- China

- /

- Household Products

- /

- SZSE:000523

Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou's (SZSE:000523) earnings trajectory could turn positive as the stock spikes 11% this past week

This week we saw the Hongmian Zhihui Science and Technology Innovation Co.,Ltd.Guangzhou (SZSE:000523) share price climb by 11%. But if you look at the last five years the returns have not been good. You would have done a lot better buying an index fund, since the stock has dropped 49% in that half decade.

On a more encouraging note the company has added CN¥477m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

See our latest analysis for Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

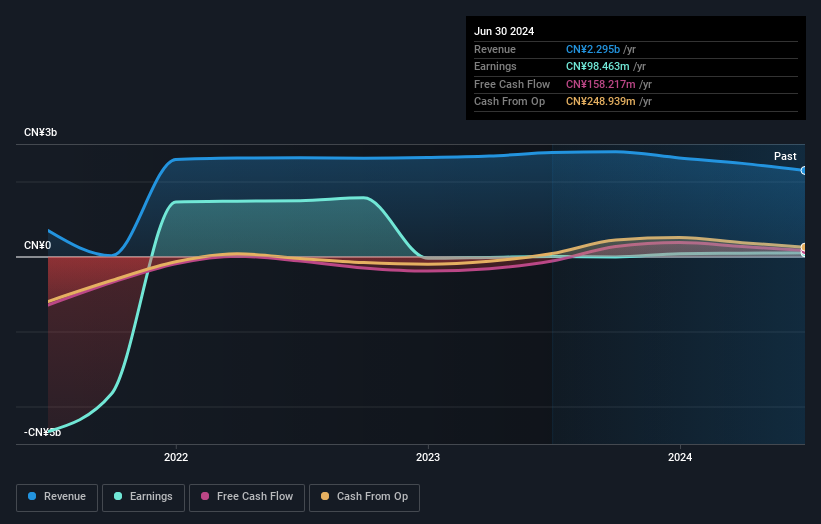

Arguably, the revenue drop of 44% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 14% in the twelve months, Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou shareholders did even worse, losing 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou better, we need to consider many other factors. Case in point: We've spotted 1 warning sign for Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou you should be aware of.

Of course Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000523

Hongmian Zhihui Science and Technology InnovationLtd.Guangzhou

Engages in the manufacture and sale of cleaning products in China.

Flawless balance sheet and slightly overvalued.