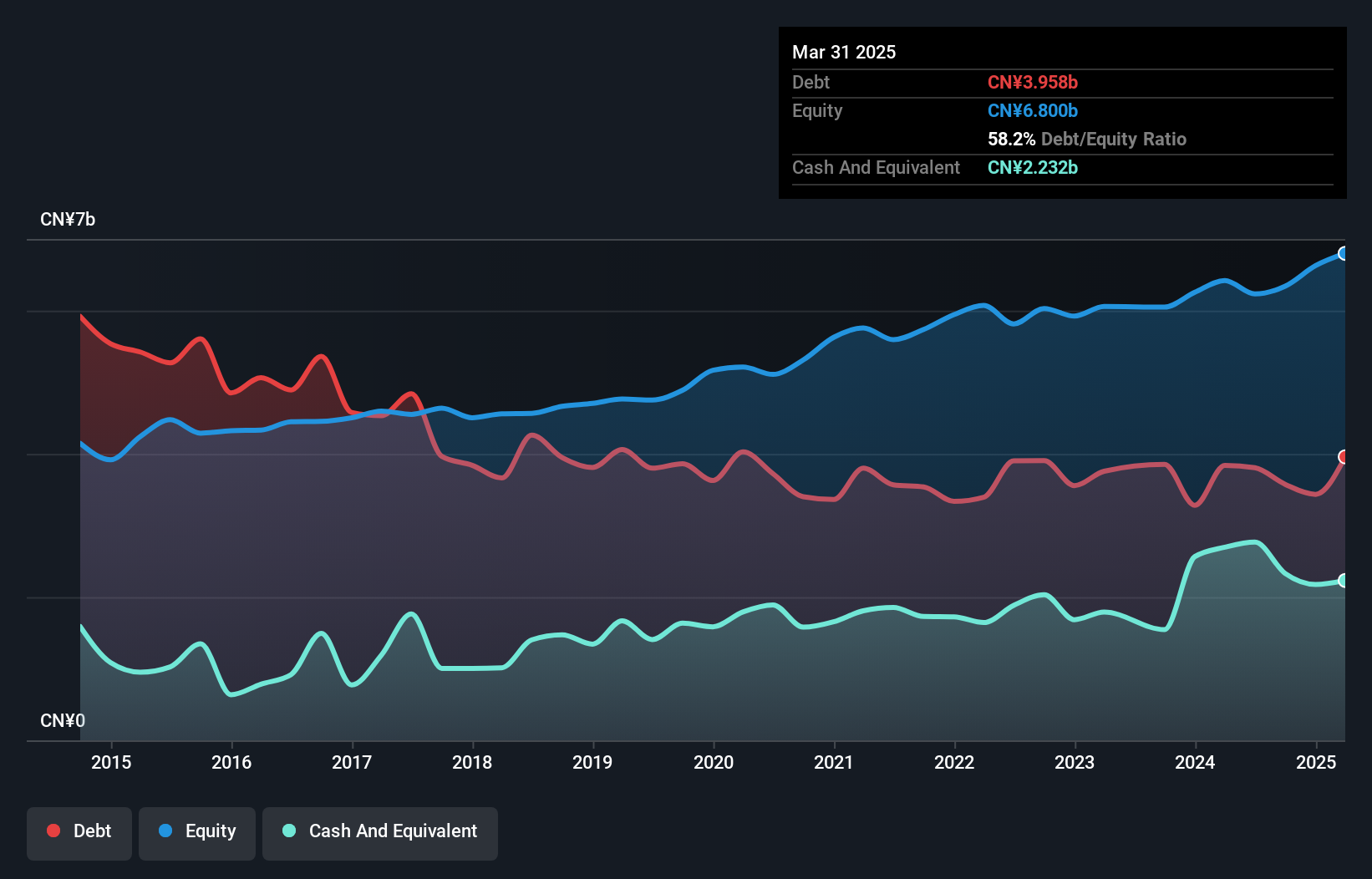

Shanghai Zijiang Enterprise Group seems to be a promising contender in the industry with its earnings growing at 4.8% annually over the past five years, despite not outpacing the packaging sector's growth. The company's debt-to-equity ratio has improved from 79% to a healthier 56.4%, indicating better financial management. Trading at a significant discount of 98% below estimated fair value, it offers good relative value compared to peers. Recent reports show net income rising from CNY 450.96 million to CNY 527.56 million over nine months, with basic earnings per share increasing from CNY 0.297 to CNY 0.348, reflecting solid operational performance amidst stable sales figures.

