- China

- /

- Metals and Mining

- /

- SHSE:600725

February 2025's Top Penny Stocks To Watch

Reviewed by Simply Wall St

Global markets have recently experienced a mix of volatility and growth, with U.S. stocks facing challenges from competitive pressures in the AI sector and political uncertainties surrounding tariffs, while European markets have been buoyed by strong earnings and interest rate cuts. In such fluctuating conditions, investors may find opportunities in lesser-known areas like penny stocks—an investment category that remains relevant despite its old-fashioned name. These smaller or newer companies can offer unique growth potential when supported by solid financials, making them an intriguing option for those looking to uncover hidden value in the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.53 | MYR2.64B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.74 | HK$42.97B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.395 | MYR1.1B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.905 | £468.49M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.70 | MYR414.16M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.80 | £455.09M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| Tristel (AIM:TSTL) | £3.70 | £174.08M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.78 | A$143.12M | ★★★★☆☆ |

| Lever Style (SEHK:1346) | HK$1.15 | HK$730.01M | ★★★★★★ |

Click here to see the full list of 5,709 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Jacobio Pharmaceuticals Group (SEHK:1167)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Jacobio Pharmaceuticals Group Co., Ltd. is an investment holding company focused on the in-house discovery and development of oncology therapies, with a market cap of HK$1.19 billion.

Operations: Jacobio Pharmaceuticals Group Co., Ltd. has not reported any revenue segments.

Market Cap: HK$1.19B

Jacobio Pharmaceuticals Group, with a market cap of HK$1.19 billion, is pre-revenue and focused on oncology therapies. It has significant short-term assets (CN¥1.1B) exceeding liabilities and a cash runway extending over three years, indicating financial stability despite negative equity five years ago. Recent developments include promising clinical trial results for its KRAS G12C inhibitor glecirasib, showing effective outcomes in lung cancer patients and being under priority review in China. Additionally, the company is advancing other candidates like JAB-8263 for myelofibrosis and JAB-23E73 targeting KRAS mutations, reflecting active pipeline progression amidst its unprofitable status.

- Jump into the full analysis health report here for a deeper understanding of Jacobio Pharmaceuticals Group.

- Review our growth performance report to gain insights into Jacobio Pharmaceuticals Group's future.

Yunnan Yunwei (SHSE:600725)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Yunnan Yunwei Company Limited operates in China, focusing on the production and operation of coal coke and chemical products, with a market cap of CN¥3.80 billion.

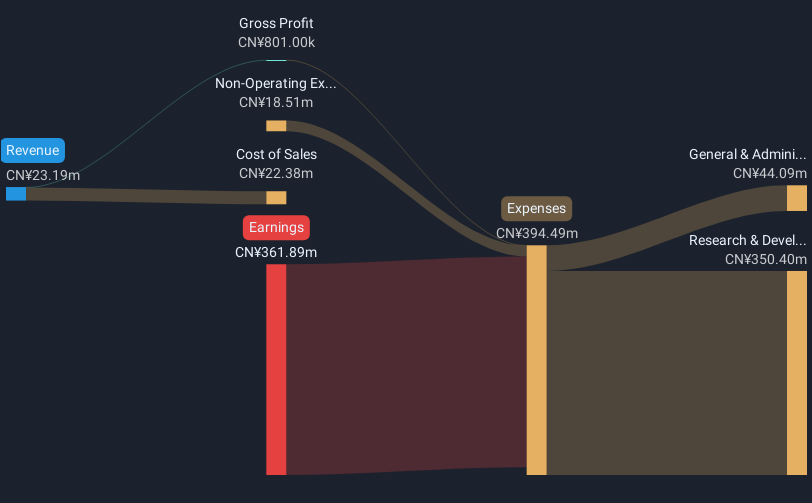

Operations: The company generates a revenue of CN¥960.89 million from its operations within China.

Market Cap: CN¥3.8B

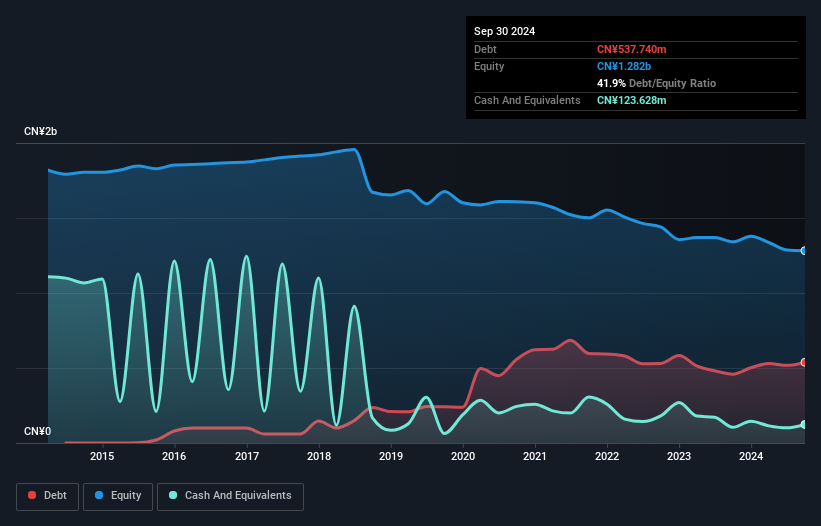

Yunnan Yunwei Company Limited, with a market cap of CN¥3.80 billion, operates within China's coal coke and chemical sector but remains unprofitable. Despite its earnings decline of 14.7% annually over the past five years, the company maintains a debt-free status and holds short-term assets (CN¥430.8M) that exceed both its short-term (CN¥81.2M) and long-term liabilities (CN¥13.5M). The board's average tenure is 6.2 years, indicating experience; however, share price volatility remains high compared to most Chinese stocks with no significant shareholder dilution over the past year noted in recent analysis.

- Dive into the specifics of Yunnan Yunwei here with our thorough balance sheet health report.

- Learn about Yunnan Yunwei's historical performance here.

Honz Pharmaceutical (SZSE:300086)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Honz Pharmaceutical Co., Ltd. focuses on the research, development, manufacturing, and sales of pediatric medicines in China with a market cap of CN¥2.12 billion.

Operations: No specific revenue segments are reported for Honz Pharmaceutical Co., Ltd.

Market Cap: CN¥2.12B

Honz Pharmaceutical Co., Ltd. has a market cap of CN¥2.12 billion and focuses on pediatric medicines in China, yet it remains unprofitable with increasing losses over the past five years at a rate of 26.9% annually. The company is not pre-revenue, with short-term assets (CN¥522.3M) exceeding both short-term (CN¥475.7M) and long-term liabilities (CN¥329.6M). Despite having an inexperienced board with an average tenure of 2.2 years, its management team is seasoned with a 5.2-year average tenure, and the net debt to equity ratio stands at a satisfactory 32.3%.

- Click here and access our complete financial health analysis report to understand the dynamics of Honz Pharmaceutical.

- Understand Honz Pharmaceutical's track record by examining our performance history report.

Seize The Opportunity

- Unlock our comprehensive list of 5,709 Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600725

Yunnan Yunwei

Engages in the production and operation of coal coke and chemical products in China.

Excellent balance sheet with minimal risk.

Market Insights

Community Narratives