- China

- /

- Communications

- /

- SZSE:300136

3 Growth Companies With Up To 20% Insider Ownership

Reviewed by Simply Wall St

As global markets reach record highs, driven by China's robust stimulus measures and optimism around artificial intelligence, investors are increasingly looking for growth opportunities. A key indicator of a potentially strong stock is high insider ownership, which often signals confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 27.4% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.1% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 14.0% | 95% |

Below we spotlight a couple of our favorites from our exclusive screener.

Shenghe Resources Holding (SHSE:600392)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenghe Resources Holding Co., Ltd is involved in the R&D, production, and supply of rare earth products both in China and internationally, with a market cap of CN¥17.62 billion.

Operations: The company generates revenue primarily through the research, development, production, and supply of rare earth products both domestically and internationally.

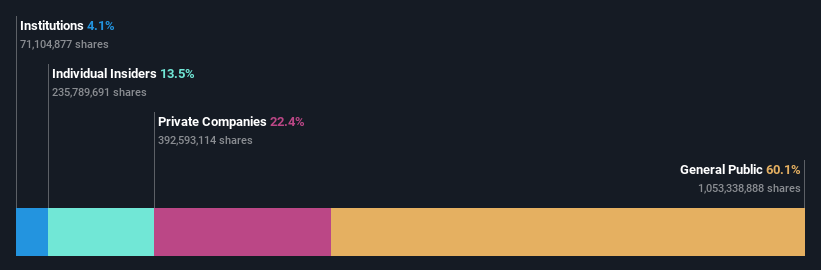

Insider Ownership: 13.5%

Shenghe Resources Holding's revenue is forecast to grow 21% per year, outpacing the CN market's 13.2%. Earnings are expected to increase significantly at 56.1% annually, well above the market average of 23.2%. Despite these growth prospects, recent financial results show a net loss of CNY 68.52 million for H1 2024, with sales dropping from CNY 8.56 billion to CNY 5.44 billion year-over-year and profit margins declining from last year’s figures.

- Take a closer look at Shenghe Resources Holding's potential here in our earnings growth report.

- Our expertly prepared valuation report Shenghe Resources Holding implies its share price may be too high.

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunway Communication Co., Ltd. engages in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions globally with a market cap of CN¥22.45 billion.

