- China

- /

- Medical Equipment

- /

- SZSE:300832

Chinese Exchange Value Stock Picks For August 2024

Reviewed by Simply Wall St

As global markets react to mixed economic signals and China's manufacturing sector continues to contract, investors are increasingly looking toward value stocks for stability. Amid these conditions, identifying undervalued stocks in China could present unique opportunities for those seeking to capitalize on potential market inefficiencies. In this article, we will explore three Chinese exchange value stock picks for August 2024 that demonstrate strong fundamentals and resilience in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Gaona Aero Material (SZSE:300034) | CN¥15.74 | CN¥30.66 | 48.7% |

| Beijing ConST Instruments Technology (SZSE:300445) | CN¥15.38 | CN¥29.91 | 48.6% |

| Changsha DIALINE New Material Sci.&Tech (SZSE:300700) | CN¥7.07 | CN¥13.50 | 47.6% |

| Jiangsu Hualan New Pharmaceutical MaterialLtd (SZSE:301093) | CN¥19.25 | CN¥37.63 | 48.8% |

| Guangzhou Tinci Materials Technology (SZSE:002709) | CN¥15.29 | CN¥29.03 | 47.3% |

| Songcheng Performance DevelopmentLtd (SZSE:300144) | CN¥7.84 | CN¥15.65 | 49.9% |

| Qingdao NovelBeam TechnologyLtd (SHSE:688677) | CN¥32.24 | CN¥62.92 | 48.8% |

| China Kings Resources GroupLtd (SHSE:603505) | CN¥26.48 | CN¥50.18 | 47.2% |

| Ecovacs Robotics (SHSE:603486) | CN¥39.99 | CN¥79.27 | 49.6% |

| 3Peak (SHSE:688536) | CN¥87.58 | CN¥172.46 | 49.2% |

Here's a peek at a few of the choices from the screener.

China Kings Resources GroupLtd (SHSE:603505)

Overview: China Kings Resources Group Co., Ltd., with a market cap of CN¥15.94 billion, invests in and develops fluorite mines in the People’s Republic of China through its subsidiaries.

Operations: The company's revenue segments primarily consist of investments in and development of fluorite mines within the People’s Republic of China.

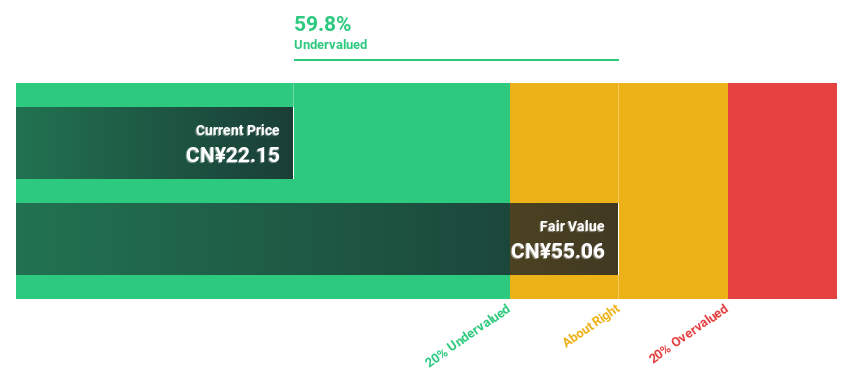

Estimated Discount To Fair Value: 47.2%

China Kings Resources Group Ltd. appears undervalued, trading at CN¥26.48, significantly below its estimated fair value of CN¥50.18. The company’s earnings are forecast to grow 27.24% annually, outpacing the market's 22.2%, with revenue expected to increase by 28.8% per year, also above market growth rates. A recent share buyback program worth up to CN¥100 million further underscores management’s confidence in the company's valuation and future prospects.

- According our earnings growth report, there's an indication that China Kings Resources GroupLtd might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of China Kings Resources GroupLtd.

Eyebright Medical Technology (Beijing) (SHSE:688050)

Overview: Eyebright Medical Technology (Beijing) Co., Ltd. operates in the medical technology sector, focusing on innovative healthcare solutions, with a market cap of CN¥15.10 billion.

Operations: The company generates revenue primarily from its medical products segment, which amounted to CN¥1.07 billion.