- Unlock comprehensive insights into our analysis of Shanghai Zijiang Enterprise Group stock in this health report.

Learn about Shanghai Zijiang Enterprise Group's historical performance.

Longyan Kaolin Clay (SHSE:605086)

Simply Wall St Value Rating: ★★★★★★

Overview: Longyan Kaolin Clay Co., Ltd. is involved in the production and supply of kaolin for ceramic raw materials in China, with a market cap of CN¥5.50 billion.

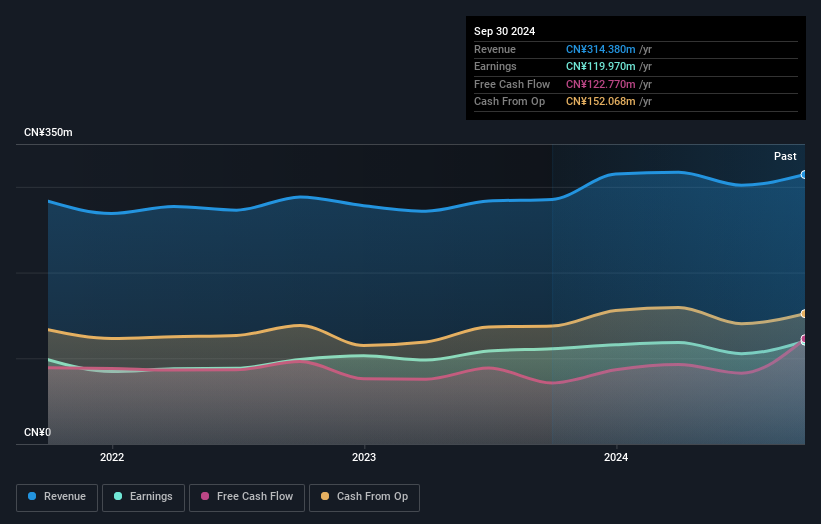

Operations: The primary revenue stream for Longyan Kaolin Clay comes from its Specialty Chemicals segment, generating CN¥314.38 million.

Longyan Kaolin Clay stands out with its solid financial health, being debt-free now compared to a 9.9% debt-to-equity ratio five years ago. The company posted a net income of CNY 96 million for the first nine months of 2024, an improvement from CNY 92 million the previous year, reflecting consistent earnings growth at an impressive rate of 8%. Despite sales remaining stable at around CNY 232 million compared to last year, its free cash flow remains positive. A recent acquisition deal by Zijin Mining Group for a 20% stake underscores potential strategic value and future growth prospects in the industry.

- Click here to discover the nuances of Longyan Kaolin Clay with our detailed analytical health report.

Gain insights into Longyan Kaolin Clay's past trends and performance with our Past report.

Advanced Technology & Materials (SZSE:000969)

Simply Wall St Value Rating: ★★★★★★

Overview: Advanced Technology & Materials Co., Ltd. operates in the advanced materials industry with a focus on developing and manufacturing high-tech materials, and has a market cap of approximately CN¥10.80 billion.

Operations: Advanced Technology & Materials generates revenue primarily from the sale of high-tech materials. The company's gross profit margin is a key financial metric to consider, reflecting its ability to manage production costs relative to sales.

