Chinese Exchange Highlights 3 Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As China implements robust stimulus measures to invigorate its economy, the Shanghai Composite Index and CSI 300 have experienced significant gains, reflecting renewed investor optimism. In this buoyant environment, growth companies with strong insider ownership can be particularly appealing as they often signal confidence from those closest to the business and may align well with market sentiment favoring stability and potential expansion.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 18% | 28.7% |

| Jiayou International LogisticsLtd (SHSE:603871) | 20.6% | 24.6% |

| Western Regions Tourism DevelopmentLtd (SZSE:300859) | 13.9% | 39.2% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 29.9% |

| Quick Intelligent EquipmentLtd (SHSE:603203) | 34.4% | 33.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 67.5% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 41.7% |

| UTour Group (SZSE:002707) | 23% | 28.7% |

| BIWIN Storage Technology (SHSE:688525) | 18.8% | 116.8% |

| Offcn Education Technology (SZSE:002607) | 25.1% | 75.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningxia Baofeng Energy Group (SHSE:600989)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningxia Baofeng Energy Group Co., Ltd. engages in the production, processing, and sale of coal mining products and chemicals such as methanol and olefins, with a market cap of CN¥127.23 billion.

Operations: The company's revenue is primarily derived from Coking Products (CN¥14.15 billion), Olefin Products (CN¥19.16 billion), and Fine Chemical Products (CN¥4.08 billion).