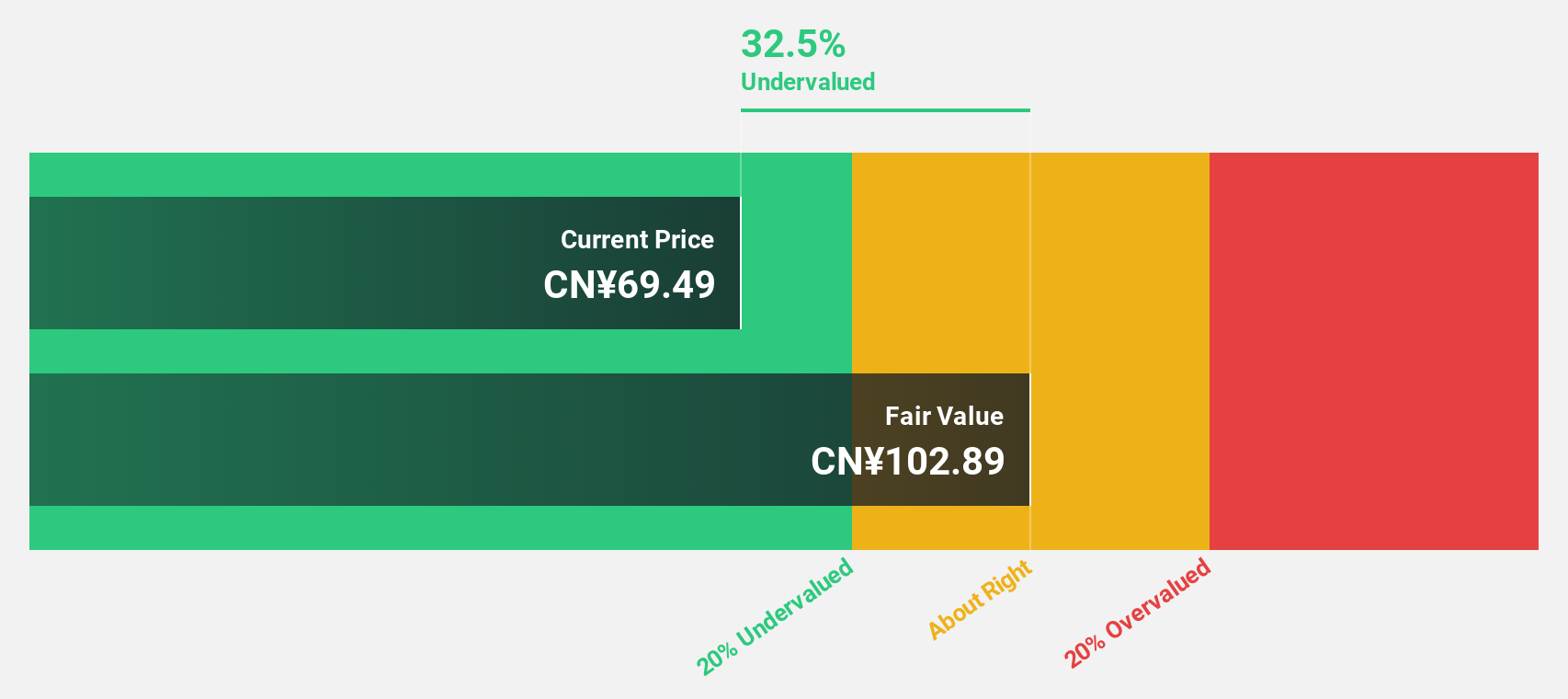

Estimated Discount To Fair Value: 43.7%

Eyebright Medical Technology (Beijing) is trading at CN¥79.65, significantly below its estimated fair value of CN¥141.47, indicating it is undervalued based on cash flows. The company’s earnings grew by 30.1% last year and are forecast to grow 27.15% annually over the next three years, outpacing the market's growth rate of 22.2%. Analysts agree that the stock price could rise by nearly 50%, although its return on equity is expected to be low at 17.7%.

- Insights from our recent growth report point to a promising forecast for Eyebright Medical Technology (Beijing)'s business outlook.

- Unlock comprehensive insights into our analysis of Eyebright Medical Technology (Beijing) stock in this financial health report.

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. is a bio-medical company that develops, produces, and sells clinical laboratory instruments and in vitro diagnostic reagents to hospitals in China and internationally, with a market cap of CN¥51.32 billion.

Operations: The company generates revenue primarily from its in vitro diagnostic segment, amounting to CN¥4.08 billion.

