Ningbo ShanshanLtd (SHSE:600884) sheds CN¥1.1b, company earnings and investor returns have been trending downwards for past three years

It's not possible to invest over long periods without making some bad investments. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Ningbo Shanshan Co.,Ltd. (SHSE:600884), who have seen the share price tank a massive 79% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 48% in a year. Shareholders have had an even rougher run lately, with the share price down 37% in the last 90 days.

With the stock having lost 6.7% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Ningbo ShanshanLtd

While Ningbo ShanshanLtd made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over three years, Ningbo ShanshanLtd grew revenue at 8.2% per year. That's a pretty good rate of top-line growth. So it seems unlikely the 21% share price drop (each year) is entirely about the revenue. More likely, the market was spooked by the cost of that revenue. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

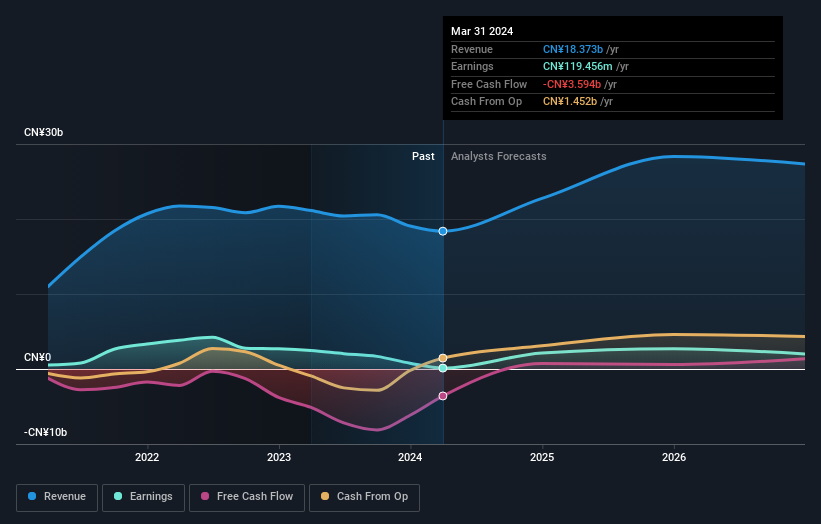

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

If you are thinking of buying or selling Ningbo ShanshanLtd stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

While the broader market lost about 16% in the twelve months, Ningbo ShanshanLtd shareholders did even worse, losing 47% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 0.5%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for Ningbo ShanshanLtd (of which 2 don't sit too well with us!) you should know about.

But note: Ningbo ShanshanLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo ShanshanLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600884

Ningbo ShanshanLtd

Provides lithium battery materials in China and internationally.

Reasonable growth potential slight.