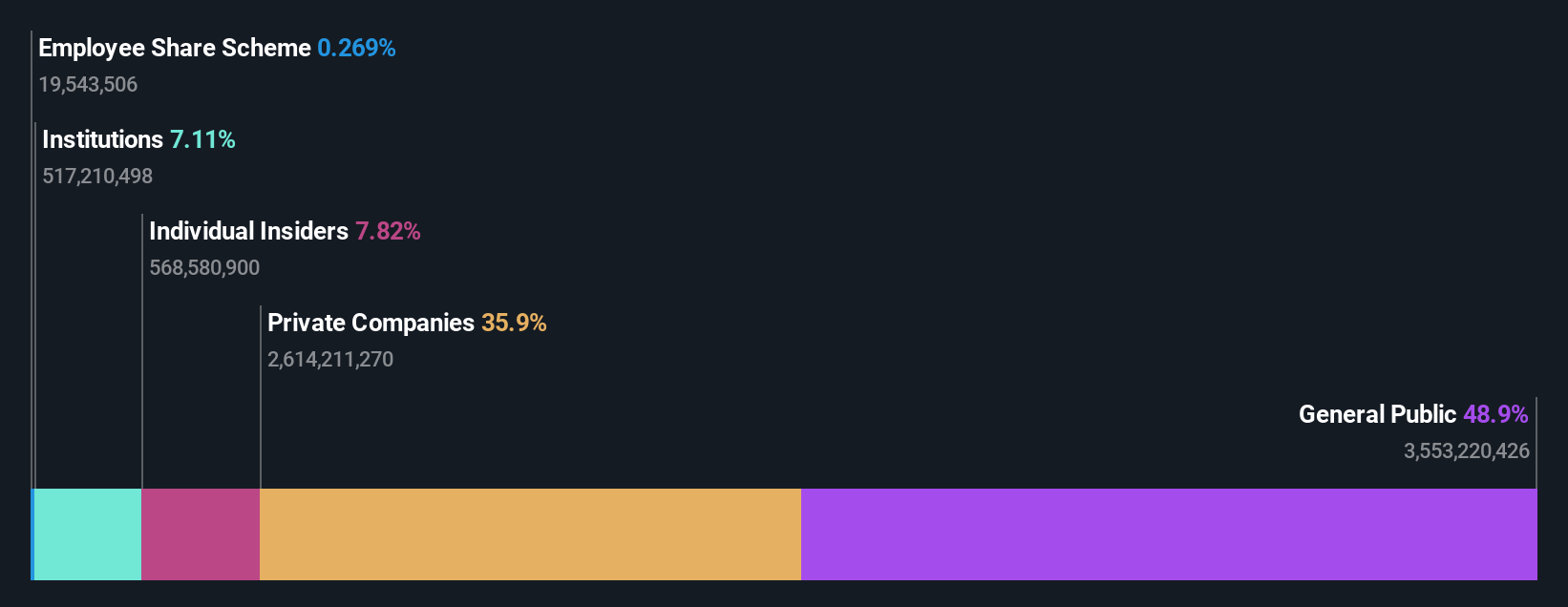

Insider Ownership: 35%

Revenue Growth Forecast: 25.4% p.a.

Ningxia Baofeng Energy Group demonstrates strong growth potential with earnings forecasted to grow significantly, outpacing the Chinese market. Recent financial results show substantial revenue and net income increases, reaching CNY 16.90 billion and CNY 3.30 billion respectively for H1 2024. Despite high debt levels, the company trades below its estimated fair value and is expected to see a stock price rise by analysts. Insider ownership remains stable without recent substantial trading activity.

- Navigate through the intricacies of Ningxia Baofeng Energy Group with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Ningxia Baofeng Energy Group shares in the market.

Zhejiang Weiming Environment Protection (SHSE:603568)

