- China

- /

- Medical Equipment

- /

- SZSE:300753

Optimism around Jiangsu Apon Medical Technology (SZSE:300753) delivering new earnings growth may be shrinking as stock declines 14% this past week

If you love investing in stocks you're bound to buy some losers. Long term Jiangsu Apon Medical Technology Co., Ltd. (SZSE:300753) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 57% share price collapse, in that time. And the ride hasn't got any smoother in recent times over the last year, with the price 48% lower in that time. Unfortunately the share price momentum is still quite negative, with prices down 21% in thirty days.

If the past week is anything to go by, investor sentiment for Jiangsu Apon Medical Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Jiangsu Apon Medical Technology

We don't think that Jiangsu Apon Medical Technology's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last three years Jiangsu Apon Medical Technology saw its revenue shrink by 11% per year. That's not what investors generally want to see. The share price decline of 16% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Having said that, if growth is coming in the future, now may be the low ebb for the company. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

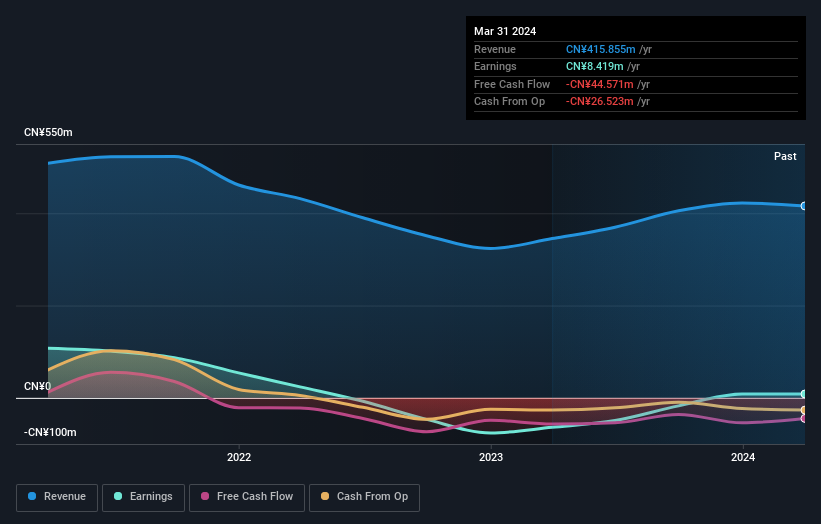

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

While the broader market lost about 12% in the twelve months, Jiangsu Apon Medical Technology shareholders did even worse, losing 48% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 9% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Jiangsu Apon Medical Technology (of which 1 is potentially serious!) you should know about.

But note: Jiangsu Apon Medical Technology may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300753

Jiangsu Apon Medical Technology

Jiangsu Apon Medical Technology Co., Ltd.

Mediocre balance sheet very low.