Stock Analysis

Top Three Chinese Stocks Estimated To Be Undervalued In July 2024

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Chinese stocks have shown resilience, with strong export data countering deflationary pressures. This environment may present opportunities for investors to identify undervalued stocks poised for potential growth.

Top 10 Undervalued Stocks Based On Cash Flows In China

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Imeik Technology DevelopmentLtd (SZSE:300896) | CN¥171.40 | CN¥319.19 | 46.3% |

| Ningbo Dechang Electrical Machinery Made (SHSE:605555) | CN¥17.29 | CN¥33.08 | 47.7% |

| Beijing Kawin Technology Share-Holding (SHSE:688687) | CN¥22.87 | CN¥45.50 | 49.7% |

| Shenzhen Ridge Engineering Consulting (SZSE:300977) | CN¥15.50 | CN¥29.79 | 48% |

| INKON Life Technology (SZSE:300143) | CN¥7.43 | CN¥14.64 | 49.3% |

| Shanghai Milkground Food Tech (SHSE:600882) | CN¥13.78 | CN¥26.97 | 48.9% |

| China Film (SHSE:600977) | CN¥10.51 | CN¥20.25 | 48.1% |

| Seres GroupLtd (SHSE:601127) | CN¥75.92 | CN¥149.18 | 49.1% |

| Quectel Wireless Solutions (SHSE:603236) | CN¥51.18 | CN¥96.41 | 46.9% |

| Beijing Aosaikang Pharmaceutical (SZSE:002755) | CN¥10.14 | CN¥18.84 | 46.2% |

We're going to check out a few of the best picks from our screener tool.

Beijing Kingsoft Office Software (SHSE:688111)

Overview: Beijing Kingsoft Office Software, Inc. specializes in offering WPS Office series products and services to enterprises both domestically and globally, with a market capitalization of approximately CN¥91.07 billion.

Operations: The company generates revenue primarily through its software and programming segment, totaling CN¥4.73 billion.

Estimated Discount To Fair Value: 41.7%

Beijing Kingsoft Office Software is trading at CN¥196.9, significantly below its estimated fair value of CN¥337.93, indicating a potential undervaluation based on cash flows. Despite a forecasted lower Return on Equity at 19.5% compared to benchmarks in three years, the company's earnings have grown by 25% over the past year and are expected to grow by 21.65% annually. Recent financials show robust performance with Q1 revenue up to CN¥1,225.3 million from CN¥1,051.44 million last year and net income rising to CN¥367.02 million from CN¥267.29 million.

- The analysis detailed in our Beijing Kingsoft Office Software growth report hints at robust future financial performance.

- Take a closer look at Beijing Kingsoft Office Software's balance sheet health here in our report.