Simply Wall St Growth Rating: ★★★★★★

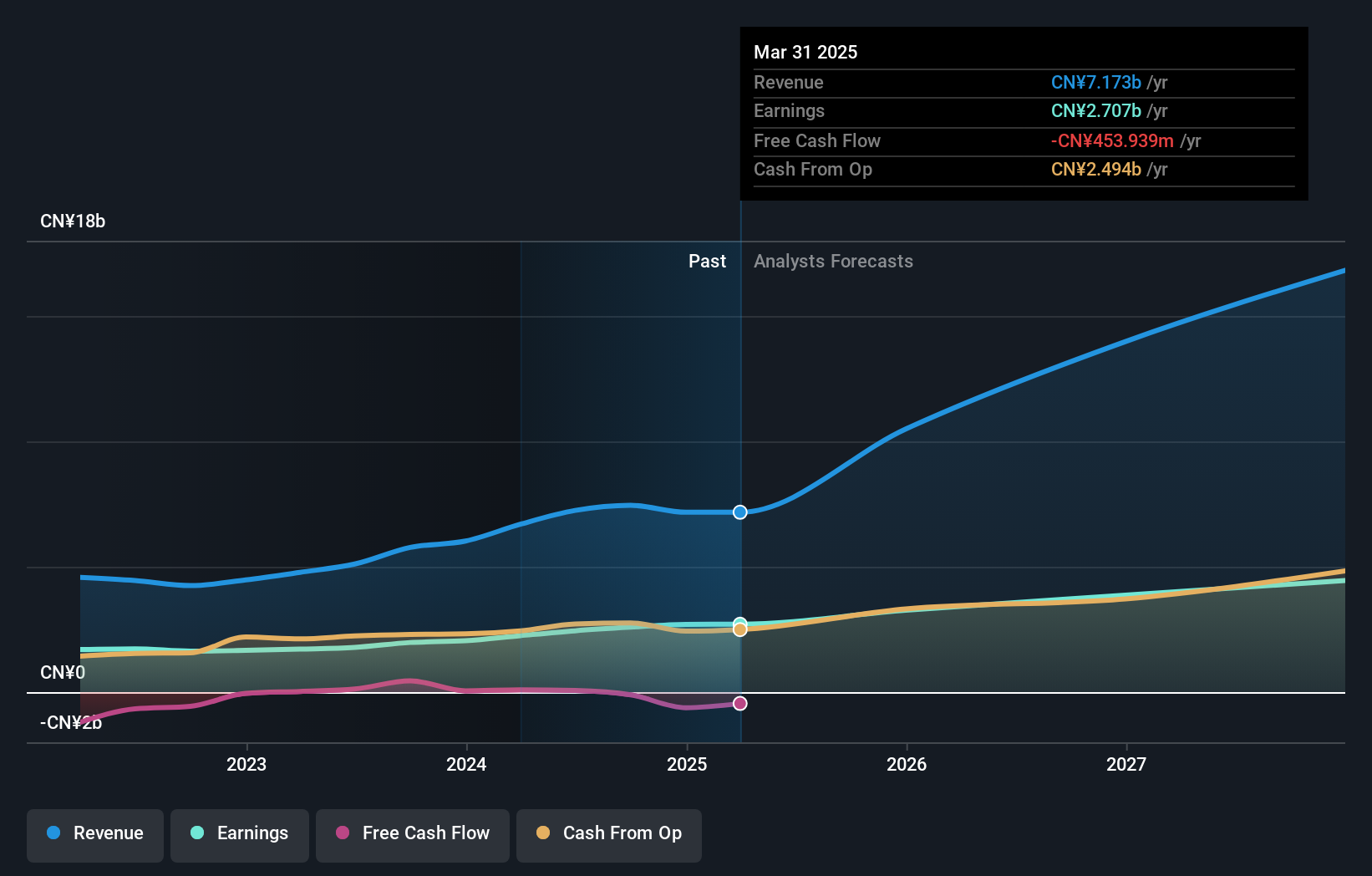

Overview: Zhejiang Weiming Environment Protection Co., Ltd., with a market cap of CN¥36.84 billion, operates in the environmental protection sector, focusing on waste incineration and energy recovery solutions.

Operations: The company's revenue from the industrial segment is CN¥7.24 billion.

Insider Ownership: 24%

Revenue Growth Forecast: 29.9% p.a.

Zhejiang Weiming Environment Protection shows promising growth prospects, with revenue and earnings expected to grow faster than the Chinese market. Recent H1 2024 results highlight a significant increase in sales to CNY 4.11 billion and net income of CNY 1.42 billion. The company's price-to-earnings ratio is favorable compared to the market, suggesting good value despite a low dividend coverage by free cash flows. Insider ownership remains stable with no recent substantial trading activity reported.

- Delve into the full analysis future growth report here for a deeper understanding of Zhejiang Weiming Environment Protection.

- The valuation report we've compiled suggests that Zhejiang Weiming Environment Protection's current price could be quite moderate.

Canmax Technologies (SZSE:300390)

