- China

- /

- Retail Distributors

- /

- SZSE:000025

Undiscovered Gems in China to Explore This October 2024

Reviewed by Simply Wall St

As Chinese equities see a boost from the central bank's stimulus measures, with the Shanghai Composite Index rising by 1.17%, there is growing interest in exploring opportunities within China's dynamic market landscape. In this environment, identifying stocks that are well-positioned to benefit from economic support and policy shifts can be crucial for investors looking to uncover potential growth stories.

Top 10 Undiscovered Gems With Strong Fundamentals In China

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zhejiang Kingland Pipeline and TechnologiesLtd | 1.99% | 3.49% | -8.00% | ★★★★★★ |

| Beijing WKW Automotive PartsLtd | 6.14% | -1.34% | 69.26% | ★★★★★★ |

| Changzhou Zhongying Science & Technology | NA | 10.88% | 29.30% | ★★★★★★ |

| Hangzhou Biotest BiotechLtd | 0.02% | -46.81% | -19.87% | ★★★★★★ |

| Xiangyang Changyuandonggu Industry | 29.88% | -5.98% | -18.53% | ★★★★★★ |

| Hollyland (China) Electronics Technology | 4.37% | 12.39% | 9.21% | ★★★★★★ |

| Jinsanjiang (Zhaoqing) Silicon Material | 4.36% | 14.46% | -8.89% | ★★★★★☆ |

| Keli Motor Group | 21.66% | 9.99% | -12.19% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 50.87% | 5.32% | -0.38% | ★★★★★☆ |

| Shenzhen Tongyi Industry | 72.24% | 13.41% | -16.34% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Guangdong Rongtai IndustryLtd (SHSE:600589)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guangdong Rongtai Industry Co., Ltd specializes in the production and sale of chemical materials and other chemical products in China, with a market capitalization of CN¥6.43 billion.

Operations: Rongtai generates revenue primarily from its Internet Data Center Business, which reported CN¥387.11 million.

Guangdong Rongtai Industry seems to be turning a corner, having achieved profitability over the last year despite a challenging environment in the chemicals sector. The company reported sales of CNY 203.14 million for the first half of 2024, up from CNY 183.1 million previously, and reduced its net loss to CNY 37.36 million from CNY 78.64 million a year ago. However, substantial shareholder dilution has occurred recently, and its debt-to-equity ratio has slightly increased to 44.9% over five years, indicating some financial restructuring may be underway as it navigates industry volatility and growth opportunities as part of the S&P Global BMI Index inclusion.

- Delve into the full analysis health report here for a deeper understanding of Guangdong Rongtai IndustryLtd.

Learn about Guangdong Rongtai IndustryLtd's historical performance.

Shenzhen Tellus Holding (SZSE:000025)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Tellus Holding Co., Ltd. operates in China through its subsidiaries, focusing on automobile sales, maintenance, and testing activities, with a market cap of CN¥7.97 billion.

Operations: The company generates revenue primarily from automobile sales, along with maintenance and testing services in China.