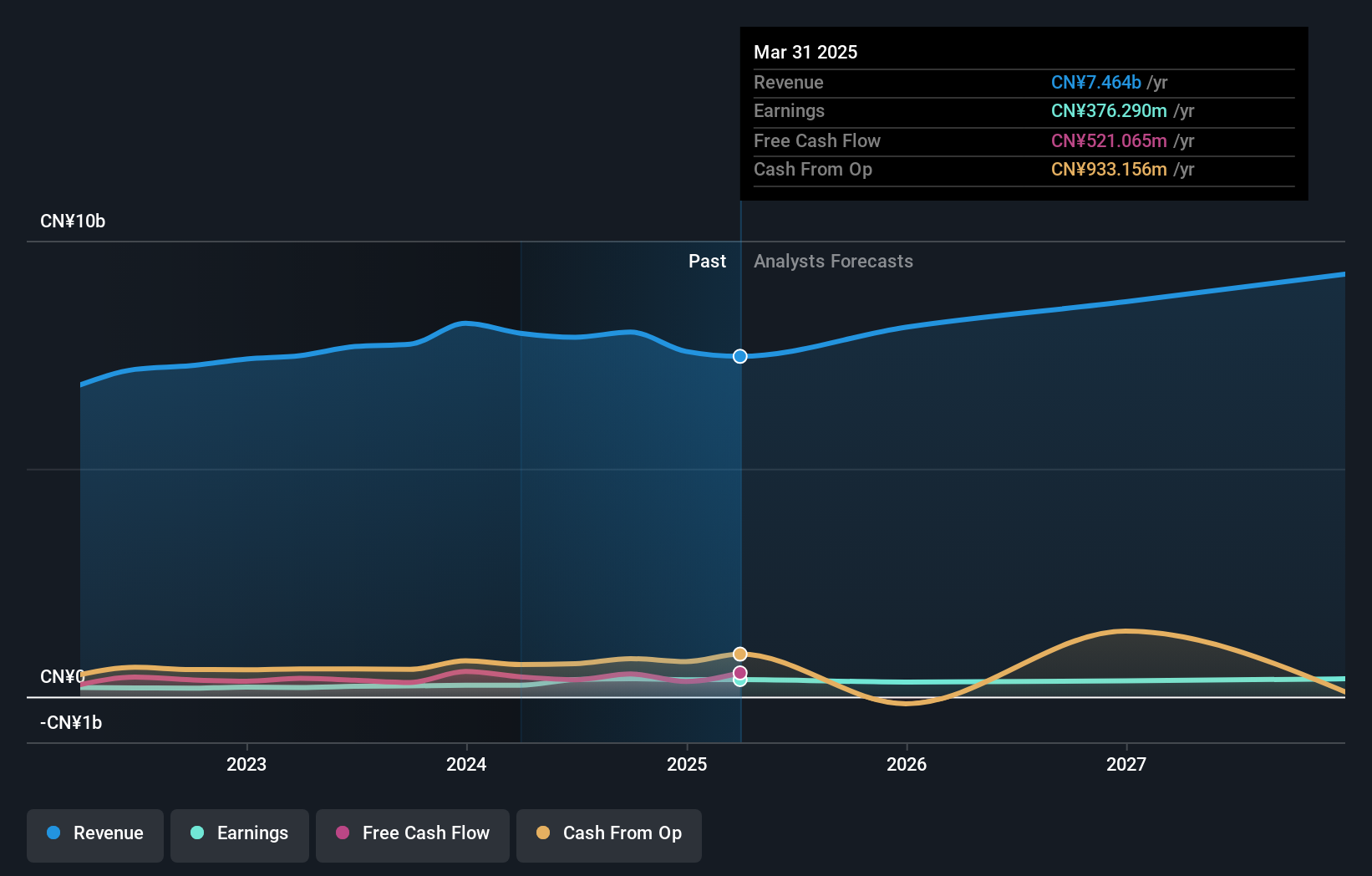

Advanced Technology & Materials, a smaller player in the industry, has shown promising financial performance recently. Over the past year, its earnings surged by 67.2%, outpacing the Metals and Mining industry's -0.8% growth rate. The company's debt situation is favorable with more cash than total debt and a reduced debt-to-equity ratio from 25.6% to 13.5% over five years, indicating prudent financial management. Recent earnings reveal net income of CNY 340 million for nine months ending September 2024 compared to CNY 195 million last year, while basic EPS rose from CNY 0.19 to CNY 0.33, reflecting improved profitability despite slightly lower sales figures this year at CNY 5,853 million versus last year's CNY 6,045 million.

Key Takeaways

- Unlock our comprehensive list of 4734 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600210

Shanghai Zijiang Enterprise Group

Shanghai Zijiang Enterprise Group Co., Ltd.

Flawless balance sheet, undervalued and pays a dividend.