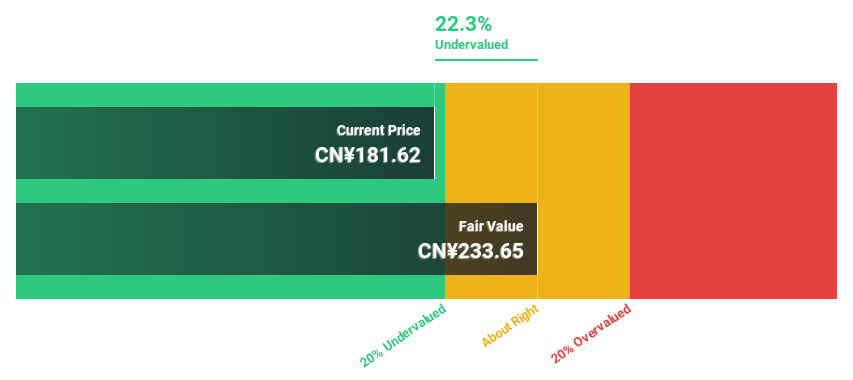

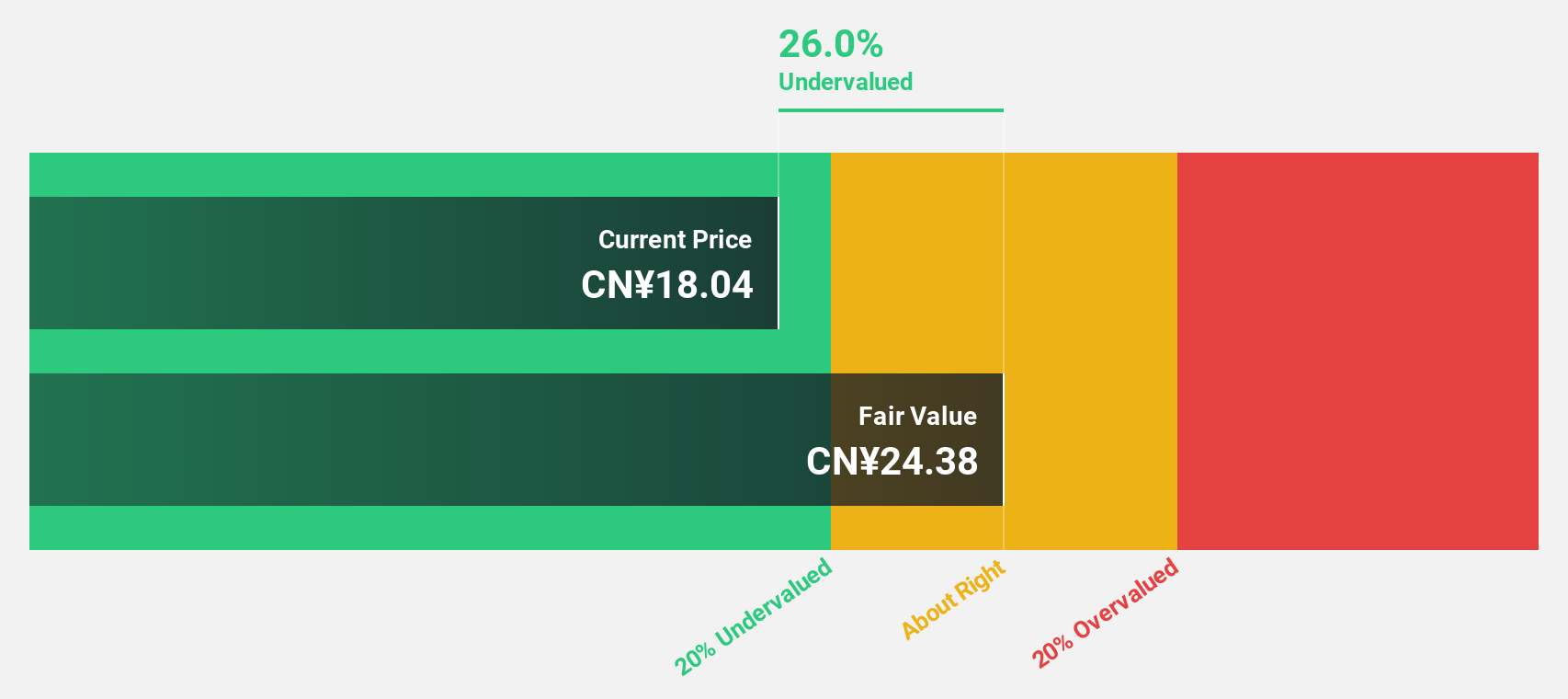

Beijing Aosaikang Pharmaceutical (SZSE:002755)

Overview: Beijing Aosaikang Pharmaceutical Co., Ltd. is a pharmaceutical company based in China with a market capitalization of approximately CN¥9.41 billion, focusing on the research, development, production, and sale of various pharmaceutical products.

Operations: The company generates revenue through the research, development, production, and sale of pharmaceutical products.

Estimated Discount To Fair Value: 46.2%

Beijing Aosaikang Pharmaceutical, trading at CN¥10.14, is priced well below its calculated fair value of CN¥18.84, reflecting significant undervaluation based on cash flow analysis. The company's recent shift from a net loss to a profit with Q1 earnings rising to CN¥31.54 million from a previous loss highlights improving financial health. Despite slower expected revenue growth at 18.3% annually and a low forecasted return on equity of 4.3%, the firm is anticipated to achieve profitability within three years, suggesting potential for future financial stability.

- Our expertly prepared growth report on Beijing Aosaikang Pharmaceutical implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Beijing Aosaikang Pharmaceutical's balance sheet by reading our health report here.