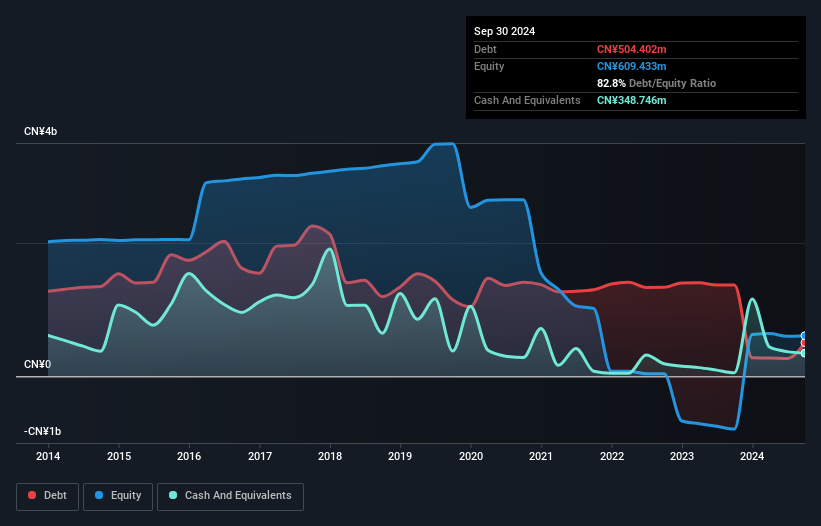

Shenzhen Tellus Holding, a smaller player in the market, has shown impressive growth with its earnings surging by 60.5% over the past year, significantly outpacing the Retail Distributors industry average of -9.4%. The company reported sales of CNY 2.07 billion for nine months ending September 2024, up from CNY 1.22 billion a year ago, while net income rose to CNY 108 million from CNY 73.7 million previously. Despite a reduction in debt-to-equity ratio from 7.9% to 6.3% over five years and high-quality earnings, free cash flow remains negative at -CNY 153 million as of June-end this year.

- Unlock comprehensive insights into our analysis of Shenzhen Tellus Holding stock in this health report.

Assess Shenzhen Tellus Holding's past performance with our detailed historical performance reports.

J.S. Corrugating Machinery (SZSE:000821)

Simply Wall St Value Rating: ★★★★☆☆

Overview: J.S. Corrugating Machinery Co., Ltd. specializes in the R&D, design, production, and sale of non-standard smart equipment for photovoltaics and corrugated packaging industries both domestically in China and internationally, with a market cap of CN¥9.13 billion.

Operations: J.S. Corrugating Machinery generates revenue through the sale of specialized equipment for the photovoltaics and corrugated packaging sectors. The company's cost structure includes expenses related to research, design, and production activities. Its financial performance is influenced by its ability to manage these costs effectively while capitalizing on both domestic and international markets.