Simply Wall St Growth Rating: ★★★★★☆

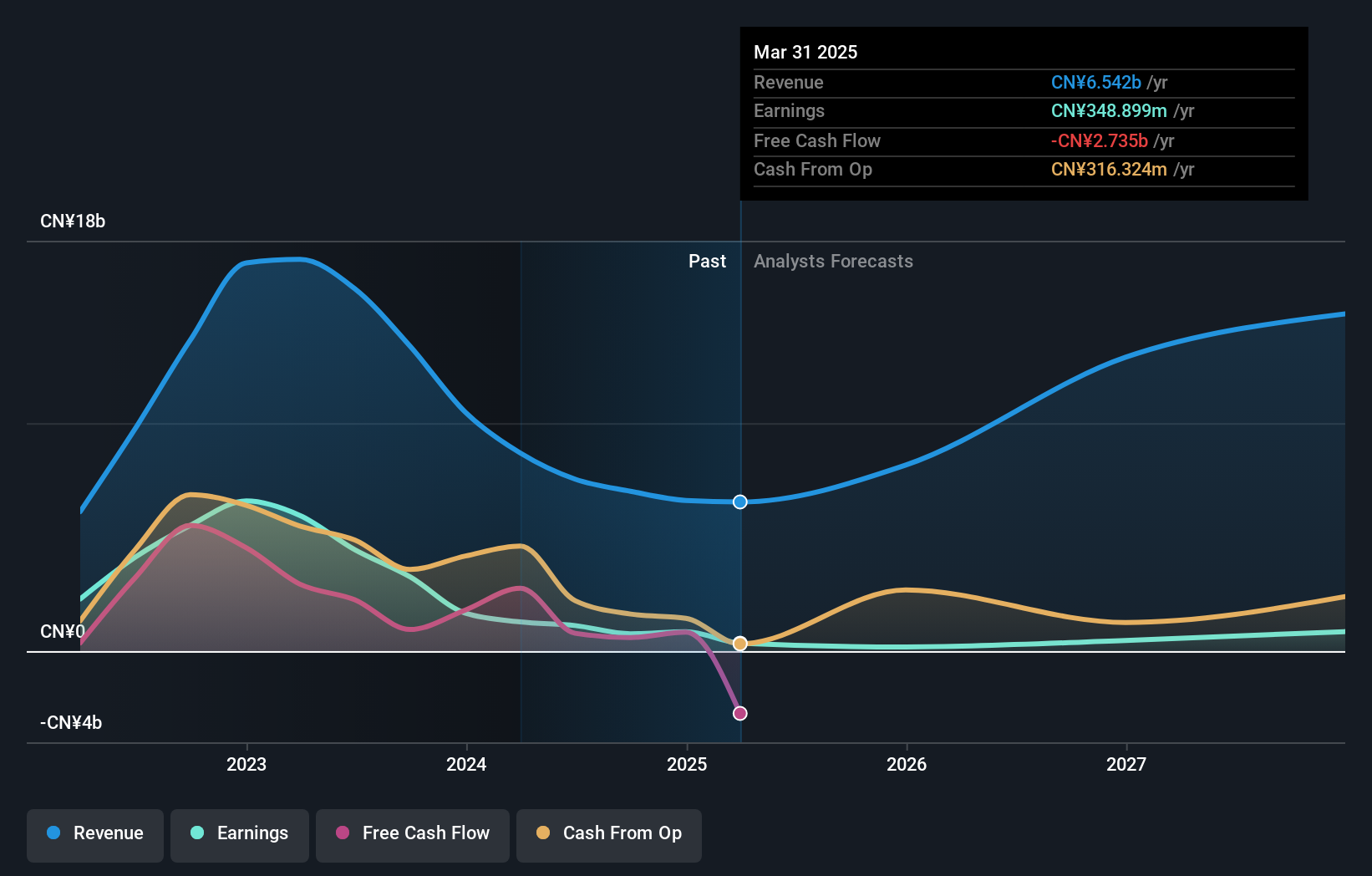

Overview: Canmax Technologies Co., Ltd. specializes in producing new energy lithium battery materials and has a market cap of CN¥20.50 billion.

Operations: Revenue Segments (in millions of CN¥): Canmax Technologies Co., Ltd. generates revenue primarily from its production and sale of new energy lithium battery materials.

Insider Ownership: 34%

Revenue Growth Forecast: 36.9% p.a.

Canmax Technologies is poised for growth, with earnings and revenue forecasted to outpace the Chinese market significantly. Despite recent declines in sales and net income for H1 2024, the company's price-to-earnings ratio of 18.3x suggests it is undervalued relative to peers. The company recently completed a share buyback worth CNY 249.97 million, reflecting strategic capital management amid volatile share prices and low dividend coverage by free cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Canmax Technologies.

- Our valuation report unveils the possibility Canmax Technologies' shares may be trading at a discount.

Turning Ideas Into Actions

- Explore the 381 names from our Fast Growing Chinese Companies With High Insider Ownership screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Ningxia Baofeng Energy Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600989

Ningxia Baofeng Energy Group

Produces, processes, and sells coal mining, washing, coking, coal tar, crude benzene, C4 deep-processed, methanol, and olefin products.

Very undervalued with exceptional growth potential.