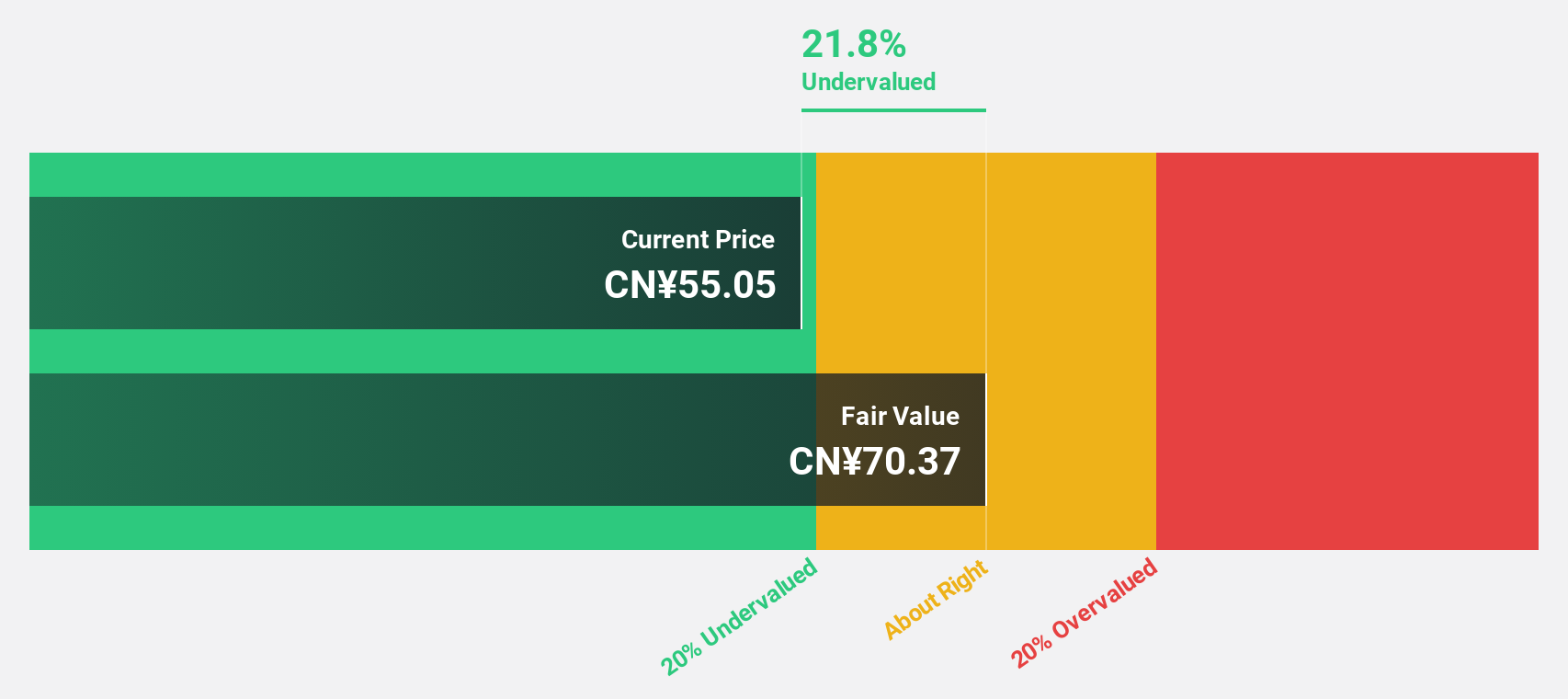

Estimated Discount To Fair Value: 29.2%

Shenzhen New Industries Biomedical Engineering is trading at CN¥65.32, well below its estimated fair value of CN¥92.33, making it undervalued based on cash flows. The company's earnings grew by 25.5% last year and are expected to grow 22.6% annually, outpacing the market's growth rate of 22.2%. Analysts forecast a stock price increase of around 30%, with a high return on equity projected at 24.3% in three years' time.

- Our growth report here indicates Shenzhen New Industries Biomedical Engineering may be poised for an improving outlook.

- Dive into the specifics of Shenzhen New Industries Biomedical Engineering here with our thorough financial health report.

Seize The Opportunity

- Access the full spectrum of 99 Undervalued Chinese Stocks Based On Cash Flows by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300832

Shenzhen New Industries Biomedical Engineering

A bio-medical company, engages in the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals in the People's Republic of China and internationally.

Exceptional growth potential with flawless balance sheet.