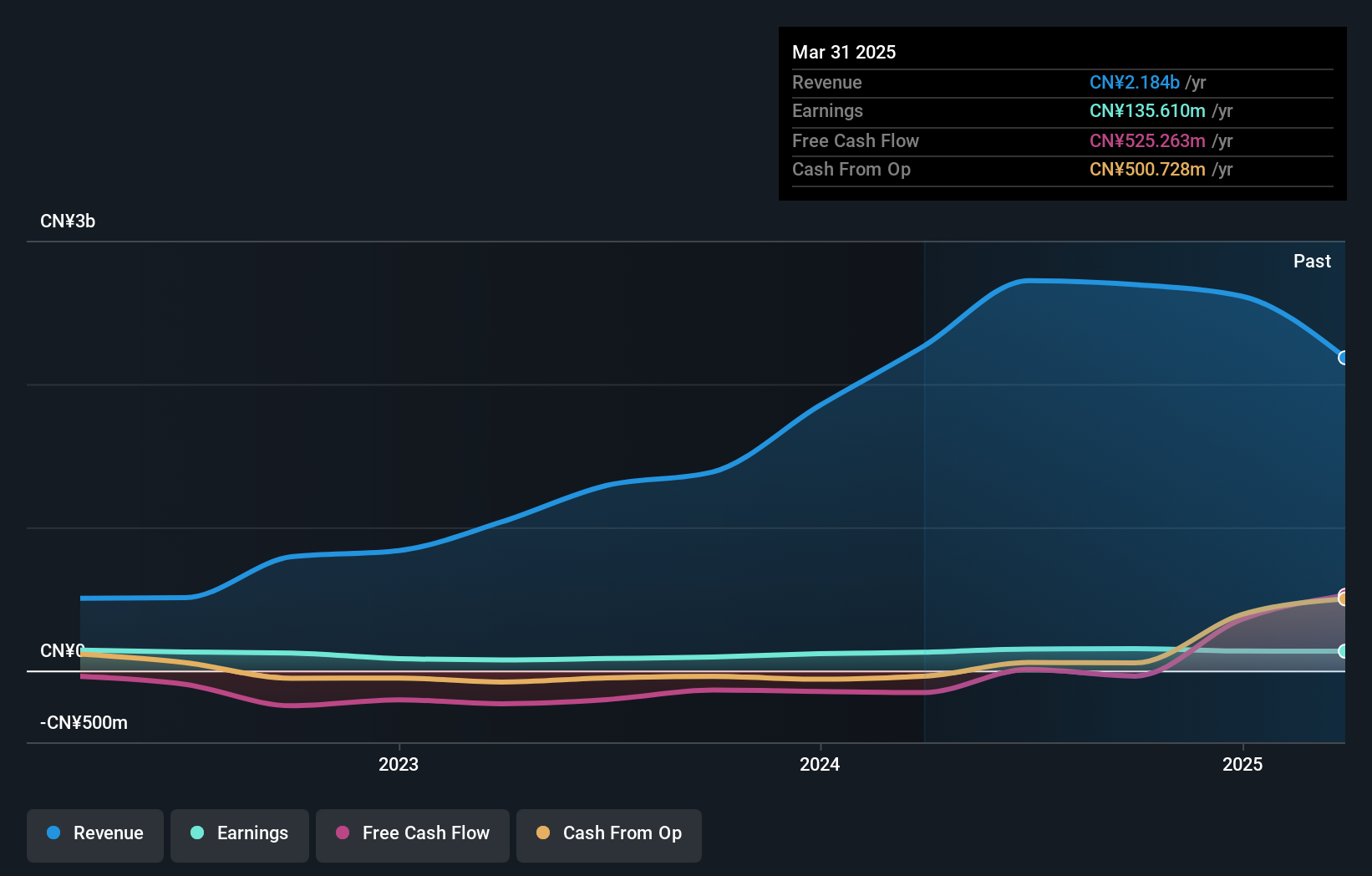

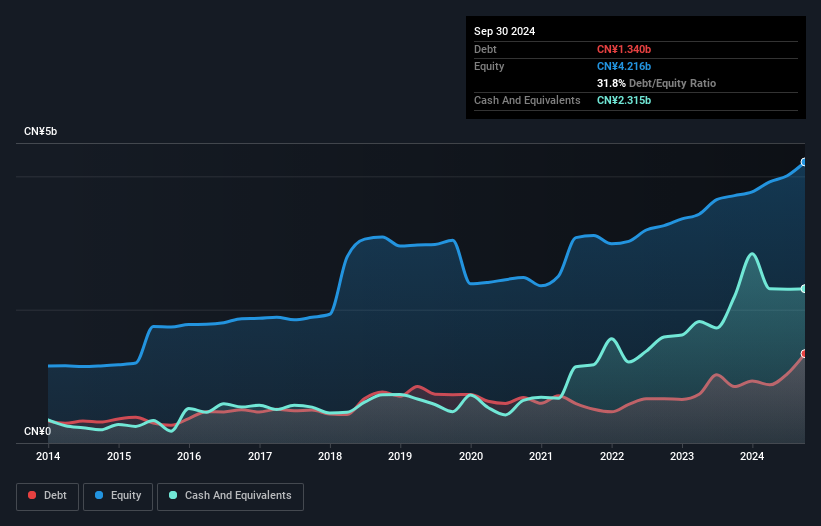

J.S. Corrugating Machinery, a relatively smaller player in the machinery sector, has shown impressive financial performance recently. Sales for the first nine months of 2024 reached CNY 6.66 billion, up from CNY 4.95 billion last year, with net income jumping to CNY 432.95 million from CNY 298.43 million previously. The company's earnings per share have risen to CNY 0.7 from last year's CNY 0.48, reflecting strong profitability amidst industry challenges where peers saw a -3.9% growth rate contrast to J.S.'s robust earnings increase of 18%. With a price-to-earnings ratio of just under half the CN market average at 19x and positive free cash flow, it seems well-positioned financially despite an increased debt-to-equity ratio over five years from 23% to nearly 32%.

- Dive into the specifics of J.S. Corrugating Machinery here with our thorough health report.

Understand J.S. Corrugating Machinery's track record by examining our Past report.

Taking Advantage

- Click here to access our complete index of 872 Chinese Undiscovered Gems With Strong Fundamentals.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000025

Shenzhen Tellus Holding

Engages in automobiles sales, and maintenance and testing activities in China.

Flawless balance sheet with acceptable track record.