- China

- /

- Metals and Mining

- /

- SHSE:600022

Shandong Iron and Steel (SHSE:600022 investor three-year losses grow to 25% as the stock sheds CN¥1.1b this past week

Shandong Iron and Steel Company Ltd. (SHSE:600022) shareholders should be happy to see the share price up 15% in the last month. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 29% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

If the past week is anything to go by, investor sentiment for Shandong Iron and Steel isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Shandong Iron and Steel

Shandong Iron and Steel isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last three years, Shandong Iron and Steel's revenue dropped 7.8% per year. That is not a good result. The stock has disappointed holders over the last three years, falling 9%, annualized. And with no profits, and weak revenue, are you surprised? However, in this kind of situation you can sometimes find opportunity, where sentiment is negative but the company is actually making good progress.

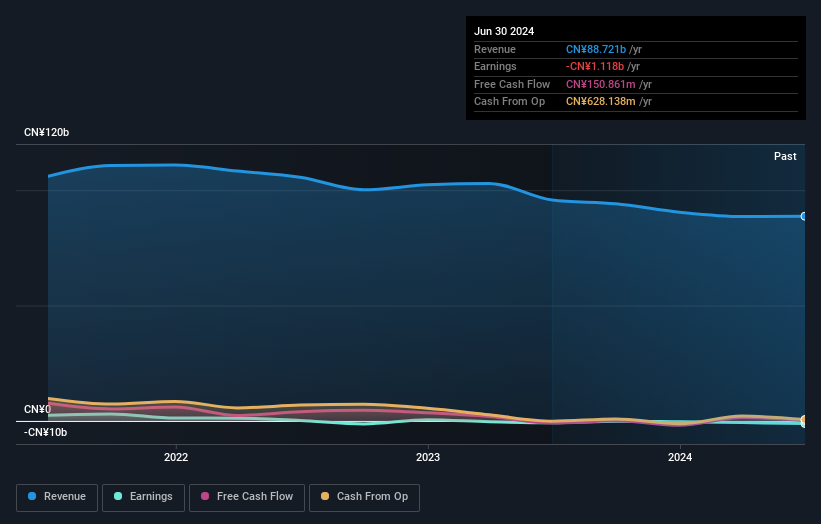

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Shandong Iron and Steel's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Shandong Iron and Steel's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Shandong Iron and Steel's TSR of was a loss of 25% for the 3 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

Shandong Iron and Steel shareholders are down 2.1% for the year, but the market itself is up 11%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 0.3%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Shandong Iron and Steel you should know about.

But note: Shandong Iron and Steel may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600022

Mediocre balance sheet and slightly overvalued.