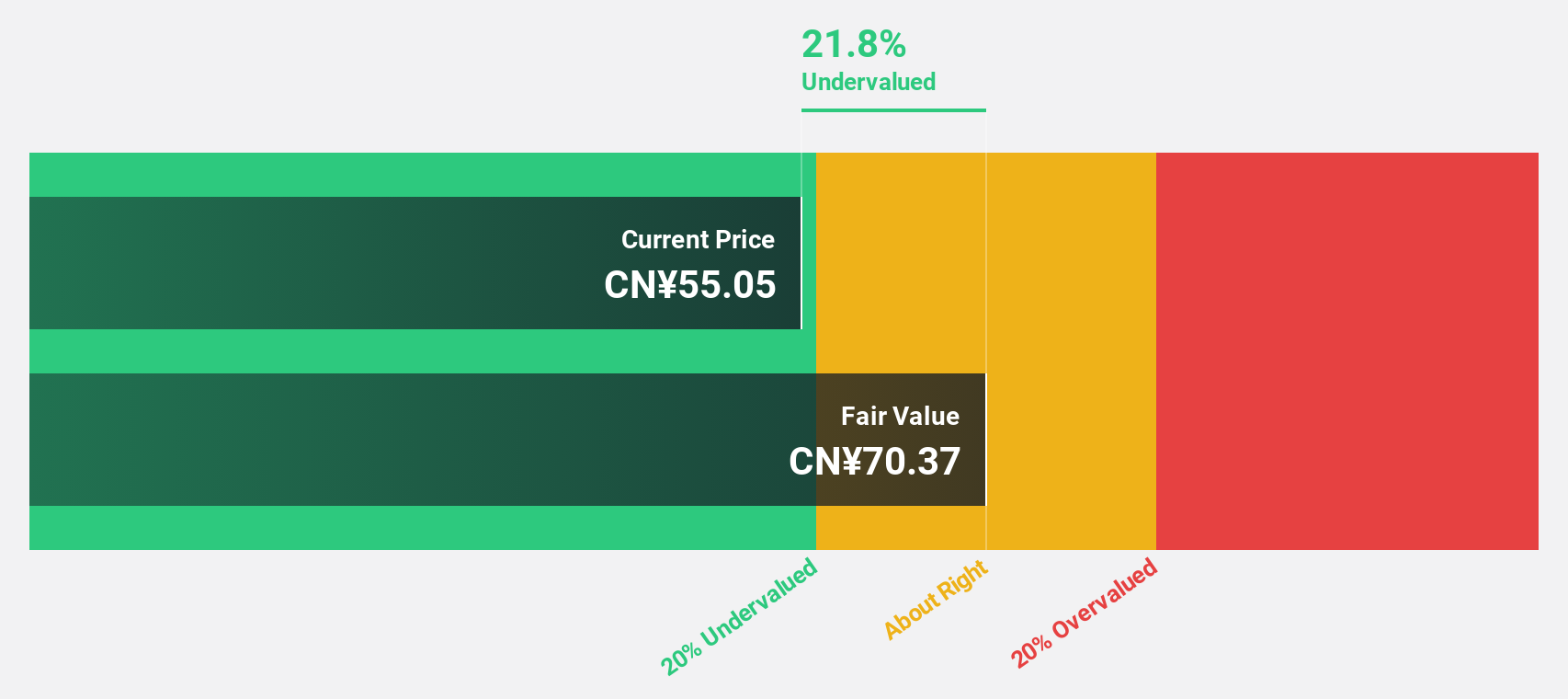

Shenzhen New Industries Biomedical Engineering (SZSE:300832)

Overview: Shenzhen New Industries Biomedical Engineering Co., Ltd. is a biomedical company that focuses on the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals both domestically in the People's Republic of China and internationally, with a market capitalization of approximately CN¥50.15 billion.

Operations: The company generates revenue primarily from its vitro diagnostic segment, which amounted to CN¥4.08 billion.

Estimated Discount To Fair Value: 23.8%

Shenzhen New Industries Biomedical Engineering Co., Ltd., currently trading at CN¥63.83, is valued below its fair value estimate of CN¥83.79, indicating a significant undervaluation based on cash flow analysis. The company's earnings and revenue are both expected to grow at over 20% annually, outpacing the Chinese market averages. However, despite recent dividend increases and strong quarterly earnings growth with net income rising to CN¥426.22 million from CN¥355.07 million year-over-year, concerns about the sustainability of its dividend persist due to an unstable track record.

- Our growth report here indicates Shenzhen New Industries Biomedical Engineering may be poised for an improving outlook.

- Dive into the specifics of Shenzhen New Industries Biomedical Engineering here with our thorough financial health report.

Summing It All Up

- Access the full spectrum of 101 Undervalued Chinese Stocks Based On Cash Flows by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Beijing Kingsoft Office Software is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688111

Beijing Kingsoft Office Software

Provides WPS Office series products and services to enterprises in China and internationally.

Flawless balance sheet with solid track record.