Stock Analysis

- China

- /

- Consumer Durables

- /

- SHSE:603486

Analyzing Three Leading Growth Companies In China With Insider Ownership As High As 28%

Reviewed by Sasha Jovanovic

In a week marked by cautious optimism in global markets, Chinese stocks experienced gains fueled by governmental pledges of increased economic support. This context sets the stage for examining three growth-oriented companies in China distinguished not only by their performance but also by significant insider ownership, suggesting a strong alignment between company management and broader corporate objectives.

Top 10 Growth Companies With High Insider Ownership In China

| Name | Insider Ownership | Earnings Growth |

| Jiangsu Pacific Quartz (SHSE:603688) | 31.5% | 28.9% |

| Arctech Solar Holding (SHSE:688408) | 38.7% | 24.8% |

| Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

| Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

| Eoptolink Technology (SZSE:300502) | 27.3% | 38% |

| Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.7% |

| Anhui Huaheng Biotechnology (SHSE:688639) | 28.3% | 28.5% |

| Xi'an Sinofuse Electric (SZSE:301031) | 36.7% | 46.5% |

| Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.2% | 69.2% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 72.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Ecovacs Robotics (603486)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ecovacs Robotics Co., Ltd. is a company based in China that specializes in the design, development, manufacture, and sale of robotic products, with a market capitalization of approximately CN¥29.06 billion.

Operations: The company generates revenue primarily through the design, development, manufacture, and sale of robotic products in China.

Insider Ownership: 27.8%

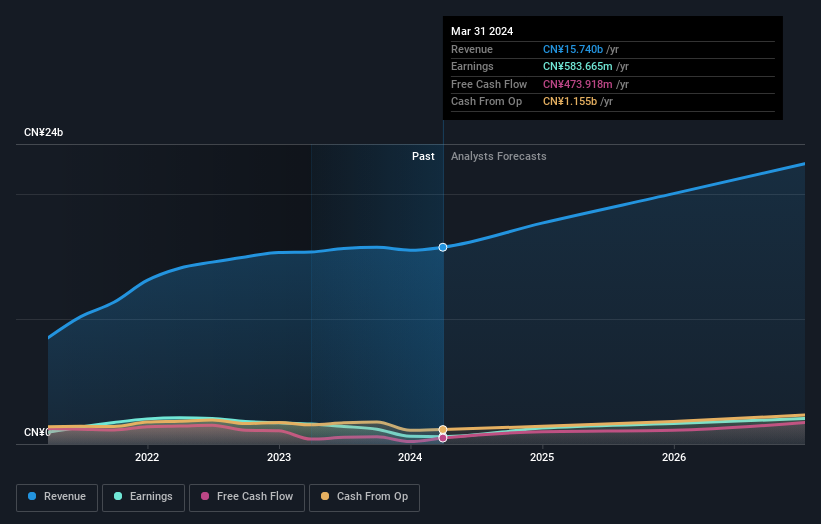

Ecovacs Robotics, a notable player in China's growth sector with substantial insider ownership, recently reported a slight dip in quarterly net income to CNY 297.74 million from CNY 326.15 million year-over-year, despite an increase in sales to CNY 3,474.11 million. The company is trading at 21.5% below its estimated fair value and is expected to see significant earnings growth of approximately 39.4% annually over the next three years, outpacing the broader Chinese market forecast of 24.1%. However, it faces challenges with a reduced profit margin now at 3.7%, down from last year's 10.4%.

- Unlock comprehensive insights into our analysis of Ecovacs Robotics stock in this growth report.

- The analysis detailed in our Ecovacs Robotics valuation report hints at an inflated share price compared to its estimated value.

APT Medical (688617)

Simply Wall St Growth Rating: ★★★★★★

Overview: APT Medical Inc. operates in China, focusing on the research, development, production, and sale of electrophysiology and interventional medical devices, with a market capitalization of CN¥34.47 billion.

Operations: APT Medical Inc.'s revenue is primarily generated from its medical products segment, totaling CN¥1.76 billion.

