- China

- /

- Medical Equipment

- /

- SZSE:300832

Here's Why We Think Shenzhen New Industries Biomedical Engineering (SZSE:300832) Is Well Worth Watching

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Shenzhen New Industries Biomedical Engineering (SZSE:300832). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Shenzhen New Industries Biomedical Engineering with the means to add long-term value to shareholders.

Check out our latest analysis for Shenzhen New Industries Biomedical Engineering

How Quickly Is Shenzhen New Industries Biomedical Engineering Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, Shenzhen New Industries Biomedical Engineering has grown EPS by 27% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

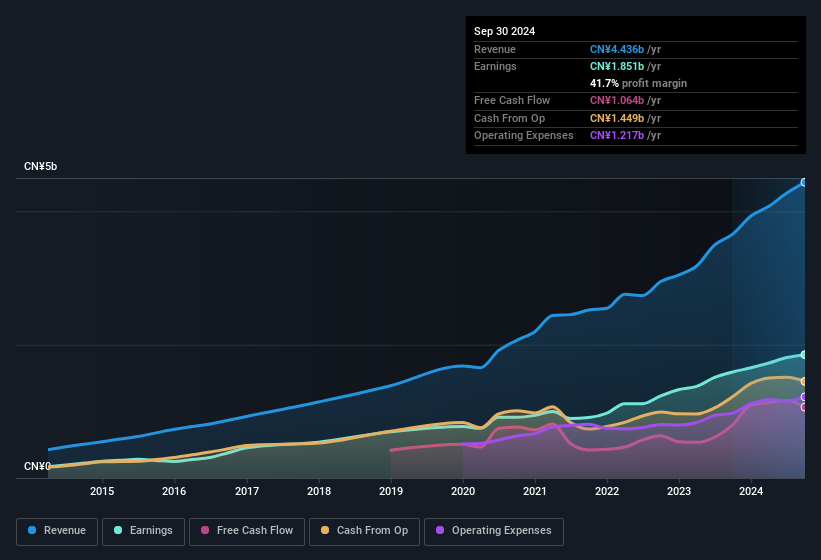

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Shenzhen New Industries Biomedical Engineering achieved similar EBIT margins to last year, revenue grew by a solid 21% to CN¥4.4b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Shenzhen New Industries Biomedical Engineering.

Are Shenzhen New Industries Biomedical Engineering Insiders Aligned With All Shareholders?

Since Shenzhen New Industries Biomedical Engineering has a market capitalisation of CN¥49b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥11b. That equates to 22% of the company, making insiders powerful and aligned with other shareholders. Very encouraging.

Should You Add Shenzhen New Industries Biomedical Engineering To Your Watchlist?

For growth investors, Shenzhen New Industries Biomedical Engineering's raw rate of earnings growth is a beacon in the night. With EPS growth rates like that, it's hardly surprising to see company higher-ups place confidence in the company through continuing to hold a significant investment. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. You still need to take note of risks, for example - Shenzhen New Industries Biomedical Engineering has 1 warning sign we think you should be aware of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in CN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300832

Shenzhen New Industries Biomedical Engineering

Engages in the research, development, production, and sale of clinical laboratory instruments and in vitro diagnostic reagents to hospitals in China and internationally.

Flawless balance sheet with moderate growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026