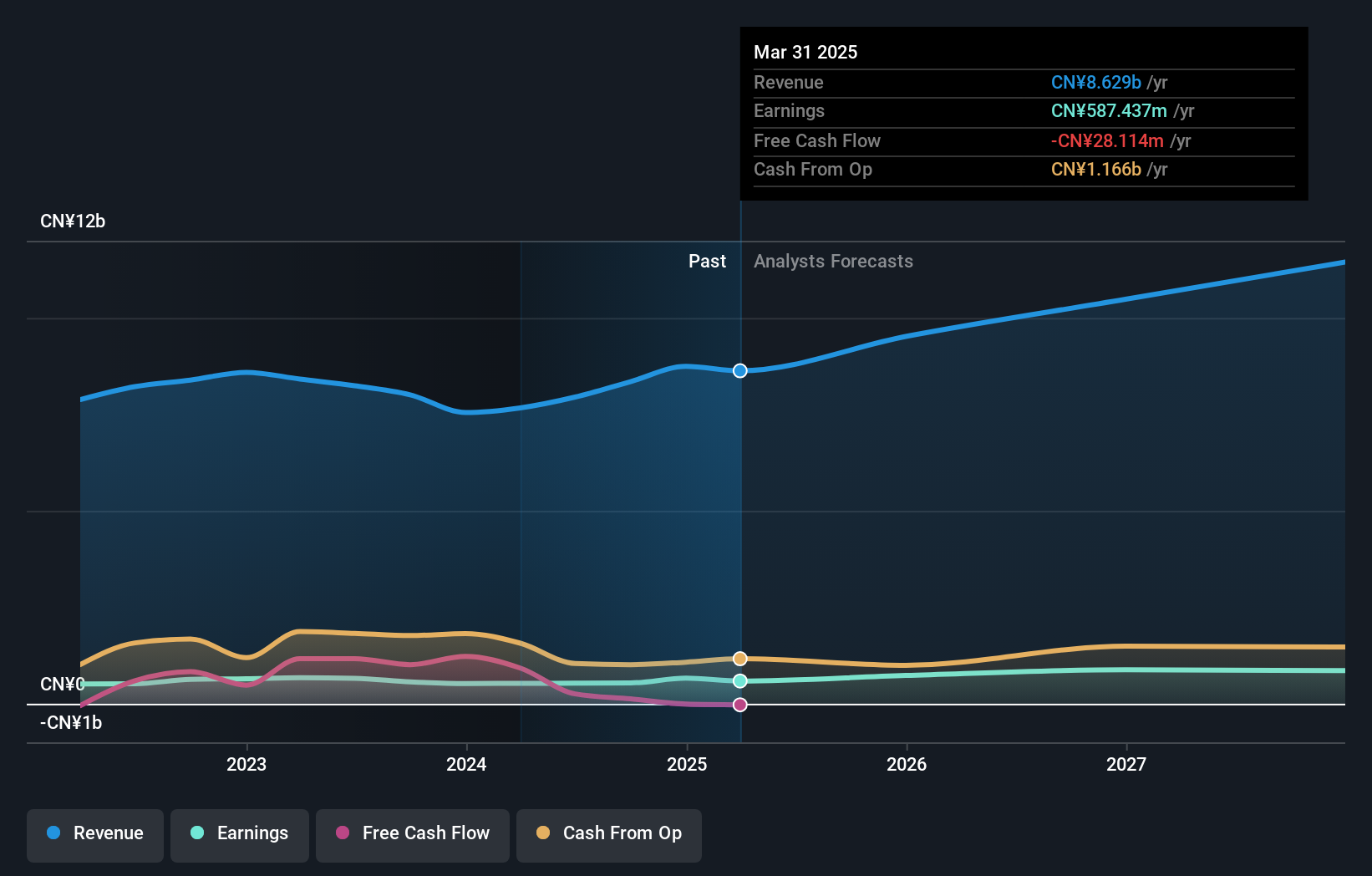

Operations: The company derives its revenue primarily from the Electronic Component segment, which generated CN¥7.95 billion.

Insider Ownership: 20.6%

Shenzhen Sunway Communication has announced a CNY 400 million share repurchase program, signaling confidence in its growth prospects. The company reported H1 2024 revenue of CNY 3.75 billion and net income of CNY 202.74 million, showing year-over-year growth. Earnings are forecast to grow significantly at 30.6% annually, outpacing the CN market's average of 23.2%. However, the stock has been highly volatile recently and faces a lower forecasted return on equity (11.7%).

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Sunway Communication.

- Our valuation report unveils the possibility Shenzhen Sunway Communication's shares may be trading at a premium.

Jiangsu Nata Opto-electronic Material (SZSE:300346)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Nata Opto-electronic Material Co., Ltd. (SZSE:300346) specializes in the production of advanced optoelectronic materials and has a market cap of CN¥19.20 billion.

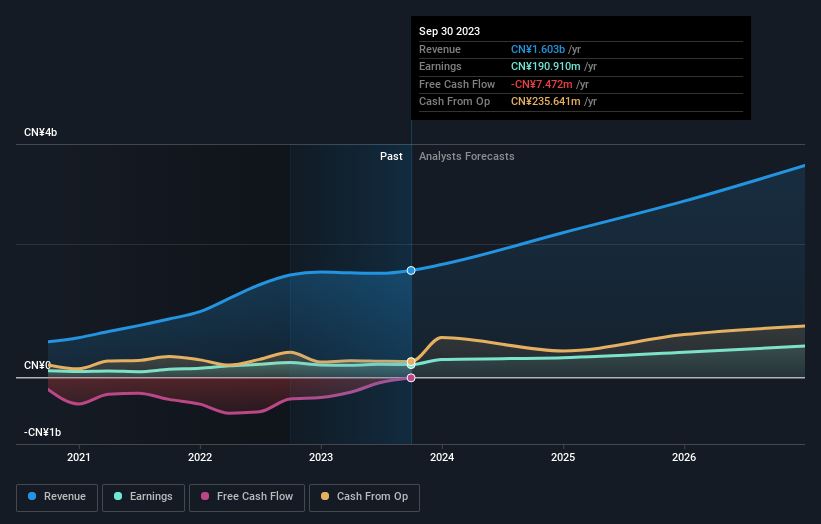

Operations: Jiangsu Nata Opto-electronic Material Co., Ltd. generates CN¥1.60 billion in revenue from its Semiconductor Materials segment.

Insider Ownership: 19.2%

Jiangsu Nata Opto-electronic Material reported H1 2024 revenue of CNY 1.12 billion, up from CNY 826.24 million a year ago, with net income rising to CNY 178.69 million. The company's earnings are forecast to grow significantly at 24.6% annually, outpacing the CN market's average of 23.2%. Recent changes in company bylaws and an interim dividend approval reflect active corporate governance and shareholder returns, though return on equity is expected to be lower at 14.3%.

- Dive into the specifics of Jiangsu Nata Opto-electronic Material here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Jiangsu Nata Opto-electronic Material's share price might be too optimistic.

Next Steps

- Unlock more gems! Our Fast Growing Companies With High Insider Ownership screener has unearthed 1516 more companies for you to explore.Click here to unveil our expertly curated list of 1519 Fast Growing Companies With High Insider Ownership.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300136

Shenzhen Sunway Communication

Engages in the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions in China and internationally.

Flawless balance sheet with reasonable growth potential.