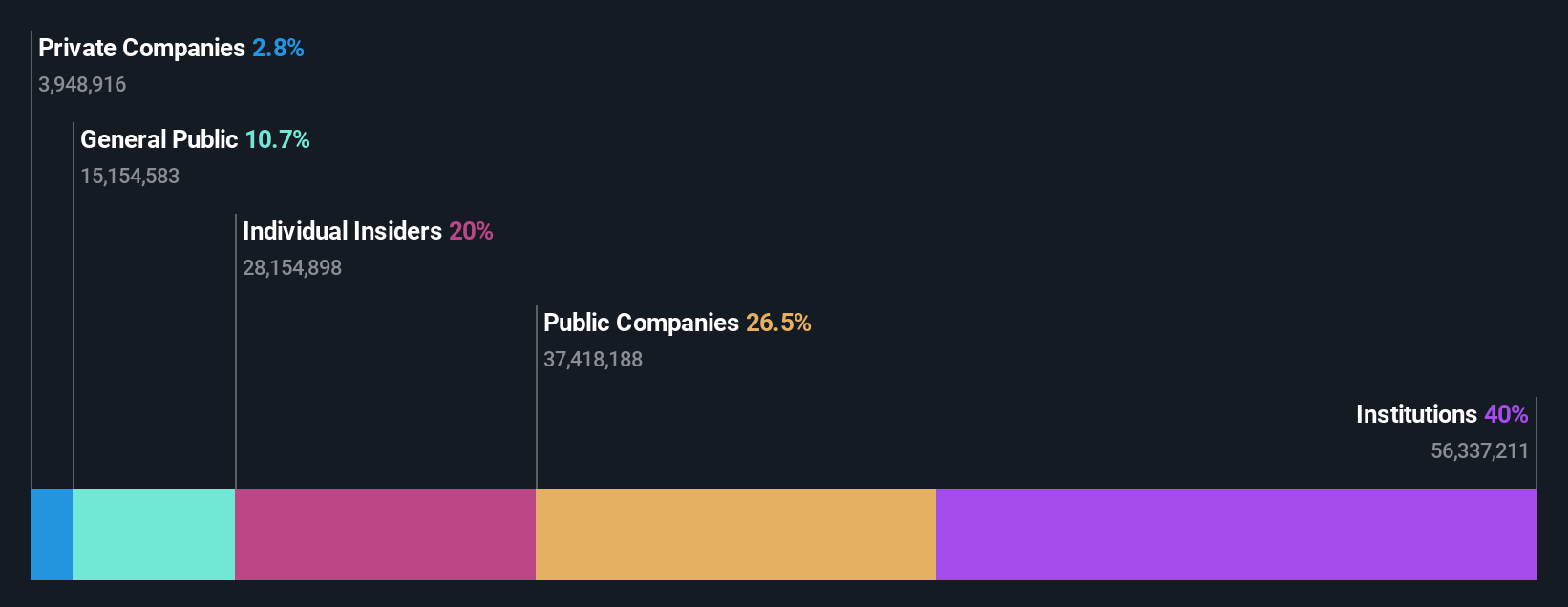

Insider Ownership: 28.5%

APT Medical, a growth company in China with high insider ownership, has shown robust financial performance with first-quarter sales rising to CNY 455.33 million from CNY 349.71 million year-over-year and net income increasing to CNY 140.14 million. The company's earnings per share also grew significantly. Recent strategic moves include the approval of board candidates by Shenzhen Mindray Technology, enhancing governance structures amid their acquisition of a 19.72% stake for CNY6.2 billion, approved by regulatory bodies and shareholders alike. APT Medical's revenue and earnings are expected to grow at rates surpassing the broader Chinese market forecasts.

- Click to explore a detailed breakdown of our findings in APT Medical's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of APT Medical shares in the market.

Zhejiang Century Huatong GroupLtd (002602)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Zhejiang Century Huatong Group Co., Ltd operates in the auto parts, Internet games, and cloud data sectors both domestically and internationally, with a market capitalization of approximately CN¥34.42 billion.

Operations: The company generates revenue from three primary sectors: auto parts, Internet games, and cloud data services.

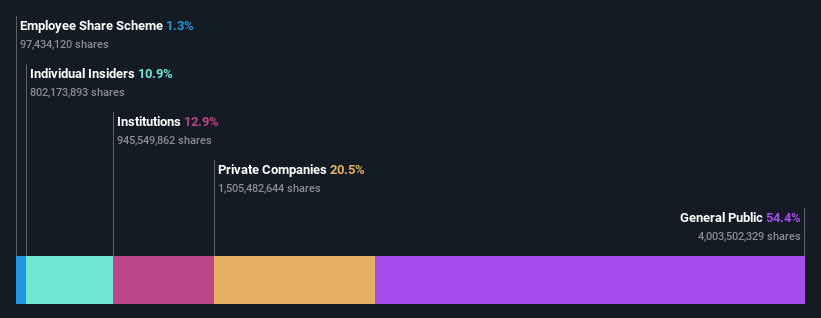

Insider Ownership: 10.9%

Zhejiang Century Huatong Group Co., Ltd, a player in China's growth sector with high insider ownership, reported a substantial increase in first-quarter earnings for 2024. Sales surged to CNY 4.26 billion from CNY 3.02 billion the previous year, and net income rose to CNY 651.51 million from CNY 433.42 million. The company's earnings per share improved from CNY 0.06 to CNY 0.09, reflecting strong financial health and operational efficiency despite trading at a significant discount to its estimated fair value.

- Take a closer look at Zhejiang Century Huatong GroupLtd's potential here in our earnings growth report.

- Our valuation report unveils the possibility Zhejiang Century Huatong GroupLtd's shares may be trading at a discount.

Next Steps

- Click this link to deep-dive into the 418 companies within our Fast Growing Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Ecovacs Robotics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603486

Ecovacs Robotics

Engages in the research, development, design, manufacture, and sale of robotic products in China.

Excellent balance sheet with moderate growth potential.